Crypto Market Under Pressure: Over $2 Billion Wiped Out in 24 Hours

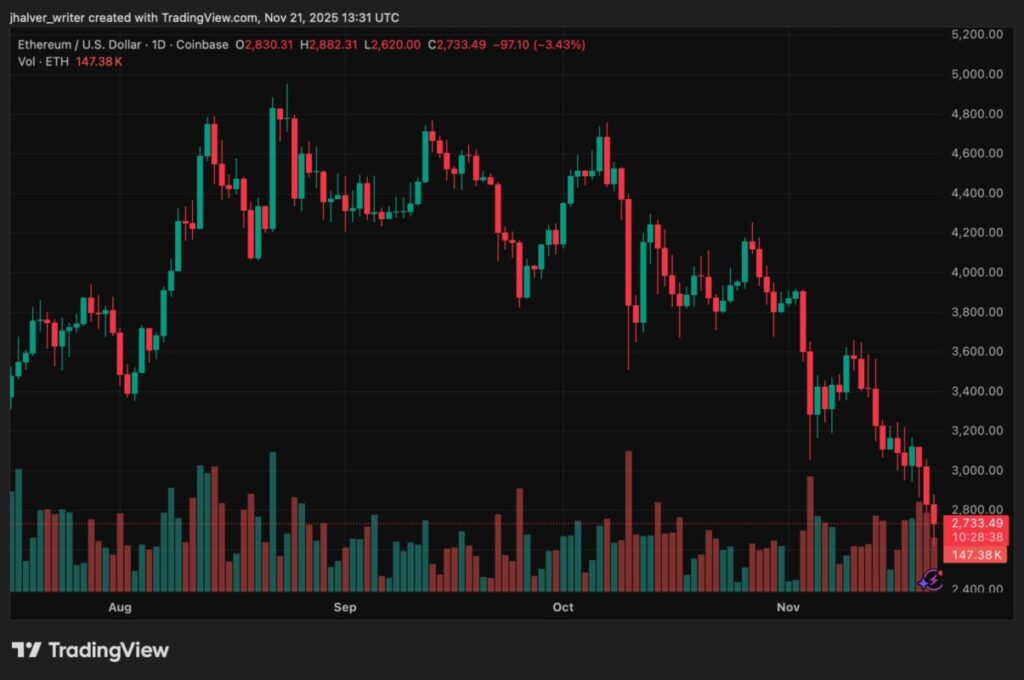

Jakarta, Pintu News – The crypto market has been rocked hard again after more than $2 billion of leveraged positions were liquidated in just one day. Large assets such as Bitcoin (BTC) and Ethereum (ETH) plummeted sharply, sparking fears of a larger wave of corrections to come.

A Wave of Massive Liquidations

Data from Coinglass revealed that the market experienced one of the most brutal liquidation sprees since the big crash in October. In the last 24 hours:

- Bitcoin longs liquidated for $966 million

- Ethereum longs suffered losses of around $407 million

- Total liquidation reached $2 billion, including long and short positions

The largest liquidation occurred on the Hyperliquid platform, with a single BTC-USD position worth $36.78 million vanishing.

Also Read: 4 Bitcoin Indicators that Triggered the Market Rally Reappear!

Options Maturing, Whale on the Move

The situation is further complicated as the market is preparing for the maturity of $4.2 billion worth of crypto options, covering:

- 39,000 BTC option contracts

- 185,000 ETH option contracts

Many traders take put positions (price down bets), reflecting the expectation of a continued decline. Meanwhile:

- A legendary Bitcoin whale who held BTC since 2011 sold 11,000 BTC worth $1.3 billion

- On the other hand, another whale bought $65 million BTC around the $85,000 level.

Thin Liquidity, Fragile Market

The market crash this time stems from the $19.5 billion mass liquidation event in October, which shattered market confidence and made major market participants extremely cautious. As a result:

- Market liquidity becomes fragile

- Small price movements can trigger a domino effect

Even so, networks like Solana and infrastructure like Fireblocks remain stable and can handle spikes in activity, providing some hope amidst the chaos.

Next Market Direction?

With macro uncertainty, outflows from crypto ETFs, and whale action, the crypto market is on edge. Traders are now focused on watching:

- Will the correction continue?

- Or is this an accumulation opportunity before the big rebound?

Also Read: 5 Shocking Facts: This US Congressman Secretly Bought IDR 41 Billion in Bitcoin!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ – Crypto Market Crisis and Its Impacts

Q1: What was the main cause of the $2 billion loss in 24 hours?

A1: A wave of liquidation of leveraged positions (both long and short) amid the Bitcoin and Ethereum price declines.

Q2: What is “max pain point” and how does it affect options?

A2: Max pain is the price at which the option incurs the greatest loss for the option holder. For BTC it is currently around $98,000, which is well above the market price, putting additional pressure on sentiment.

Q3: Why is whale selling his BTC now?

A3: Some whales may be taking profits or anticipating further declines. However, this action triggers selling pressure in the market.

Q4: Is there any sign of accumulation amidst this pressure?

A4: Yes, some whales reportedly bought $65 million worth of BTC around the $85,000 level, signaling strategic buying interest.

Q5: What should investors pay attention to right now?

A5: Focus on market liquidity, whale movements, and post-option maturity market response. Volatility is likely to remain high in the near term.

Reference:

NewsBTC – Crypto Market Remains on Edge After Over $2B Wiped Out in the Last 24 Hours. Accessed November 22, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.