21Shares XRP ETF Officially Comes to Cboe with Ticker “TOXR”, Here are the Details!

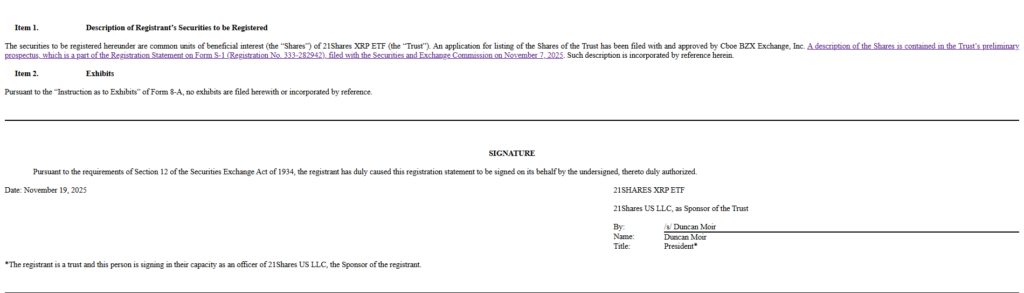

Jakarta, Pintu News – In the latest development in the crypto finance market, 21Shares, one of the world’s largest issuers of crypto-related products, has secured automatic approval for their XRP ETF. The product is scheduled to begin trading on the Cboe BXZ Exchange under the ticker symbol “TOXR” next week. This approval was announced after 21Shares filed a form 8-A with the US Securities and Exchange Commission (SEC).

21Shares XRP ETF Approved and Ready to Trade

The 21Shares XRP ETF, which will trade under the ticker symbol “TOXR”, has gotten the green light from the SEC through the filing of a form 8-A which makes it automatically effective. Cboe BXZ Exchange has also approved the listing of shares of this ETF on their exchange. With these approvals, the ETF is expected to begin trading next week, pending listing certification from the exchanges.

The ETF aims to provide exposure to Ripple (XRP), by following the XRP spot price set by the CME CF XRP-Dollar Reference Rate price index. Coinbase Custody, Anchorage Digital Bank, and BitGo Trust will act as asset custodians for the 21Shares XRP ETF.

Operational Structure of ETFs and the Role of Supporting Institutions

In the operational structure of the ETF, BNY Mellon will act as the cash depository, administrator and transfer agent of the trust. Foreside Global Services has been appointed as the marketing agent for this ETF. This structure is designed to ensure safety and efficiency in the management of ETF funds.

Read also: Maple Finance Hampered by Core Foundation Injunction in syrupBTC Launch

The initial investor, 21Shares US LLC, is expected to purchase an initial creation basket consisting of 10,000 shares. This step is part of the initial process in the establishment and stabilization of ETFs in the market. With this strong structure and support, the ETF is expected to attract significant investor interest.

XRP price rebound supported by surge in trading volume

The price of Ripple (XRP) has rebounded by 5% in the past 24 hours, after falling by more than 9%. Currently, the XRP price stands at $2.12, with the day’s low and high being $2.01 and $2.17. This rise indicates increased interest from traders.

XRP’s trading volume increased by 26% in the last 24 hours, indicating increased interest among traders. This comes along with the approval of several ETFs, including the 21Shares XRP ETF. The increase also reflects the market’s positive expectations of the new product.

Conclusion

The approval of the XRP ETF by 21Shares on Cboe BXZ marks an important step in the integration of crypto assets into mainstream financial products. With a strong structure and backing from leading financial institutions, this ETF is expected to bring more liquidity and stability to the Ripple (XRP) market.

FAQ

What is the 21Shares XRP ETF?

The 21Shares XRP ETF is a financial product that aims to provide exposure to Ripple (XRP) by following the XRP spot price set by the CME CF XRP-Dollar Reference Rate price index.

Where will the XRP 21Shares ETF be traded?

The XRP 21Shares ETF will trade on the Cboe BXZ Exchange under the ticker symbol “TOXR”.

Who acts as the custodian of assets for the XRP 21Shares ETF?

Coinbase Custody, Anchorage Digital Bank, and BitGo Trust will act as asset custodians for the 21Shares XRP ETF.

What is the current price of Ripple (XRP)?

The current price of Ripple (XRP) is $2.12, with daily price fluctuations between $2.01 and $2.17.

What is BNY Mellon’s role in the 21Shares XRP ETF?

BNY Mellon will act as the cash depository, administrator and transfer agent of the XRP 21Shares ETF trust.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. 21Shares XRP ETF Gains Approval to List on CBOE Under TOXR Ticker. Accessed on November 21, 2025

- Featured Image: U Today

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.