Bitcoin Plunges to $94,000, Wiping Out All 2025 Gains

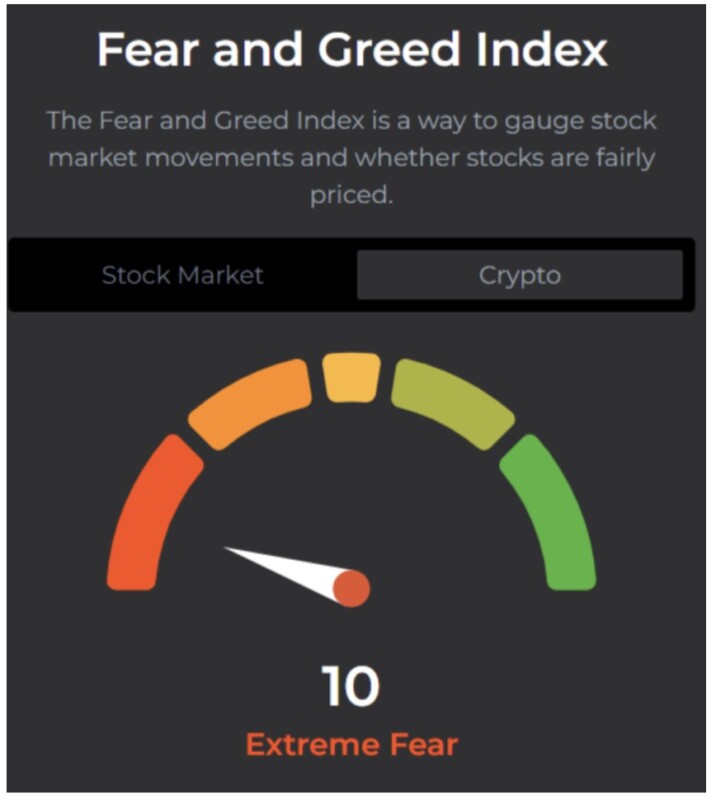

Jakarta, Pintu News – Bitcoin (BTC) briefly plummeted to $93,000 on Monday morning Asian time before recovering, triggering $510 million in liquidation in 24 hours and wiping out all gains made throughout 2025. The sharp move pushed the Fear and Greed Index down to 10, indicating extreme fear among market participants.

Market analysts are now watching key support zones to assess whether Bitcoin is able to bounce back or if it has the potential to continue its decline in the next few days. Then, how is the current Bitcoin price movement?

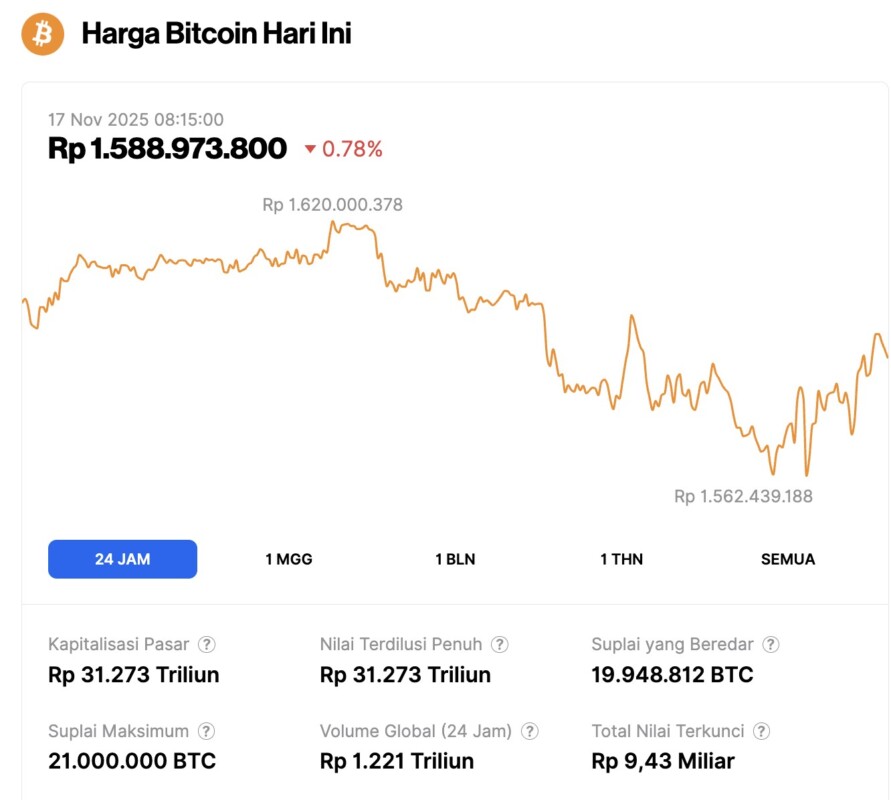

Bitcoin Price Drops 0.78% in 24 Hours

As of November 17, 2025, Bitcoin was trading at $94,910, equivalent to IDR 1,588,973,800, marking a 0.78% decline over the past 24 hours. During this period, BTC reached a low of IDR 1,562,439,188 and a high of IDR 1,620,000,378.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 31,273 trillion, with 24-hour trading volume surging 94% to IDR 1,221 trillion.

