3 Altcoins Worth Keeping an Eye on Before Black Friday Arrives, According to ChatGPT Predictions!

Jakarta, Pintu News – With Black Friday falling on November 28, several large-cap and near-large-cap tokens still have promising catalysts as well as strong trading footprints, despite the recent market turmoil.

Here are three of ChatGPT’s preferred altcoins selected based on their performance and fundamentals. Learn why all three have the potential to go up during the holiday season, and why buying on dips can be a wise decision.

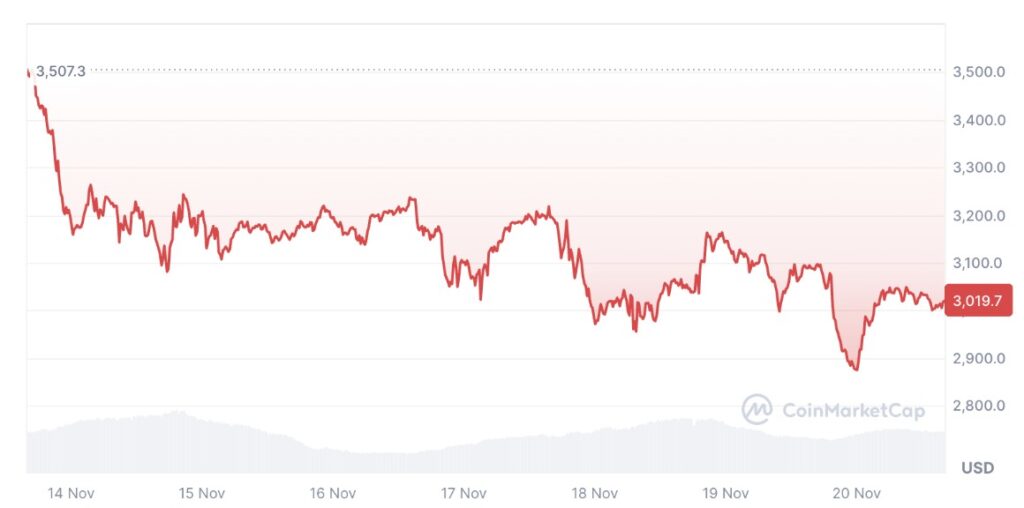

Ethereum (ETH): ETF Flow Support and ETH Staked

Ethereum (ETH) has fallen by 14% in the past week and is now hovering around $3,000. Daily fund flows are still volatile, but the ETF dashboard still shows continued unit creation and redemption activity.

Read also: Vitalik Buterin Warns of Quantum Threat: Ethereum Ready to Boost Cryptographic Security

This kind of institutional “shock absorber” mechanism has never been seen in previous market cycles. If fund flows begin to stabilize or turn positive in late November, historically this has often been the trigger for a recovery rally for ETH.

The spot Ethereum ETF in the US has now become a significant channel of demand, with mid-year data showing sustained net inflows and asset growth outpacing spot ETH performance.

Recent news also suggests that BlackRock has taken initial steps towards a staked ETH ETF – a potential additional catalyst that could drive institutional demand towards the end of the year.

ETH is a key foundation for asset tokenization, stablecoin settlement, and DeFi activity. Several banks and trading platforms continue to test tokenized assets using infrastructure directly or indirectly connected to Ethereum. Recent projections from Citi remain optimistic about ETH prices later in the year, with support from application usage and staking appeal.

