Ethereum Stalls at $2,800 Today — Is a Move Back to $3,000 Still Possible?

Jakarta, Pintu News – Ethereum (ETH) is still struggling to recover from its latest price drop, with the second-largest crypto asset trying to regain momentum after falling below key levels. Although ETH has strong support from long-term holders, its recovery process still requires fresh cash injections.

However, the flow of new capital currently appears to be limited, creating uncertainty about the direction of Ethereum’s next move.

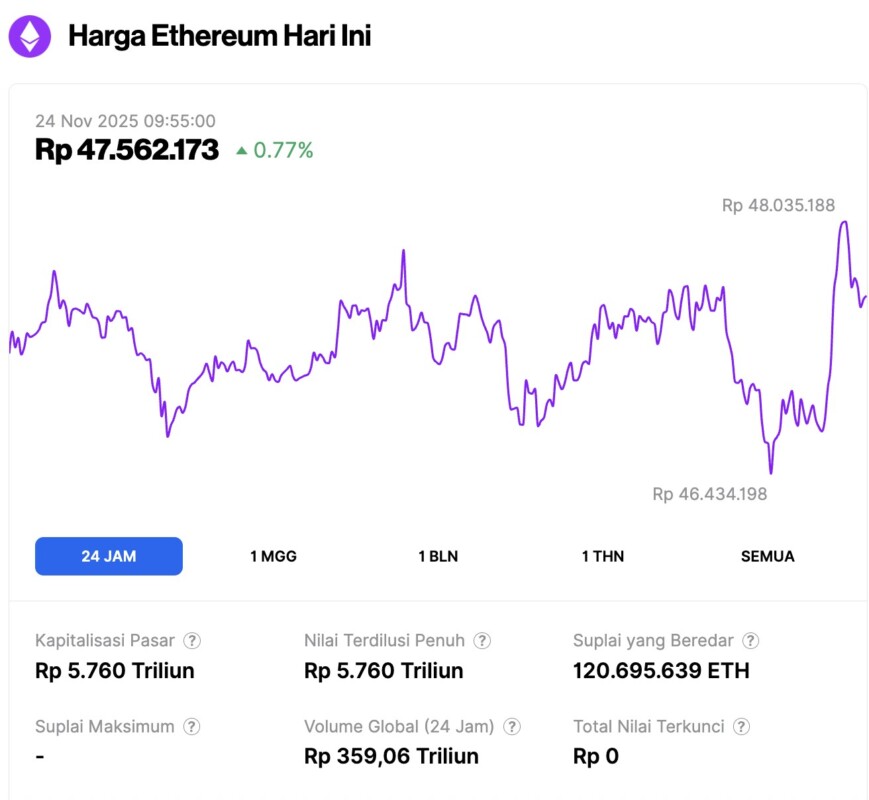

Ethereum Price Up 0.77% in 24 Hours

On November 24, 2025, Ethereum was trading at approximately $2,837, or around IDR 47,562,173 — marking a modest 0.77% increase over the past 24 hours. During this time, ETH reached a low of IDR 46,434,198 and a high of IDR 48,035,188.

At the time of writing, Ethereum’s market capitalization is estimated at around IDR 5,760 trillion, while its 24-hour trading volume has surged by 34% to IDR 359.06 trillion.

Read also: Top 10 Real World Assets (RWA) Tokenization Platforms in the Crypto World in 2025

