Why These 3 Altcoins Are Grabbing Attention Right Now

Jakarta, Pintu News – This weekend was a crucial moment for the crypto market as fears that the price of Bitcoin (BTC) would fail to break the $100,000 mark intensified. This condition makes altcoin movements no longer dependent on general market sentiment, but rather on the development of their respective networks.

Here is an analysis of three altcoins that investors should look out for this week, according to a report by BeInCrypto.

Internet Computer (ICP)

Internet Computer (ICP) became one of the best performing altcoins this week after Dfinity launched their latest AI tool, Caffeine. This AI-based upgrade, which does not rely on a specific programming language, doubles the project’s subnet capacity to 2 TiB. This strengthened the performance of HIPAA-compliant decentralized applications and increased investor interest in the network’s AI ecosystem.

Read also: Why Robert Kiyosaki Believes Bitcoin Will Hit $250,000 by 2026?

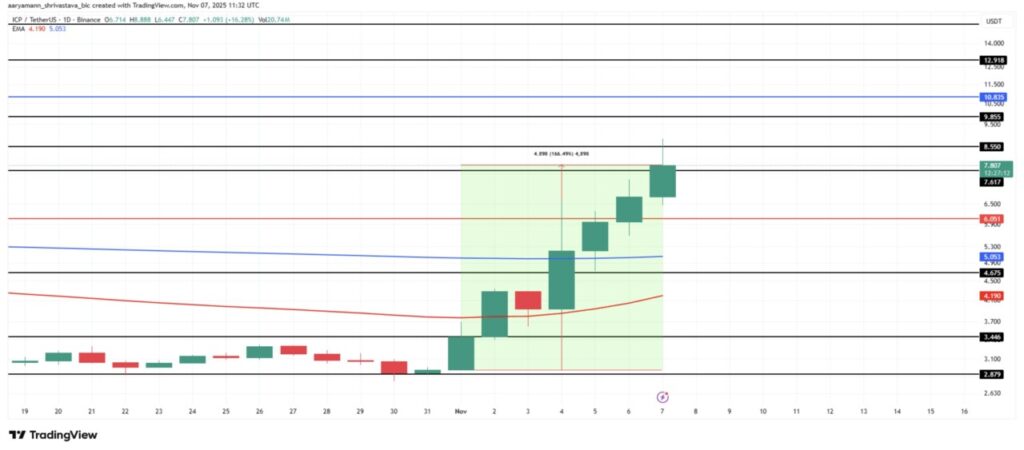

This surge in innovation prompted sharp demand, resulting in ICP prices rising 166% in one week. By the end of the week, ICP was trading at $7.80, and had broken through the $7.61 resistance level and reached a 10-month high.

If market sentiment remains positive, ICP prices have the potential to continue rallying to the $10.83 level, strengthening its upward trend until the end of the week.

However, if investors start realizing profits after a sharp rise, selling pressure could increase. This risks lowering the ICP price to $6.05 or even lower to $4.67. A drop below that level would negate the prospect of a rise and wipe out most of the weekly gains made.

Movement (MOVE)

Movement (MOVE) is gearing up for a major token opening event in the next two days, with 50 million MOVE tokens worth over $2.90 million set to enter circulation. A sudden increase in supply amid weak demand could potentially increase selling pressure.

Over the past month, this altcoin has shown a consistent downward trend. MOVE’s strong correlation with Bitcoin of 0.86 also adds to market uncertainty.

If MOVE follows Bitcoin’s bearish direction, the price could fall below the $0.0525 support and potentially drop below $0.0461, extending losses and weakening investor sentiment.

Conversely, improved investor support could reverse this trend. If the buying pressure strengthens, MOVE has a chance to break the current downward trend, passing the $0.0669 resistance level and $0.0741 barrier. Successfully breaking through these levels will negate the bearish scenario.

Read also: 5 Crypto Privacy Coins that Soared, Number 1 Up to 76%

Axie Infinity (AXS)

Axie Infinity (AXS) is one of the altcoins to watch this week, following plans to launch a token similar to MOVE, albeit on a smaller scale.

The amount of tokens to be released is valued at approximately $854,780, and is not expected to have a significant impact on the price. Limited supply flows lower the risk of excessive selling pressure, helping to maintain price stability in the short term.

However, AXS is still in a downtrend over the past month, which has the potential to reverse soon. The MACD indicator is approaching a bullish crossover point, signaling a possible momentum reversal. If market sentiment improves, AXS has the potential to break the downtrend, cross the $1.39 resistance and reach $1.51 or more in the upcoming trading sessions.

Conversely, if the bearish conditions persist, selling pressure could increase again. A drop below the $1.18 support risks taking the AXS price below $1.15, potentially even retesting the $1.00 level. This scenario would negate the upside prospects and prolong losses for Axie Infinity investors.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins to Watch This Weekend November 8-9. Accessed on November 10, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.