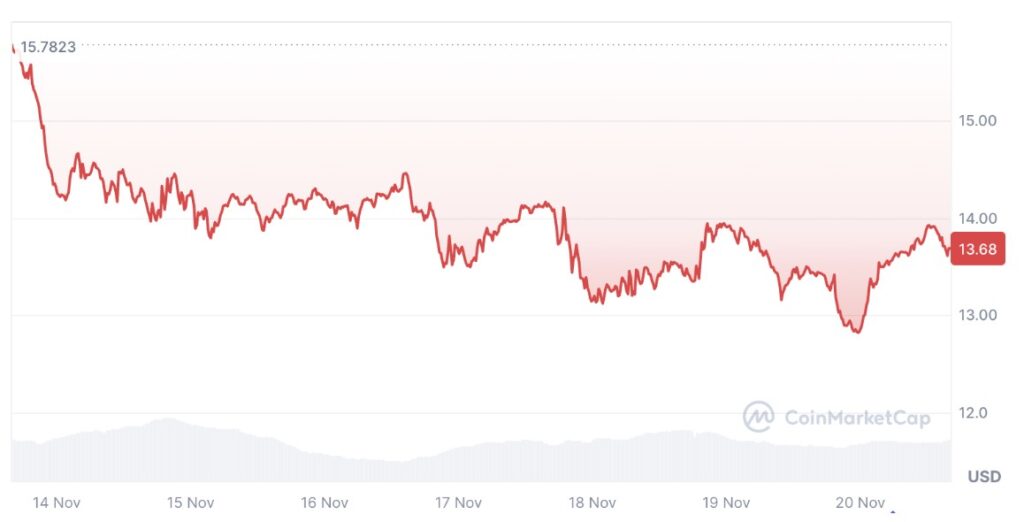

Chainlink (LINK): Tokenization Infrastructure

Chainlink (LINK) has fallen by 12.5% in the last seven days and is currently trading at around $13.6. SWIFT and a number of major global banks continue to push for blockchain-based transaction settlement and tokenization trials. Chainlink’s CCIP is one of the key interoperability technologies being tested in this context.

Chainlink recently won a SWIFT hackathon focused on regulatory-compliant cross-border settlement. Narratives like this tend to attract fund flows when markets are in risk-on mode, and provide protection when markets are risk-off.

Oracle Chainlink secures data for dozens of blockchains, while CCIP aims to establish cross-chain communication and value transfer standards for banks, custodians, and market infrastructures – all of which are currently exploring the tokenization of deposits, funds, and securities.

Read also: 4 Powerful Catalysts that Could Push Zcash (ZEC) Price to $1,000

Toncoin (TON): Large Scale Distribution via Telegram

Toncoin (TON) has dropped by 17% due to the recent market turmoil, and is currently trading around $1.71. However, the deepening integration with Telegram has become a real powerful distribution engine for TON. This started with the official launch of the TON wallet in the United States, and is now being expanded through a broader mini-app financial experiment within the Telegram app.

The list of listings on major exchanges this week – including Coinbase launching trading of the TON-USD pair – adds liquidity and increases exposure ahead of the holiday season.

TON tends to show relative strength whenever there is Telegram-related product news. New listings also help narrow spreads and expand the potential buyer base – conditions that have historically often favored continued price gains.

In terms of fundamentals: Since Telegram established TON as its “official Web3 infrastructure”, the in-app stablecoin transfer feature and mini-app financial services have turned Telegram’s massive user base into an adoption channel for on-chain activities. This is an adoption dynamic that other layer-1 blockchains can rarely match.

FAQ

What is Ethereum (ETH) and why does it have high investment potential?

Ethereum (ETH) is a blockchain platform that enables decentralized application development. With the support of an increasing flow of ETFs and a high number of ETH stakes, Ethereum offers stability and attractive growth potential for investors.

How does Chainlink (LINK) support the blockchain ecosystem?

Chainlink (LINK) provides a decentralized oracle that enables smart contracts to access real-world data, which is essential to the operation of many blockchain applications. This makes Chainlink a critical component in the development of blockchain applications.

Why is Toncoin (TON) distribution via Telegram considered unique?

The distribution of Toncoin (TON) via Telegram leverages the app’s large user base, enabling large-scale distribution and rapid adoption, which gives it a competitive advantage over other altcoins.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. ChatGPT Suggests You Buy These 3 Cryptocurrencies Before Black Friday. Accessed on November 21, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.