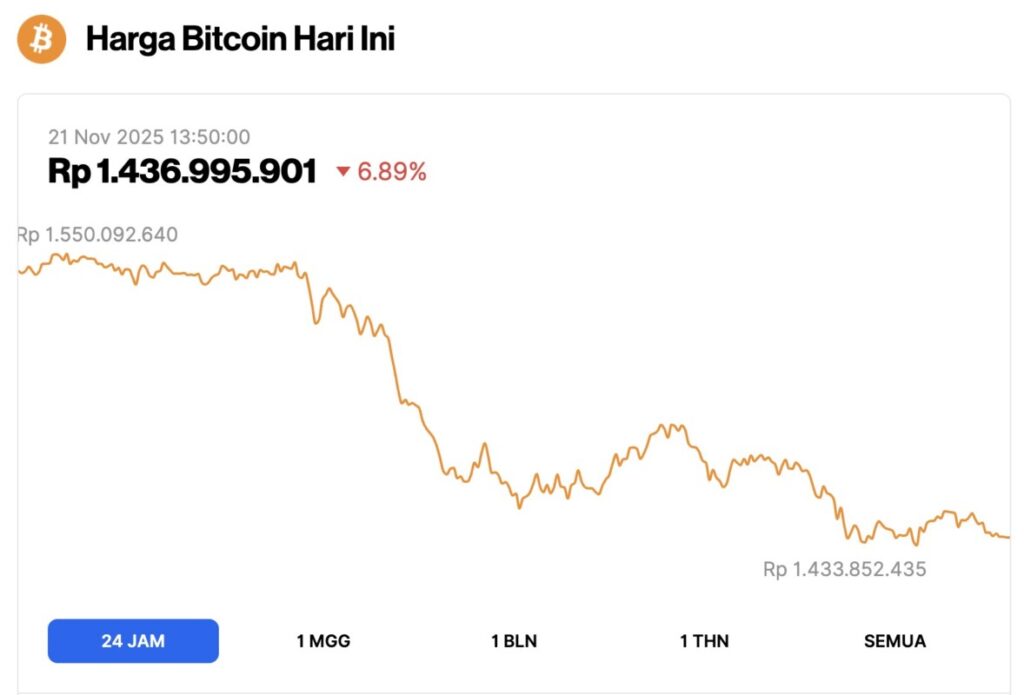

Bitcoin Price Crashes Below $90,000: Impact Analysis and Stabilization Predictions

Jakarta, Pintu News – Bitcoin’s (BTC) price drop below $90,000 has sparked concern among investors and market analysts. The drop comes amid declining expectations of corporate buying and outflows from exchange-traded funds (ETFs). This has caused the crypto market’s fear and greed index to reach an extreme of 11, signaling a very high level of fear among investors.

Analysis of the Causes of the Decline

Jamie Elkaleh, Chief Marketing Officer at Bitget Wallet, points out that the $800 million forced liquidation is indicative of the excessive use of leverage in the crypto market. A more stable stock market thanks to income diversification and macroeconomic stability stands in stark contrast to the crypto market which exhibits stress more dramatically and transparently.

The analytics team from Bitcoin yield protocol, TeraHash, emphasized that ETF fund flows are an important indicator for Bitcoin (BTC) price. They noted the record outflow of $523 million from the BlackRock Bitcoin ETF as a sign of falling demand. At the peak of the inflow at the end of the second quarter, spot ETFs for Bitcoin attracted around $600-$700 million daily, which drove the price to surge past $115,000 and peak above $126,000.

Also read: Gold Jewelry Price Today, Friday, November 21, 2025

Bitcoin Price Stabilization Prediction

Despite the significant drop, crypto market analysts predict that Bitcoin will stabilize in the range of $89,000 to $95,000. Factors such as excessive leverage, profit-taking by whales, and lower expectations for corporate accumulation are thought to be the main causes of the current price decline. However, there is no indication that this is a broader structural collapse in the crypto market.

Conclusion

Although the market is currently experiencing uncertainty, analysts suggest that this is an adjustment phase after a period of very rapid growth in the first half of the year. Investors are advised to watch market indicators such as ETF flows and corporate activity to get a clearer picture of the future direction of the Bitcoin market.

FAQ

What are the main causes of Bitcoin’s recent price drop?

The main causes include large forced liquidations, decreased demand for ETFs, and lower expectations for corporate buying.

What is the current value of the crypto market fear and greed index?

The crypto market fear and greed index is currently at an extreme 11, indicating a very high level of fear.

What are analysts’ predictions for Bitcoin price stabilization?

Analysts predict that Bitcoin (BTC) will stabilize in the range of $89,000 to $95,000.

Does Bitcoin’s price drop signal a structural market crash?

No, according to analysts, this price drop does not reflect a broader structural collapse, but simply the need for the market to adjust after a period of rapid growth.

What role do ETFs play in determining the price of Bitcoin?

ETFs are an important indicator for the price of Bitcoin, with fund flows in and out of ETFs directly affecting price dynamics.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Bitcoin Faces Pressure as ETF Demand Cools – Analysts. Accessed on November 21, 2025

- Featured Image: Investing News Network

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.