10 Altcoin Futures Surging on the Back of Crypto Whale Activity

Jakarta, Pintu News – The movements of large investors or crypto whales are often an early indicator of changing market trends, especially in the altcoin futures segment. In recent weeks, massive accumulation, withdrawal of funds from exchanges, as well as capital rotation to specific projects have triggered a surge in interest in a number of altcoins.

Here are 10 altcoin futures that you need to keep an eye on right now.

Ethereum (ETH)

Ethereum (ETH) is attracting huge interest from whale investors. Whale Alerts data notes that on Friday, an investor withdrew 45,360 ETH worth $148.6 million from Coinbase Institutional to a new unknown wallet.

Read also: 5 Crypto with Strong Catalysts This Week, Likely to Surge?

In addition, according to Ash Crypto, a whale known as an “insider” who was short BTC and ETH before the October 10 market correction is now long ETH worth $137 million.

The Whale is widely regarded as one of the most discerning market participants today, so its bullish position on ETH is a significant signal to market participants.

Dash (DASH)

Dash (DASH), a veteran privacy coin launched in 2014, is again attracting attention as one of the key altcoins for traders looking for opportunities in a sector that is still undervalued. After the strong rally experienced by Zcash (ZEC) in the past 30 days, a number of older privacy coins have started to see high demand, including DASH.

The highly negative aggregate funding rate (-1.36) as well as large short liquidation positions in the $130-$140 range point to a potential short squeeze. On the 4-hour time frame, the price pattern formed a bullish pennant, further reinforcing the possibility of buying pressure from the short squeeze.

With the price of Bitcoin (BTC) seemingly having found a bottom at $100, the rotation to this privacy coin is expected to continue, providing various opportunities for investors to gain potential.

XRP (XRP)

XRP (XRP) remains one of the most stable large-cap assets in the market today. While general market volatility remains high, XRP continues to post higher lows and move within a well-defined price range. Analysts see this as an indicator of market maturity and strong investor confidence.

The divergence on the daily chart, which goes along with the increase in trading volume, suggests accumulation. If Bitcoin is able to maintain its position, XRP could potentially test the upper resistance level in the near future.

The growing legal clarity in its ecosystem also strengthens the long-term outlook, making XRP a key focus for traders who want more stable exposure.

Read also: Get Ready! 5 Spot XRP ETFs to Launch in November After DTCC Listing

Internet Computer (ICP)

Internet Computer (ICP) has shown striking performance in recent weeks, driven by consistent network development and increased institutional involvement. The token’s divergence structure signals a shift from distribution to accumulation phase, indicating that large holders are starting to re-enter the market.

On-chain data shows an increase in transaction volume and activity in decentralized applications, which could extend this upward trend. If momentum is maintained, ICP has the potential to retest mid-year highs on the back of positive sentiment towards Web3 infrastructure assets.

Sui (SUI)

Sui (SUI) stands out among new tokens thanks to solid development activity and increased liquidity. The divergence seen on SUI’s chart suggests that buying pressure is starting to dominate again after a heavy correction phase.

Technical indicators such as RSI and MACD show positive divergence, which reinforces the possibility of a trend reversal. As participation in the ecosystem increases and new apps are launched, SUI has the potential to be one of the most dynamic assets in the next market cycle.

Solana (SOL)

Solana (SOL) continues to show remarkable recovery momentum, leading the altcoin revival narrative. The latest divergence coincides with the re-entry of institutional funds and growth in network activity. The token’s chart patterns suggest a base formation that could potentially support a sustained rise.

Analysts see SOL’s resilience and ecosystem expansion as key factors that could push prices towards higher resistance levels in the coming weeks.

Hedera (HBAR)

Hedera (HBAR) price continues to move within the descending channel pattern that has formed its structure since mid-August, with the pattern alternating between compression and recovery phases. Currently, the HBAR value is at $0.1920, having rebounded from the lower boundary that previously served as a zone of strong demand.

According to ZAYK Charts crypto analysts, this formation reflects a similar pattern from early June, when a breakout above the upper trendline triggered a sharp rally. The same structural rhythm is now re-establishing itself, where sustained buying pressure and narrowing price ranges are often early indications of a trend reversal.

The 90-day Spot Taker CVD indicator shows a predominance of long takers, indicating that aggressive market orders are more inclined towards the buy side. This reflects a high level of confidence from market participants who are positioning themselves for a continuation of the HBAR price increase.

Pepe (PEPE)

Data from Nansen shows that whales are accumulating Pepe (PEPE) again, indicating expectations of a potential rebound. Currently, whale holdings stand at 4.19 trillion tokens, an increase of 800 billion from the October lows of 4.18 trillion.

Continued buying by whales signals a weakening of the previously dominating selling pressure, a positive development. In addition, the movement of tokens off exchanges also provided a strong signal. Based on Nansen data, the number of tokens held on exchanges dropped to 232 trillion from last month’s peak of 241 trillion.

Outflows from exchanges are usually considered a positive catalyst, as they indicate that investors are choosing to keep their tokens independently and have no intention of selling in the near future.

Read also: Analyst Javon Marks Says Shiba Inu Has the Potential to Increase by 200%, Here’s Why

Tron (TRX)

Tron (TRX) is one of the L1 blockchains currently attracting significant attention from whale investors. Whale Alert recorded a withdrawal of 99,999,999 TRX from Binance on Friday, valued at $28.4 million.

