Will Crypto Crash in 2026?

Jakarta, Pintu News – The question traders often ask is simple: Will crypto crash in 2026, or has the crash already started? Every major downturn in this market has followed the same pattern: Bitcoin (BTC) reaches its cyclical peak, sentiment peaks, and a major correction begins a few weeks later.

Before we discuss the fall timeline, we need to determine if Bitcoin has already peaked. The peak window is usually past, but the key peak signal has never been triggered. If the peak is still ahead, the crash window moves to 2026. Here is how the data relates to each other.

Four Years of Bitcoin Supply Cycle: First Clues to Crypto Crash

Bitcoin operates on a predictable schedule. Every 210,000 blocks, its block reward is reduced to half. This reduces new supply and usually pushes the price up for twelve to eighteen months. The previous cycle behaved similarly.

The 2012 cut leads to a peak after about 13 months, the 2016 cut peaks after about 17 months, and the 2020 cut peaks after about 18 months. Based on this pattern, the April 20, 2024 cut suggests a peak between July and October 2025. Bitcoin even touched $126,000 in early October, and at the time, it looked like a classic cyclical peak.

Also read: Bitcoin (BTC) price plummets 5.68% in a day, market sentiment hits rock bottom!

Why This Cycle Runs Longer Than Normal

Two forces extended this cycle beyond its normal time. First, changing global liquidity conditions have affected market dynamics. Second, the wider adoption and integration of blockchain technology has affected investor behavior and market dynamics.

Both of these factors contributed to the unexpected extension of the cycle, keeping analysts and investors guessing about the actual timing of the peak. This suggests that the crypto market may still have some surprises left before it reaches the peak of this cycle.

Read also: OKX Launches DEX Trading for US and Global Markets, Here are the Details!

Indicators and Analytics that Determine the Future of Bitcoin

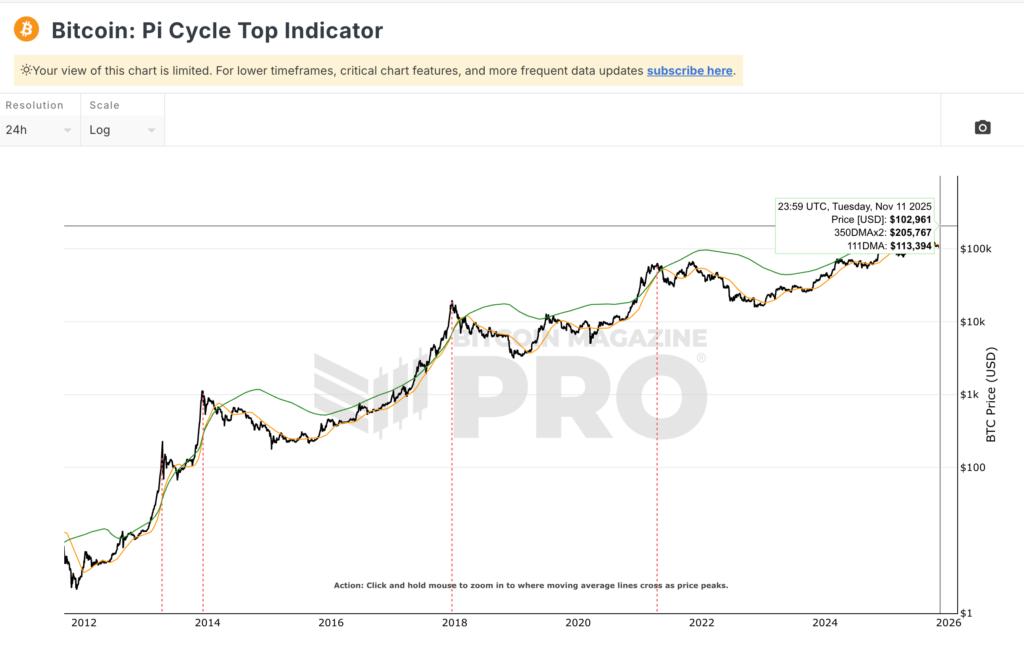

The Pi-Cycle Top indicator compares two moving averages: the 111-day average and twice the 350-day average. When the 111-day line rises above the slower one, Bitcoin is usually only a day or two away from the final top. This signal has been correct in every major cycle.

Furthermore, MVRV measures Bitcoin’s market value compared to its realized value, which reflects the average price at which all coins last moved. A high MVRV means holders have large unrealized gains, and the previous cycle reached a peak when the MVRV surged to the extreme zone.

Conclusion

With all the leading indicators converging in one broad structure, we will most likely see the peak of the cycle in mid-2026. From there, the next major crash in the crypto market could start anytime from March to August 2026, depending on which peak arrives first. This is a critical time for investors to monitor indicators and adjust their strategies according to changing market dynamics.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Crypto Crash 2026: Bitcoin on Top Analysis. Accessed on November 14, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.