Ethereum Holders Show Mixed Sentiment

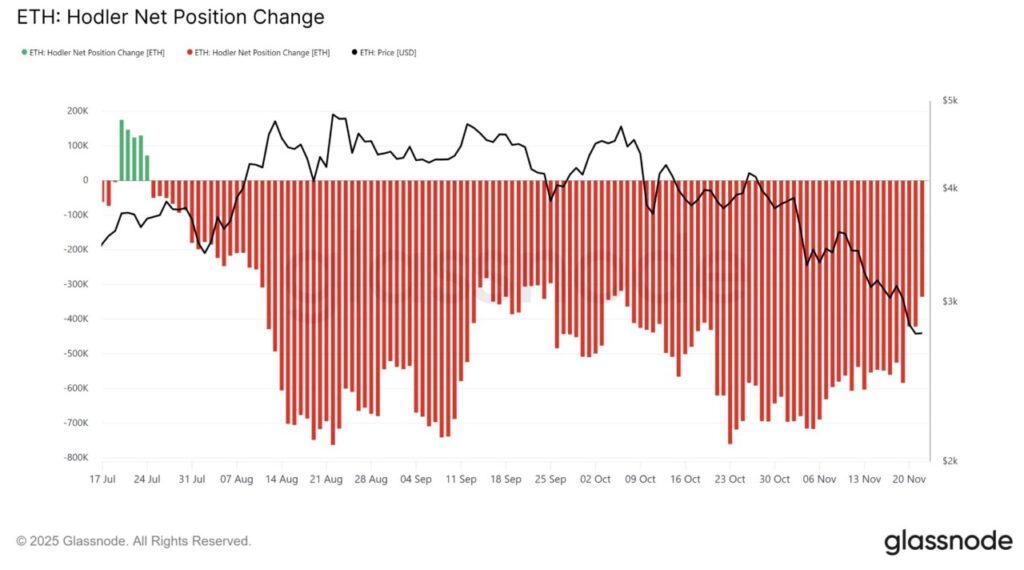

The HODLer Net Position Change indicator showed a steady rise, signaling increased confidence among long-term holders (LTH).

This indicator measures the movement of ETH in the wallets of LTHs, and the recent rise from the negative zone indicates that outflows are starting to slow down. Historically, such changes have often signaled the beginning of a new accumulation phase.

As long-term holders reduce selling activity, the market stabilizes. Their faith in Ethereum’s recovery strengthened the asset’s foundation, even amid volatile market conditions.

If this trend continues, LTHs will likely shift from simply storing to accumulating again, which could be an important support for ETH’s price push higher.

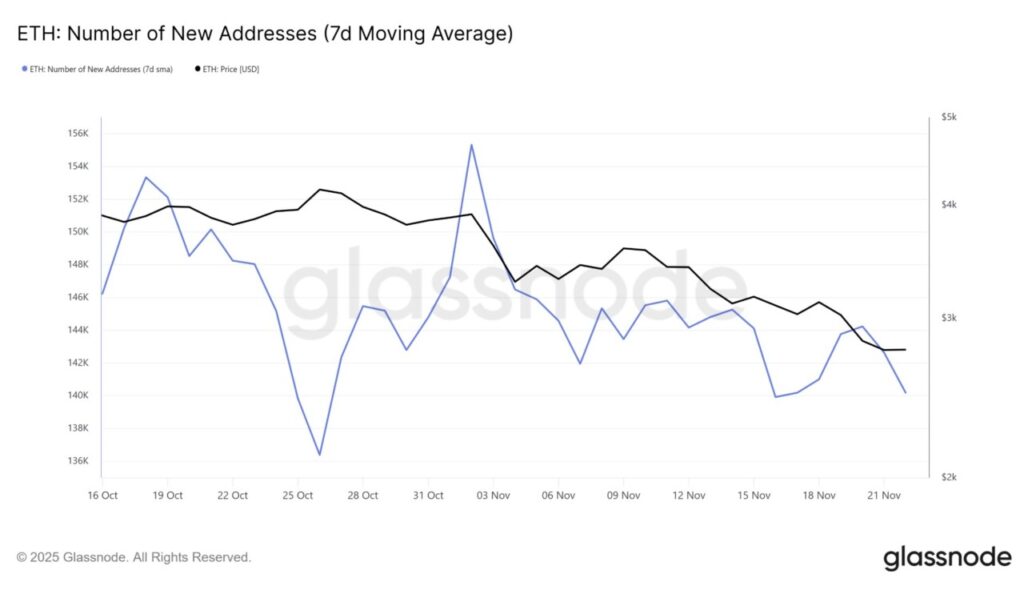

However, despite the improved sentiment from existing holders, the overall macro momentum is still mixed. The number of new Ethereum addresses has not shown a significant increase and has been stagnant, indicating that interest from new investors is still weak.

This stagnation is quite worrying, as new demand is a key element in a sustained price recovery.

Without growth in the number of new participants in the market, inflows may not be strong enough to push ETH prices towards the $3,000 level. Support from existing holders is important, but without additional external capital, a significant rally could be delayed or lose steam.

Read also: 5 Strong Signals Crypto Bull Market is Ready to Return

ETH Price Needs to Recover Soon

Currently, Ethereum is trading at $2,837, just below the key resistance area. At this distance, ETH only needs to rise about 6.6% to break the psychological $3,000 mark again, which is an important level for both traders and long-term investors.

For Ethereum to reach those levels, support from new investors is needed. If new demand remains weak, ETH will likely go sideways and consolidate below $3,000, as existing capital alone may not be enough to fuel a long-term rally. Broader market engagement is key to sustaining a potential breakout.

If the inflow of funds starts to increase and new investors become active again, ETH could potentially rise towards $3,000 and try to make that level a new support. If it manages to break and maintain a position above that area, the path to $3,131 or higher could be open.

This would also abort the existing bearish sentiment and restore the bullish momentum for Ethereum.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum’s Recovery to $3,000 Could Be Challenged by New Holders. Accessed on November 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.