3 Big Analyst Predictions on XRP Performance If Bear Market Continues

Jakarta, Pintu News – Amidst the dominance of the crypto market that is undergoing bearish pressure, several renowned analysts have given firm views regarding the price outlook of Ripple (XRP). This comes as XRP breaks below the $2.00 range and market sentiment is categorized as “anxiety-stage” according to on-chain data.

Ali Martinez Prediction: Potential to Drop Below $2.00

Analyst Ali Martinez warned that if the XRP price fails to hold above the $2.15 support level, then the next support targets are around $1.91 and $1.73. On-chain data shows that 41.5% of XRP supply is currently in an unrealized loss, signaling distribution pressure from long-term holders.

Martinez highlighted technical formations that show a decline in retailer and whale buying interest – this reinforces the scenario of falling prices amid weak market conditions.

Also read: Bitcoin has entered the ‘bear market’ phase? Here’s what crypto analysts say

Ali Martinez Prediction: Rain-Stage Sentiment and Vulnerability below $2

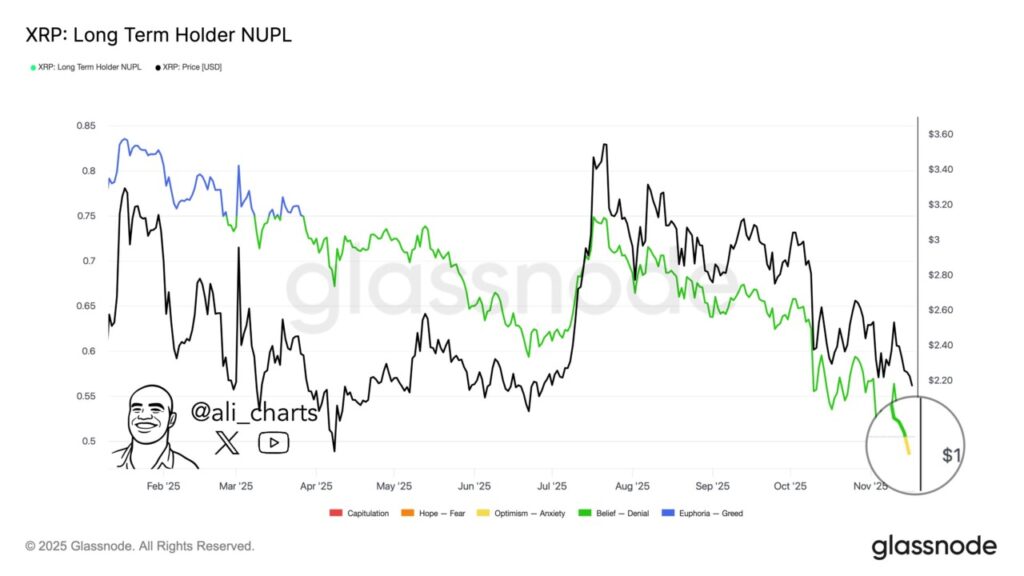

According to Ali Martinez, the NUPL (Net Unrealized Profit/Loss) index for long-term holders of XRP shows a transition from the “denial” to “anxiety” phase – signaling a high level of fear among large holders.

Singh mentioned that the supply of XRP that is still profitable is only 58.5% – the lowest level since November 2024 – which could trigger further distribution if prices do not recover soon.

The report warned that falling open-interest and pressure on the derivatives market could strengthen bearish momentum for XRP, especially in a global market with tight liquidity.

Read also: Bitcoin Threatened to Collapse to $58,000, Crypto Market Getting Shaken?

CasiTrades Analysis: Macro Target at $1.65

The CasiTrades analyst account pointed out that XRP’s long-term structure displays a corrective pattern that could potentially take the price up to $1.65 – the 0.618 fibo level of the previous move. He revealed that a daily “death cross” formation has appeared and the daily Relative Strength Index (RSI) is around 32, indicating strong bearish momentum.

Large stop-losses and increased liquidation could open up room for a deeper drop, especially if institutional liquidity remains low and retail selling pressure increases.

Conclusion

In an increasingly gloomy crypto market atmosphere, the three analysts highlighted that XRP (Ripple) faces significant risks if key supports fail to hold. Price targets such as $1.91, $1.73 to $1.65 emerge as key negative scenarios – suggesting that investors and traders should be wary of potential further downward pressure during this bear market phase.

FAQ

What is the “anxiety phase” in the context of XRP?

The “anxiety” phase refers to the psychological state of long-term holders who begin to respond to market pressure with anxiety, as indicated by the decline in XRP’s NUPL index, from “denial” to “anxiety”.

Who are the analysts making these predictions regarding XRP?

Predictions were delivered by three main parties: Ali Martinez who targets $1.91-$1.73, CasiTrades with a target of $1.65, and Varinder Singh through sentiment analysis and on-chain data.

Why did XRP drop below $2.00?

Due to a combination of factors – including failure to maintain $2.15 support, bearish technical formations (such as a death cross), weak volume and market sentiment, and distribution from large holders.

Does this prediction mean XRP will definitely drop to $1.65 or $1.73?

This prediction is not a guarantee. All analysis is based on technical, on-chain, and sentiment data through November 19, 2025 and remains subject to risk due to highly volatile market conditions.

When can this change for XRP?

Changes could occur if there are strong catalysts such as positive regulation, institutional product launches, or restoration of market liquidity – but no specific dates have been mentioned in the current analysis.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinGape. XRP Price Risks Falling Below $2 as Sentiment Dips to ‘Anxiety’ Stage, Analyst Predicts. Accessed Nov 22, 2025.

- FXStreet. Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH, and XRP continue to crash as market bears take control. Nov 22, 2025.

- Featured Image: Coin Central

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.