Helium Buyback Program Pushes HNT to $4? (11/17/25)

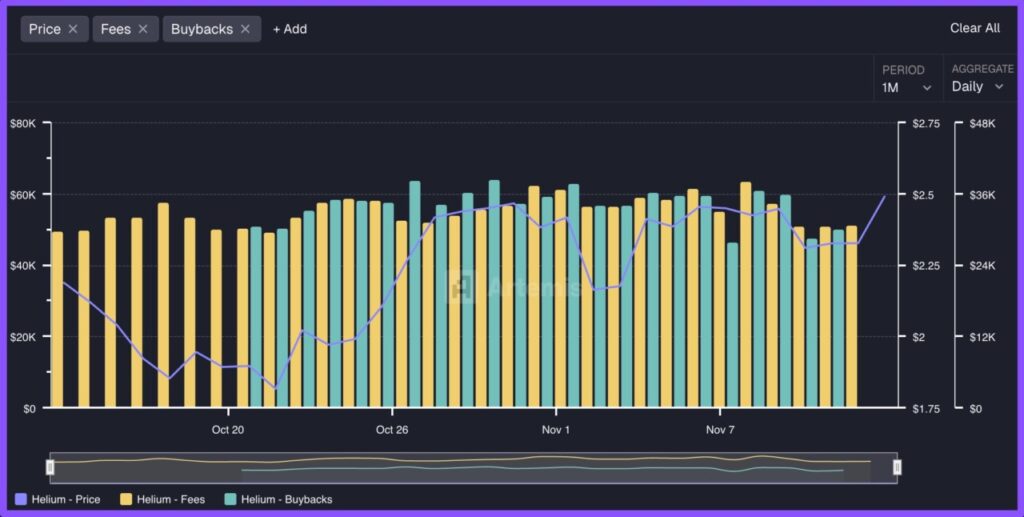

Jakarta, Pintu News – The Helium token (HNT) buyback program has attracted market attention with its significant impact on the token’s price. This activity, which began on October 20, uses the fees collected to buy back HNT tokens, managing the circulating supply and potentially influencing price dynamics.

This article will analyze how this program, along with trading volume on DEX and token transfers, could push HNT to reach a price of $4.

Market Dynamics and Buyback Program

Since the introduction of the buyback program by the Helium network, there has been a significant increase in the price of HNT tokens. The program aims to reduce the number of tokens in circulation by using fees collected from the network to buy back tokens. Within the first month, the program managed to increase the token price, however, the effect started to subside since early November.

On average, about $30,000 worth of HNT has been bought back each month. This increase not only affects the price but also stabilizes the value of the token in the market. This buyback activity effectively reduces selling pressure in the market, which can help in maintaining or even increasing the token price.

Further analysis shows that these activities also provide positive signals to investors about the network’s commitment to supporting the value of their tokens.

Also Read: 3 Powerful Altcoins Predicted to Rival Solana, What Are They?

DEX Trading Volume and Token Transfer

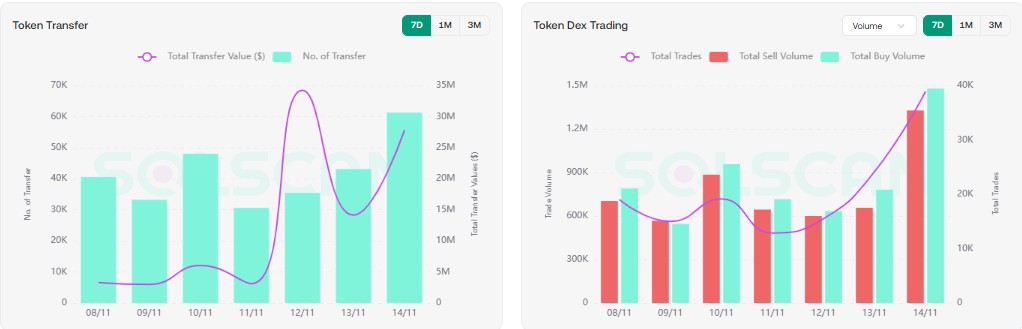

Trading volumes on decentralized exchanges (DEXs) and token transfers also showed a significant increase. Data from Solscan shows that token transfers totaled $30 million the previous day, with trading volumes on DEXs peaking at $3 million during the week.

This signals an increase in trading activity that could contribute to the stability and growth of the HNT price. In addition, the volume of buy and sell transactions on DEX also shows interesting dynamics.

Sales totaled $1.32 million, while purchases were higher at $1.47 million. The dominance of buying over selling during this past week suggests that there is more buying pressure than selling, which could be a positive indicator for HNT’s price trend going forward.

Helium Price Action Analysis

HNT experienced a short price decline but managed to hold above the $2 support level. Instead of experiencing further declines, HNT remains within a trading range suggesting the potential for a strong price floor to form. The Bull Bear Power (BBP) indicator shows a tug of war between buyers and sellers, with buyers slightly more dominant at the moment.

To achieve a bullish breakout, HNT needs to close above the $2.74 resistance zone. If it manages to hold the level, it could pave the way for a price increase up to $4. However, if not, the price may continue to consolidate between $2.17 and $2.74. Nonetheless, the general weakness in the cryptocurrency sector is still a risk to watch out for.

Conclusion

In conclusion, Helium’s buyback program along with increased DEX trading volume and token transfer activity, has the potential to boost HNT prices. However, the general strength of the cryptocurrency market is still an important factor that could affect this bullish sentiment. Investors and market watchers should continue to monitor these indicators to make informed investment decisions.

Also Read: 10 Most Popular Coin Memes of November 2025: The talk of the town!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is the Helium buyback program (HNT) and when does it start?

The Helium buyback program (HNT) is a mechanism to buy back tokens using fees collected from the network, starting from 20 October 2025, with the aim of reducing the circulating supply and supporting price stability.

How has the buyback program impacted the HNT token price so far?

The program succeeded in increasing HNT prices within the first month of implementation and helped stabilize market values by averaging about $30,000 per month in buybacks, although the effect began to subside from early November.

What role does DEX trading volume and token transfers play in HNT price trends?

The high DEX trading volume and total token transfers of $3 million and $30 million, respectively, indicate increased market activity contributing to buying pressure and supporting HNT’s price upside potential.

What have been the dynamics of HNT trading on DEX over the past week?

The data showed a buying dominance of $1.47 million over sales of $1.32 million, signaling stronger buying pressure and reflecting positive sentiment towards the direction of HNT prices.

What are the important technical levels to watch for HNT price movement?

The resistance level of $2.74 is a key area; a close above this level could open the door to $4, while a failure to break it could lead to price consolidation between $2.17 and $2.74.

Reference

- AMB Crypto. How Helium’s Buyback Program Could Push HNT Towards $4. Accessed on November 17, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.