Telcoin (TEL) Surges After Charter Bank Approval: Is This a Rally or a Whale Maneuver?

Jakarta, Pintu News – Telcoin (TEL) recently received bank charter approval from the Nebraska Department of Banking and Finance, allowing the company to operate digital asset and stablecoin services under state regulation. This decision triggered a rise in the price of TEL, but the question remains: is this the start of a sustained rally or just a manipulative tactic by the whales?

Telcoin Charter Bank Approval in Nebraska

Telcoin (TEL) has successfully secured a bank charter granting it permission to provide bank-like products such as deposits and loans denominated in their eUSD stablecoin. These services can be accessed through decentralized finance applications, providing new opportunities for Telcoin to expand its reach in the digital finance industry.

This approval not only increases Telcoin’s credibility in the eyes of investors, but also opens up opportunities for further innovation in providing financial services integrated with blockchain technology.

Also Read: 3 Powerful Altcoins Predicted to Rival Solana, What Are They?

Market Reaction to Telcoin Rally

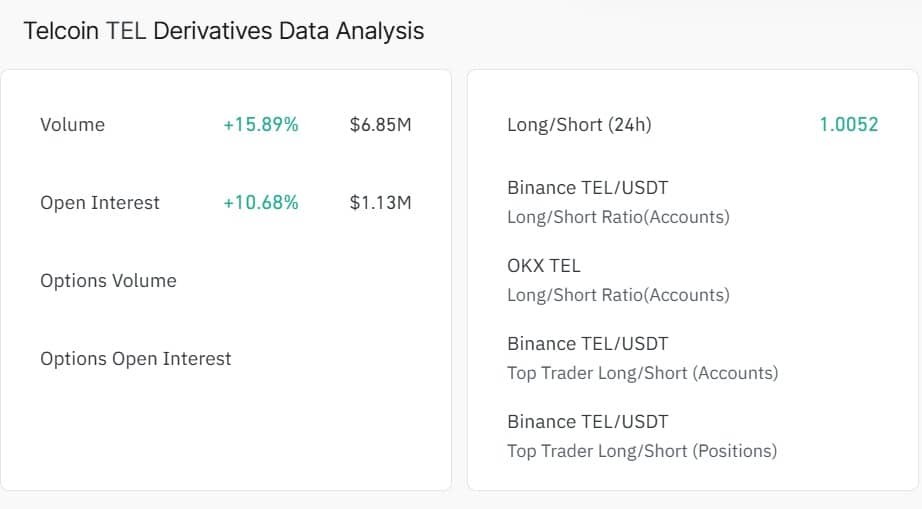

Post charter announcement, there was a significant spike in volume and open interest in the Telcoin Derivatives market. The Long/Short ratio showed more aggressive long positions, indicating the market’s expectation of continued TEL price increases.

