Whale Ethereum Adds $105 Million Investment, Total Spending Reaches $1.33 Billion!

Jakarta, Pintu News – Ethereum (ETH) is currently undergoing a consolidation phase after facing intense selling pressure due to macroeconomic uncertainty and market concerns regarding the US government shutdown. Although market sentiment remains cautious, on-chain data shows that large holders or “whales” continue to add to their ETH holdings, signaling growing confidence amid slowing market momentum.

Ethereum whales in action amidst market uncertainty

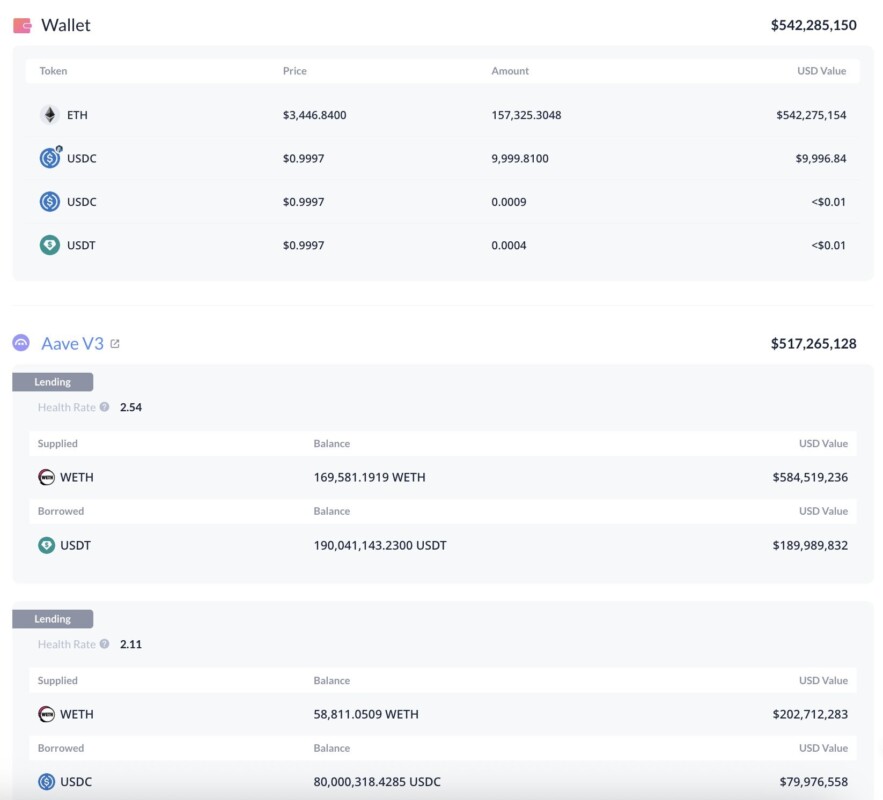

Data from Lookonchain shows that a whale known for aggressive Ethereum accumulation just added 30,548 ETH worth $105.36 million to its portfolio. This purchase increases his total acquisitions since November 4 to 385,718 ETH, or about $1.33 billion. Part of the funds used for this purchase, around $270 million, was a loan from decentralized lending platform Aave.

This represents a highly leveraged yet strategic position, signaling strong institutional confidence in Ethereum’s medium-term prospects. Large loans for ETH accumulation indicate expectations of price appreciation sufficient to cover borrowing costs and volatility risks.

Also Read: Shocking Prediction from Donald Trump’s Son: Bitcoin Will Break $1 Million!

Implications of Whale’s Large Scale Purchase

This large-scale buying activity by whales not only absorbs available market liquidity but also strengthens psychological support zones. This may trigger a change in sentiment among retail investors who may interpret these actions as bullish. However, this massive buying also carries short-term risks. If the price corrects further, the leveraged positions may magnify volatility. Therefore, while this action shows confidence, it also adds complexity to the current Ethereum market dynamics.

Ethereum Price Outlook and Stabilization

Ethereum is currently trading around $3,479, showing signs of stabilization after a period of intense selling. ETH managed to maintain a position above its 200-day moving average, which historically serves as a launching point for bullish recoveries.

However, the 50-day and 100-day moving averages are still above the current price, indicating that the short-term trend is still likely to be negative. To take control, ETH needs to close decisively above $3,650-$3,700, where there is a confluence of resistance. If Ethereum fails to defend the $3,400-$3,450 zone, the next major support lies near $3,200.

Conclusion

Overall, Ethereum appears to be in a consolidation phase, with large holders continuing to accumulate while retail traders remain cautious. This structure often precedes stronger directional moves, signaling that the market may be gearing up for the next phase.

Also Read: Bitcoin Poised to Surge After US Government Shutdown Deal: History Repeats?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Whale Adds $105M to His ETH Position, $1.33B Bought Since Nov 4. Accessed on November 14, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.