Bitcoin Holds Steady at $105,000 as Signs of Recovery Emerge

Jakarta, Pintu News – Bitcoin (BTC) has shown significant resilience in recent days by staying above the crucial $100,000 support level despite high market volatility.

The ability of this major crypto asset to maintain its position amid pressure reflects fundamental strength. What many perceive as a bearish phase indicates strong structural support in the market.

Then, how will the Bitcoin price move today?

Bitcoin Price Up 0.61% in 24 Hours

As of November 11, 2025, Bitcoin was priced at $105,904, equivalent to IDR 1,776,720,654, reflecting a modest 0.61% gain over the past 24 hours. During this timeframe, BTC reached a low of IDR 1,755,077,265 and a high of IDR 1,796,016,001.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 35,530 trillion, while its 24-hour trading volume has declined by 4% to IDR 1,099 trillion.

Read also: Why Robert Kiyosaki Believes Bitcoin Will Hit $250,000 by 2026?

Bitcoin Performs Better than Expected

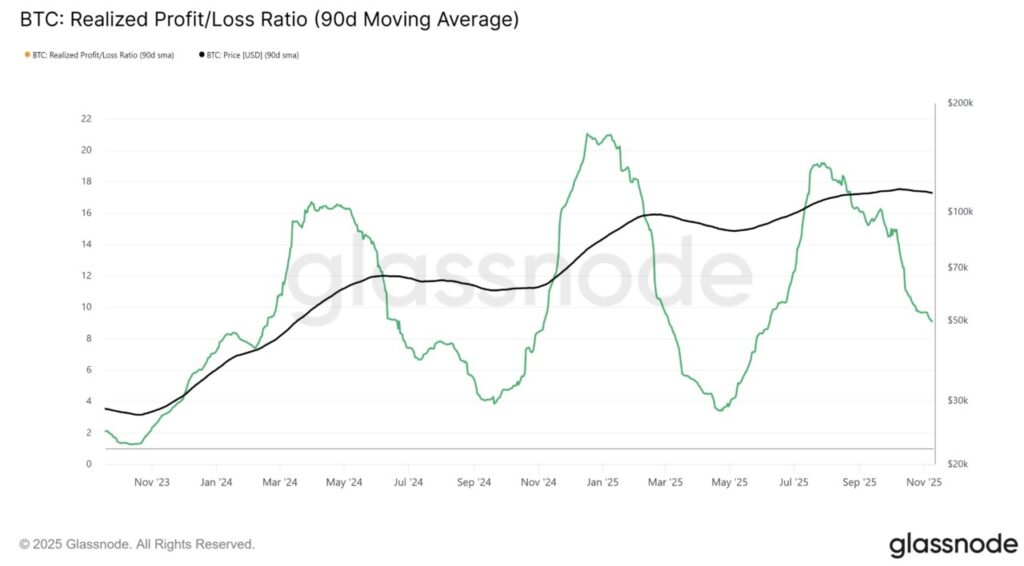

The Realized Profit/Loss Ratio, which measures investors’ net profitability, supports this optimistic interpretation. The 90-day simple moving average (SMA) currently stands at 9.1, reflecting a moderate decline from its peak in July.

Nevertheless, the earnings rate is still more than double that of the previous mid-cycle bearish phase, when this ratio dropped to 3.4.

This suggests that investors are not in a state of panic, and that the recent price drop was triggered more by mild profit-taking than market desperation. The continued high level of profitability among Bitcoin holders indicates confidence in the asset’s long-term prospects.

On-chain data also highlighted the role of whale investors in strengthening bullish momentum. Investors with large holdings capitalized on the price weakness for accumulation. Address wallets holding between 10,000 and 100,000 BTC were recorded buying more than 300,000 BTC this week, after the price briefly touched $101,000.

The accumulation of nearly $32 billion reflects the high confidence of large-scale holders. Their buying activity helped push Bitcoin’s price recovery past the $105,000 mark, reinforcing the potential for a continued upward trend.

BTC Price Starts to Recover

As of November 10, Bitcoin was trading at $106,148, comfortably above the $105,085 support level. A price surge fueled by whale buying has pushed BTC past an important psychological resistance mark, signaling a return of investor optimism.

Read also: Why These 3 Altcoins Are Grabbing Attention Right Now

With improved market sentiment and increased accumulation from institutions, Bitcoin has the potential to continue its rally towards $108,000 and possibly retest the $110,000 level in the next few days. Sustained demand and stable macro conditions will further strengthen this momentum.

However, if short-term traders return to profit-taking, Bitcoin’s price risks dropping below $105,000. In this scenario, BTC could retest the support level at $101,477, potentially temporarily halting its bullish trend.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Whales Buy $32 Billion on the Dip as BTC Holds Above $100,000. Accessed on November 11, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.