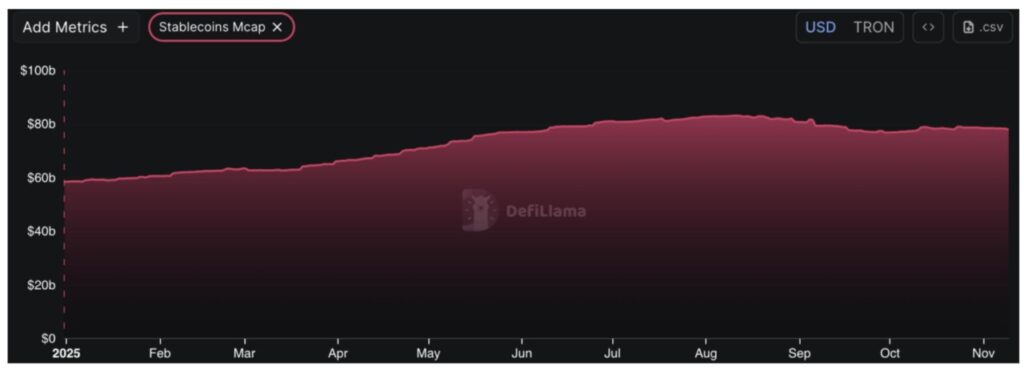

Stablecoin activity on the Tron network has also seen a huge surge. According to data from DeFiLlama, the market capitalization of stablecoins on this network has increased by more than $20 billion since the beginning of 2025.

In comparison, this figure surpasses the total market capitalization of stablecoins on both the BNB and Solana networks, indicating high whale interest in Tron.

It’s also worth noting that when the market momentum is right, some of this stablecoin liquidity could potentially be allocated to TRX, which could be a strong driver for the token’s price increase.

DeAgentAI (AIA)

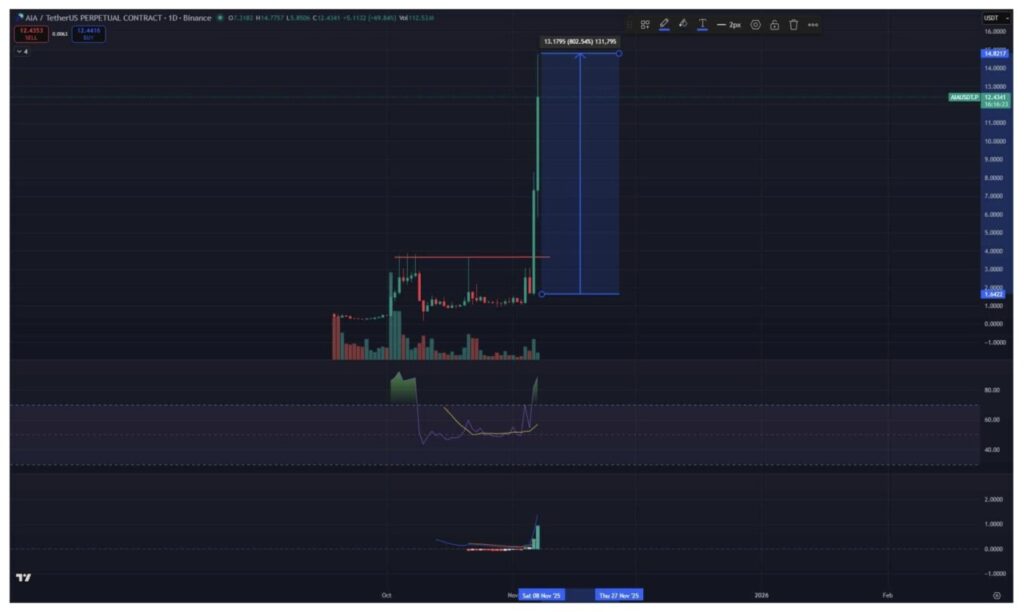

AIA managed to break through the resistance level and is now moving towards a significant upside phase. This native token of the DeAgentAI protocol is at the forefront of the AI technology wave, focusing on fundamental issues such as identity, continuity, and consensus, while operating reliably on networks such as Sui, BNB, and Bitcoin.

In the last 48 hours, the coin managed to breach a market capitalization of $1 billion. Currently, the price is hovering around $12.50, although it still exhibits high volatility so caution is required.

The previous resistance level of $3.7 has now become a support area, as stated in a recent article. Since then, the price has increased by more than 800%, reaching a peak of $14.80.

The RSI indicator shows that the asset is in overbought territory, while the MACD indicator shows a strong positive trend. This sharp rise is not driven by any particular fundamental factor, but rather reflects a broader narrative trend within the AI sector as a whole.

Futures Trading Made Easier Through Futures Door

The surge in whale interest in certain altcoins reflects the huge opportunities now available to retail traders, particularly in the futures market. To capitalize on this momentum, platforms like Pintu Futures offer easy access with professional features that support both short and medium-term strategies.

With adjustable leverage of up to 25x, traders have great flexibility in managing their risk exposure and potential profits.

Powered by an intuitive interface and a wide range of technical analysis and risk management tools, Pintu Futures is the ideal solution for those who want to follow institutional movements with greater precision.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- 99Bitcoins. Whales Target AIA, DASH, HYPER As Best Altcoins For November. Accessed on November 14, 2025

- Coingape. HBAR Price Prediction: Analyst Eyes 90% Surge Amid Taker Buy Dominance. Accessed on November 14, 2025

- Crypto DNES. Ethereum, Tron, and Bitcoin Hyper Are the Best Cryptos to Buy According to Whale Activity. Accessed on November 14, 2025

- Crypto News. Pepe Coin price at risk despite whale buying, exchange outflows. Accessed on November 14, 2025

- Crypto News Land. Bulls Return: Major Cryptocoins Divergence Hints at Imminent Rally – Top 5 Tokens Worth Holding Now. Accessed on November 14, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.