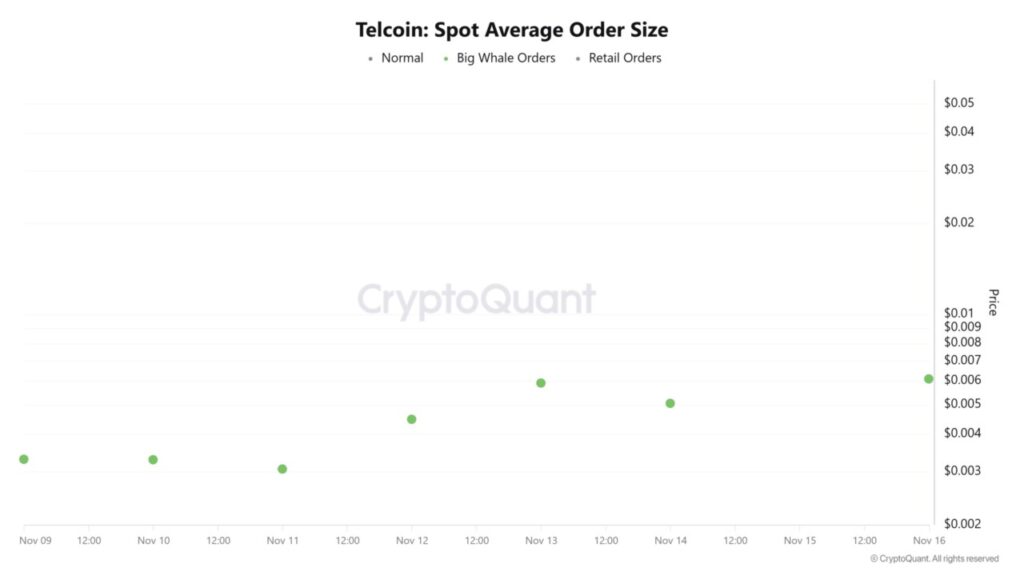

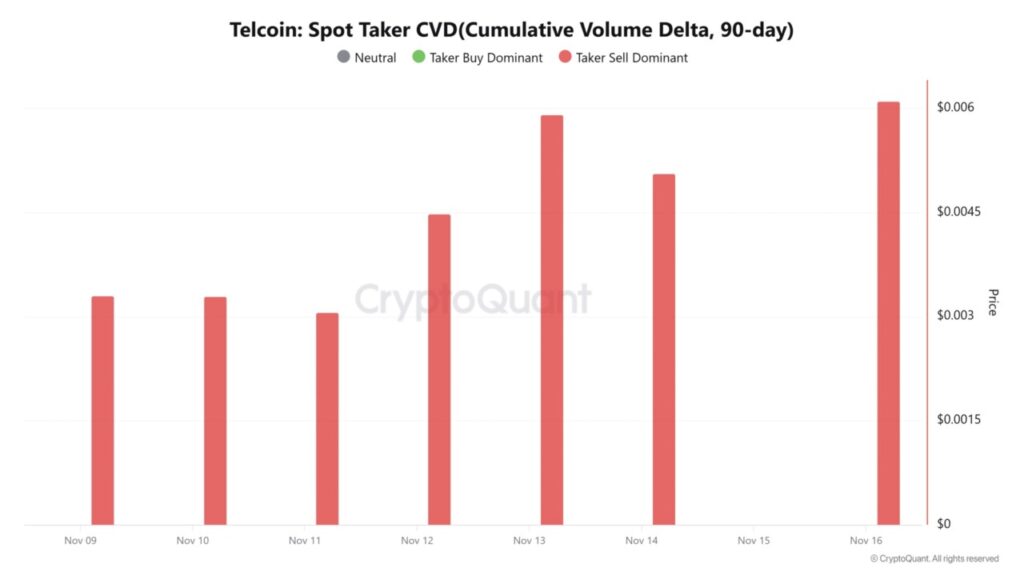

However, in the Spot market, the whales still appear cautious with large orders continuing to appear, and the dominant selling pressure seen from Spot Taker CVD increasing, suggesting that not all market participants are confident in the long-term upside potential.

Future Potential of TEL Prices

Telcoin’s bullish momentum is reinforced by the Directional Movement Index which shows a strong positive trend. If TEL manages to break the upper band of the Fibonacci Bollinger Bands, it could open a path towards $0.008.

However, failing that, TEL prices may return to mid-band support around $0.0047. Investors and traders should monitor these indicators and trading volume to make informed decisions on investing or trading TEL.

Conclusion

With the newly obtained bank charter approval, Telcoin is entering a new phase with great potential for growth. However, market volatility and mixed reactions from market participants suggest that the road ahead may not be entirely smooth. Investors and market watchers should remain vigilant of the market dynamics that could change at any time.

Also Read: 10 Most Popular Coin Memes of November 2025: The talk of the town!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is a bank charter obtained by Telcoin (TEL) and who issued it?

The bank charter obtained by Telcoin (TEL) is an official license from the Nebraska Department of Banking and Finance that allows the company to run digital asset and stablecoin services under the state’s regulatory supervision.

Q2: What services can Telcoin (TEL) provide after obtaining a bank charter?

After obtaining a bank charter, Telcoin (TEL) can provide financial services such as deposits and loans denominated in eUSD stablecoin, through blockchain-based decentralized finance applications.

Q3: How did the derivatives market react to the announcement of Telcoin’s (TEL) chartered bank approval?

The derivatives market reaction saw a surge in volume and an increase in open interest, with the Long/Short ratio signaling a preponderance of long positions, reflecting the bullish expectations of most traders.

Q4: What are the indications of whale activity in the Telcoin (TEL) spot market following the announcement?

In the spot market, whales showed caution with the emergence of large orders and dominant selling pressure, as reflected in the increase in Spot Taker CVD indicating a tendency to sell.

Q5: What is the likely price direction of Telcoin (TEL) in the near term based on technical analysis?

If Telcoin (TEL) manages to break the upper band of the Fibonacci Bollinger Bands, the price could potentially head towards $0.008; however, if it fails, the price could correct to support around $0.0047, according to the directional movement indicators and current volume patterns.

Reference

- AMB Crypto. Mapping Telcoin’s path after bank charter: Rally continuation or whale-led fakeout?. Accessed on November 17, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.