Dogecoin Price Falls 5% Today — What Could Happen Next?

Jakarta, Pintu News – The price of Dogecoin (DOGE) has recently fallen sharply, mirroring Bitcoin’s (BTC) precipitous drop below $100,000 as well as the overall crypto market weakness. Market sentiment shifted from optimism to caution overnight, as increasedwhale activity triggered a massive wave of sell-offs.

A total of $700 million worth of DOGE was recorded flowing out of the wallets of large holders, amplifying downward pressure and raising concerns among retail traders.

When the price broke the crucial level at $0.16466, the bearish technical signal became undeniable, signaling a breakdown. Amidst these tense market conditions, investors began to question: will DOGE find a stabilizing point soon, or will it continue to fall deeper?

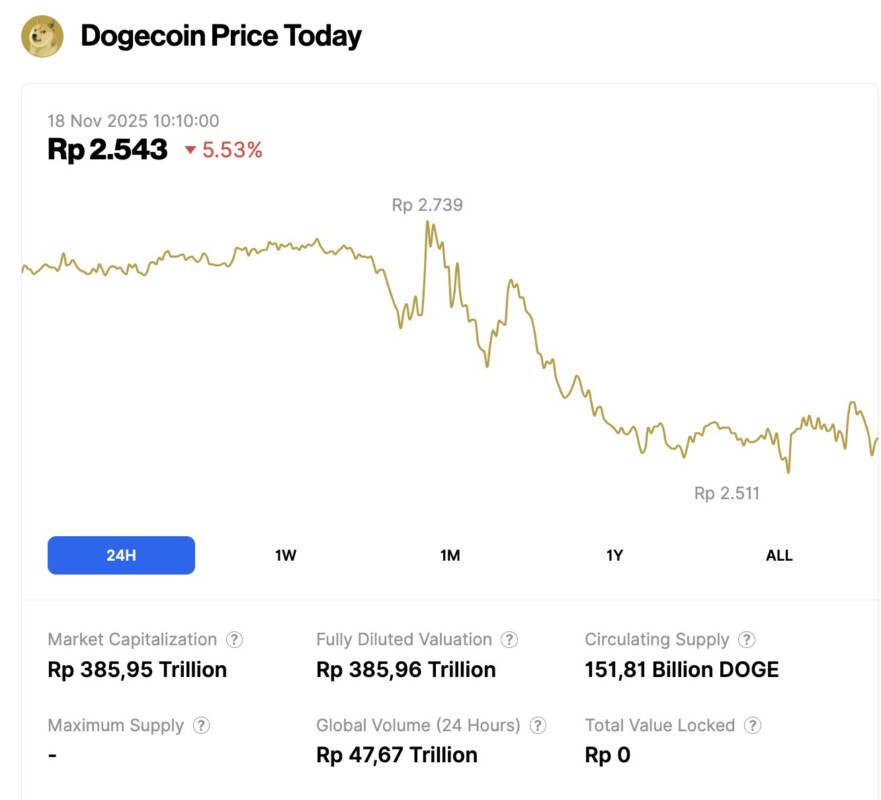

Dogecoin Price Drops 5.53% in 24 Hours

On November 18, 2025, Dogecoin’s price fell by 5.53% over the past 24 hours, trading at $0.1513, or approximately IDR2,543. During that period, DOGE fluctuated between IDR2,739 and IDR2,511.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR385.95 trillion, with a 24-hour trading volume of approximately IDR47.67 trillion.

Dogecoin (DOGE) Price Analysis

Looking at Dogecoin’s 4-hour chart (11/17), the price action shows a story of resilience being tested by market pressure. DOGE price slipped below the 78.6% Fibonacci retracement level at $0.16466 and briefly traded around $0.1619 – recording a daily decline of 0.69% and a weekly decline of 10.56%.

Technical signals remain bleak, with the RSI dropping to 45.99 and approaching theoversold area. Currently, the nearest support level is at the October low of $0.1525. If the selling pressure from the bears breaks this level, the next downside target is around $0.14.

Every time the price retests this support, the risk for the bulls increases, especially since many stop-losses are embedded below the Fibonacci zone, which could accelerate the decline. Meanwhile, the 200-day SMA which is now well above, at $0.20925, makes it clear how far the DOGE price has moved away from its intermediate trend.

For price watchers hoping for a recovery, the key point to watch is $0.171. A daily close above this level could trigger short-term bullish momentum and prompt a quick rise towards $0.18766.

However, as long as buyers haven’t returned significantly to reclaim lost territory, sentiment remains skewed towards the bearish side.

Read also: Ethereum Plunges to $2,900 Today — Is a Recovery on the Horizon for ETH?

If the next support at $0.1525 is broken, the decline could quickly continue to $0.14. Conversely, if there is a breakout above $0.171, the sentiment could change and open up opportunities for a quick rise in the higher price range.

When can this target be achieved?

The movements of DOGE are known to be quite fast and often surprising. Based on the current momentum, a possible drop to $0.1525 or a bounce to $0.171 could occur in the next 3 to 5 trading sessions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Dogecoin Price Sinks to New Lows, Can Bulls Regain $0.171 Soon? Accessed on November 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.