3 Altcoins Being Quietly Accumulated by Crypto Whales and Smart Money During the Bear Market

Jakarta, Pintu News – Throughout November, the cryptocurrency market was dominated by selling pressure, with the TOTAL index recording a decline of around 20% compared to the previous month, before briefly recovering around publication time. This weakness has again raised concerns that a new bear market phase may be beginning.

However, amidst these fears, whale investors accumulated. This activity shows that the biggest wallets in the market are not exiting, but rather starting to build positions early.

They are slowly adding to their holdings of three tokens that are not driven by momentary trends, but rather underpinned by real activity and solid fundamentals. Accumulation over the past 30 days indicates an anticipatory strategy in case the overall market experiences further declines.

Optimism (OP)

The first token that is being accumulated by large investors despite the shadows of a bearish market starting to appear is Optimism (OP). In the past month, the crypto market experienced a sharp decline, and OP corrected by 13.3%. However, large holders are showing strong faith in the asset.

Read also: Hyperliquid Strengthens On-Chain Trading Infrastructure Through HIP-3 Launch!

Over the past 30 days, the 100 largest addresses holding OP increased their holdings by 3.15%. At current OP prices, the addition is worth around $54 million-suggesting that the mega whales remain optimistic despite the sluggish market.

Optimism is one of the largest Layer-2 projects in the Ethereum ecosystem. The scale of this project is likely the main reason whales see long-term value, despite the current softening in market sentiment.

This belief is in line with the technical indicators. On a two-day time frame, OP prices formed a lower low between April 7 and November 3, while the Relative Strength Index (RSI) recorded a higher low. This kind of bullish RSI divergence is often an early sign of an end to downward pressure and a potential larger trend reversal.

Whales often look for this kind of signal as a basis for building initial positions in altcoins.

For this reversal to be confirmed, OP needs to break the $0.47 level on net-a level that has so far held back every rally attempt since mid-October. If successful, the next upside target is at $0.61 and even $0.85 if sentiment improves.

Conversely, if OP loses the $0.38 support level, then the price risks returning to $0.31. A break below $0.31 opens up potential weakness down to $0.23 and would invalidate the bullish structure currently being formed by whale accumulation.

Aster (ASTER)

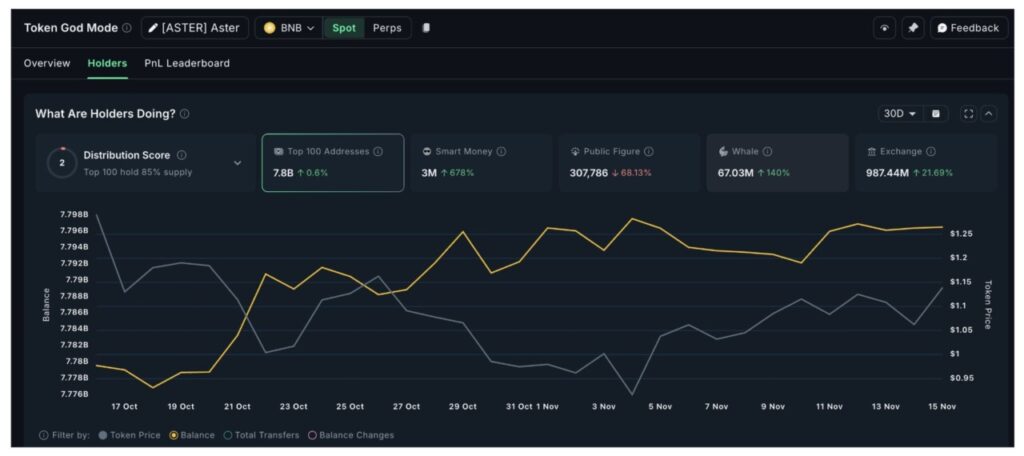

The next token that is being bought up by large investors is Aster (ASTER), with a much faster pace of accumulation than Optimism. In the past 30 days, whale holdings rose 140%, bringing total accumulation to 67.03 million ASTER.

