Will Bitwise’s New XRP ETF Drive the Next Surge in XRP’s Price?

Jakarta, Pintu News – Today, Bitwise launched its first spot XRP ETF on the New York Stock Exchange (NYSE) under the ticker “XRP”, raising hopes of a supply shock and increased institutional demand.

The launch is considered a big step for Ripple (XRP), which is now the world’s third-largest cryptocurrency by market capitalization.

Bitwise’s XRP ETF Officially Traded

Bitwise officially announced that its XRP spot ETF began trading today on the New York Stock Exchange. The company called the launch a big step for XRP, which is now the world’s third-largest crypto asset by market capitalization.

The listing page for the fund has appeared on Bloomberg, and the ticker symbol is “XRP” – something rare and highly coveted.

Bitwise has also purchased the domain BitXRPetf.com, signaling a strong marketing push for the product. The fund has a management fee of 0.34 percent, but Bitwise waives the fee for the first month for funds up to $500 million.

What is the XRP Price Today?

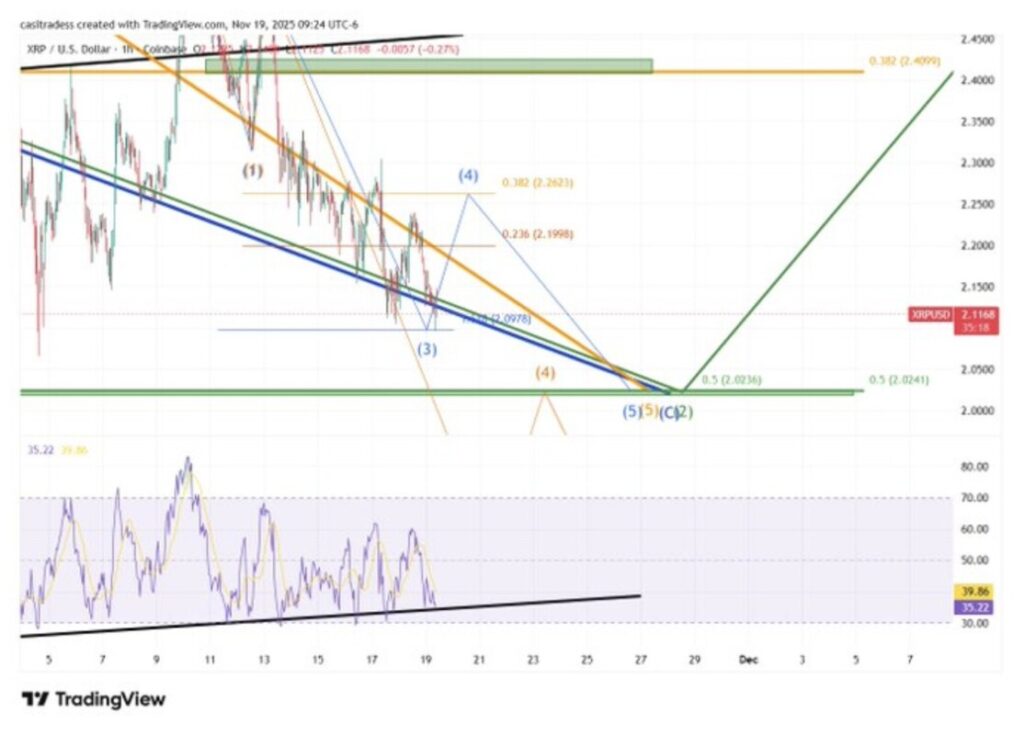

XRP has recently dropped close to $2.10, but analysts consider this movement to be normal as part of a Wave 4 correction. XRP also touched its RSI support trend line, indicating a possible price bounce in the near future.

Read also: Pi Network Price Down 2%: On-Chain Data Shows Signs of Trend Reversal?

A bounce back to $2.26 is still possible in the short term, while the macro Fibonacci level of $2.03 is the most important support zone in this correction phase.

Why This ETF Matters for XRP

According to analysts, this ETF could trigger a supply shock, as the authorities in the ETF would need to buy XRP to replenish and support the fund.

Demand for XRP is also expected to increase due to global macro shifts, including what analyst Jake Claver calls the reverse carry trade-asituation where a rate hike in Japan could encourage massive fund flows into other assets, including crypto.

Claver said this domino effect could push XRP into a long-term demand cycle, especially if institutions start to consider XRP as a real payment infrastructure.

There is also speculation that BlackRock might launch their own XRP ETF in 2025, which could further increase the pressure on the available XRP supply.

FAQ

What is the XRP ETF launched by Bitwise?

The XRP ETF launched by Bitwise is an exchange-traded fund that allows investors to invest in Ripple (XRP) through the traditional stock market without the need to hold XRP directly.

How can ETFs affect the price of XRP?

The ETF is expected to cause a supply shock as it requires the purchase of XRP by authorized participants, which could increase demand and potentially the price of XRP.

What is a “reverse carry trade” and how does it affect XRP?

The “reverse carry trade” is a phenomenon where rising interest rates in one country cause investors to move their funds to higher-yielding assets in another country, which could include cryptocurrencies like XRP.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Will XRP Price Rally After the Bitwise ETF Goes Live Today. Accessed on November 21, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.