Read also: Crypto Millionare 2025 Listicle: List of 5 Biggest Crypto Owners!

Sharp correction wipes out all Bitcoin gains in 2025

Bitcoin’s latest correction erased nearly 24% of its early October peak of $126,000. The drop to $93,000 was a crucial technical and psychological juncture, and officially erased all gains made since the beginning of 2025.

Price trends over the weekend showed a significant shift. For the first time in weeks, Bitcoin prices actually weakened over the weekend instead of strengthening. This formed a bearish pattern heading into the beginning of the week, according to market analyst KillaXBT.

Based on 300 days of historical data, this kind of pattern indicates a probability of about 36% that Monday’s price will form a short-term low.

Market sentiment also slumped as prices fell. The Crypto Fear and Greed Index dropped to 10, two points lower than the previous reading, signaling a state of extreme fear. This is a sharp reversal compared to the end of November 2024, when the index had reached 93 amid market euphoria.

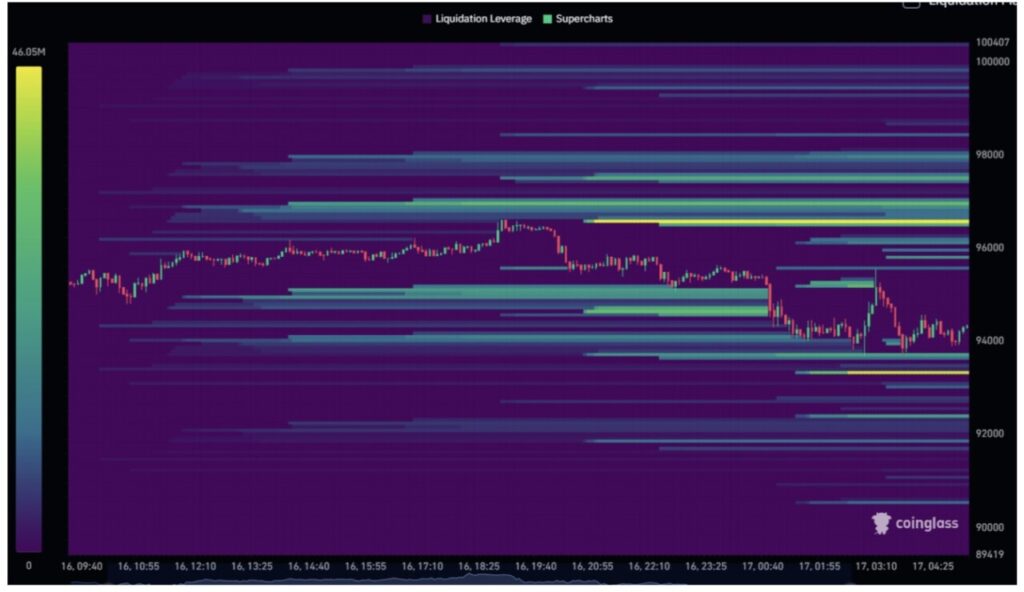

Massive Liquidation Shocks Crypto Derivatives Market

Bitcoin’s price collapse triggered a massive wave of liquidations in the crypto derivatives market. Within 24 hours, more than 150,000 traders were liquidated, with total closed positions surpassing $510 million.

Long positions were the most affected, recording losses of $40.37 million in just one hour and $77 million in four hours.

Read also: 10 Altcoin Futures Driven Up by Crypto Whale Movement

Bitcoin recorded the highest long liquidation with $41.61 million, followed by Ethereum at $13.99 million. Other assets such as Solana (SOL), XRP (XRP), and Dogecoin (DOGE) also saw millions of dollars in liquidations as the price drop followed Bitcoin’s movement.

Support zone determines recovery direction

KillaXBT market analysts identified some important support zones that will determine Bitcoin’s short-term direction.

The main focus is now at the $94,100 level, with the next strong support at $93,500-which is also the opening price of the year-and the $89,000-$91,000 range.

These zones have historically been areas of high trading activity and open interest, making them accumulation territories based on technical analysis. However, analysts warn against using high leverage at this time given the still extreme market volatility and high risk of liquidation.

With daily price fluctuations of 4-5%, over-leveraged positions are at high risk.

If Bitcoin drops decisively below $85,000, the bullish recovery scenario will fall, signaling a potential trend reversal. However, if liquidity is absorbed at the lower support zone, the opportunity to reclaim the $100,000 level remains open, although it will have to cross the strong resistance at $98,300 first.

The current market structure reflects high uncertainty. With the sentiment index at the point of extreme fear and major liquidations already taking place, the market is at a critical juncture. The direction in which Bitcoin moves from November to the end of the year will largely be determined by whether buyers emerge at the support zone or the selling pressure deepens.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Touches $93K Low as Market Sentiment Hits Extreme Fear. Accessed on November 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.