At the current price of around $1.13, the whale’s total accumulated value stands at approximately $75.7 million-about $44 million of which comes from recent purchases. Smart money wallets have followed a similar path, with holdings increasing by 678% in the past month.

This action has technical support. ASTER price has broken out of the falling channel pattern on the 12-hour chart, signaling that the bearish trend is weakening. Between October 17 and November 14, there was also a standard bullish RSI divergence: the price formed a lower low, while the RSI printed a higher low. This pattern indicates a shift in momentum towards the positive, which could be followed by the price if buying pressure continues.

In the short term, the price action already reflects this-ASTER was up almost 9% by the end of the week last week. However, the overall technical structure points to a potential trend reversal, not just a momentary bounce.

If this structure holds, the next obstacle will be the $1.29-level that held the rally on November 2. A clean close above it will strengthen the upside potential towards $1.59. On the downside, initial support lies at $1.11. If this level is broken, prices could potentially weaken to $1.00, and failure to hold $1.00 could take prices to the $0.81 area.

Read also: Bitcoin Tends to Be Bearish, These 3 Altcoins are in the Spotlight

Maple Finance (SYRUP)

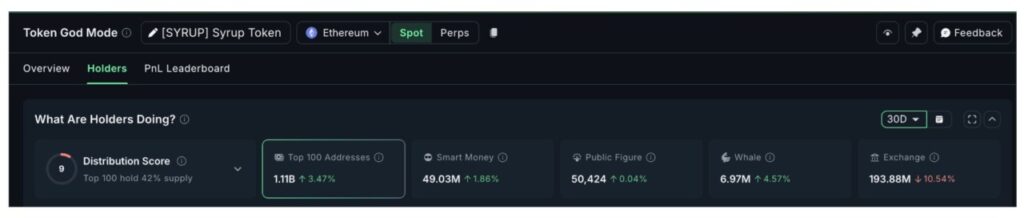

A third token that is also a target for whale accumulation ahead of a potential bear market is Maple Finance (SYRUP), a DeFi project focused on institutional credit. Although its technical projections tend to be more moderate compared to Optimism and Aster, the current structure remains favorable.

In the last 30 days, 100 mega-whale addresses increased their holdings by 3.47%, bringing the total to 1.11 billion SYRUP. At current prices, the accumulation is worth about $499.5 million.

Other groups of holders also showed the same direction: smart money wallets added 1.86%, while ordinary whales increased by 4.57%. This alignment between groups usually reflects increased confidence in the asset.

Technically, SYRUP is trying to complete an inverse head and shoulders pattern that has been forming for quite some time. The neckline of this pattern is around $0.53. A break of this level would confirm the pattern, with an upside target towards $0.65 or above.

The On-Balance Volume (OBV) indicator, which measures buying and selling pressure, also showed positive signals. The OBV started to register accumulation, although it is still stuck below the downtrend line that started around October 14.

To form a stronger trend reversal, a double breakout is required-the price must break the neckline at $0.53 and the OBV must cross that trendline simultaneously.

This double breakout often results in a more solid rally. But for now, the signal only shows conviction, not confirmation. If the price fails to hold, the invalidation level is at $0.38. A drop below it could weaken the pattern and take SYRUP down to the $0.28 area.

FAQ

What is a bear market?

A bear market is a market condition where asset prices experience a significant and persistent decline, often triggered by investor pessimism.

Why do crypto whales buy tokens during bear markets?

Crypto whales buy tokens during bear markets in preparation for potential long-term gains, showing their confidence in the fundamentals and real activity behind the tokens.

What is the value of the additional holdings made by whale for OP tokens?

Whale has added 3.15% to their holdings in the last 30 days, which is worth about $54 million.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins: Crypto Whales Buying for Bear Market. Accessed on November 21, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.