Tensor Crypto Surges Over 55% Today — What’s Driving the Rally?

Jakarta, Pintu News – The structure of the Tensor crypto market underwent significant changes this week after recording one of its strongest moves in recent months. Previously, the token was stuck under strong resistance pressure for several weeks, while trading activity continued to decline and outflows were consistent.

However, things took a drastic turn when an unexpected breakout pushed TNSR’s price up from its monthly low. This surge sparked renewed talk about whether this recovery could last after months of heavy selling pressure.

Currently, the price chart shows a tug-of-war between the renewed buying interest and the important resistance level formed from the previous price drop.

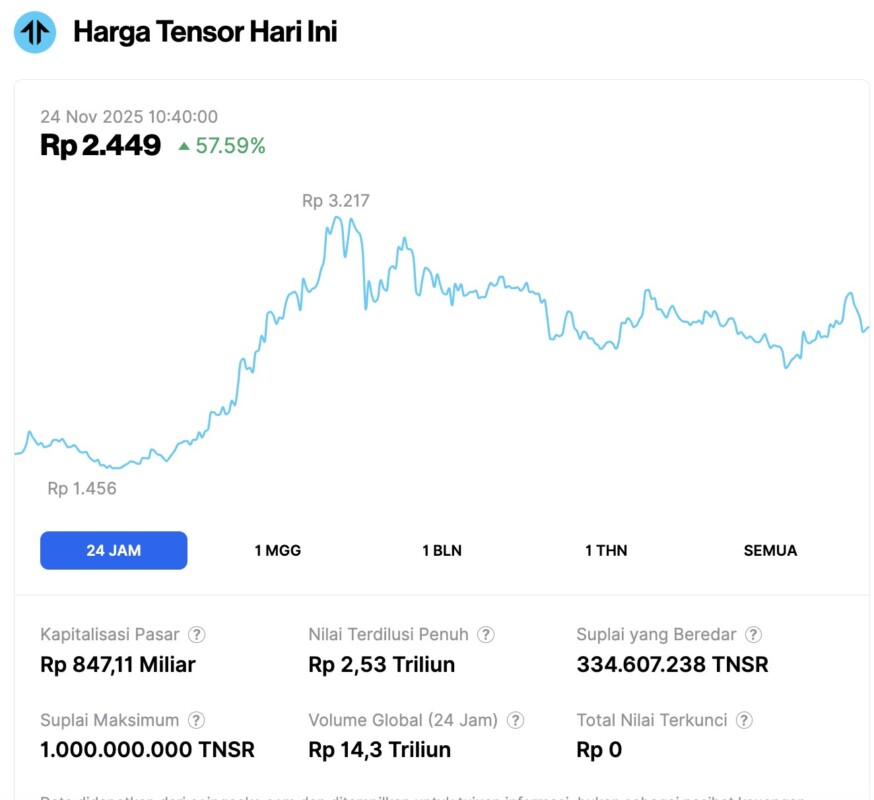

Tensor Crypto Price Rises 57.59% in 24 Hours

On November 24, 2025, the price of Tensor crypto (TNSR) recorded a significant increase of 57.59% in the last 24 hours, trading at Rp2,449. During this period, the TNSR price touched a low of Rp1,456 and peaked at Rp3,217.

In terms of fundamentals, TNSR’s market capitalization currently stands at Rp847.11 billion, with daily global trading volume reaching Rp14.3 trillion – a huge number and indicative of the surge in market interest in this asset.

Read also: Dogecoin Rises 3% Today — Could ETF Launch Be the Spark for a Bigger Rally?

The maximum supply of Tensor is set at 1 billion TNSR, with the current circulating supply reaching 334,607,238 TNSR. Meanwhile, the fully diluted value is projected to touch Rp2.53 trillion, indicating the maximum potential valuation if all tokens are circulated in the market.

What is Tensor Crypto?

Tensor is a Solana (SOL) network-based NFT marketplace . Launched in July 2022, the project has continued to grow despite being affected by the FTX collapse. Today, Tensor has become one of the main places to trade NFTs in the Solana ecosystem.

Interestingly, the recent spike in the price of the TNSR token was not driven by an obvious fundamental event. After almost two months of inactivity on the X platform (formerly Twitter), the Tensor Foundation suddenly announced its integration with Ryder One – an announcement that was not considered strong enough as a reason for a massive price spike.

From a technical and market behavior standpoint, this price spike is most likely due to a short squeeze. Since mid-September 2025, funding rates for TNSR have fallen sharply. This means that traders with short positions using leverage have to pay traders with long positions – a condition that indicates the dominance of short positions in the market.

Breakout Occurs After a Long Period of Consolidation

For most of October and November, TNSR traded in a narrow range, with pressure from sellers dominating any attempts at price recovery. In this period, the token price stayed below $0.05, and repeatedly failed to break the trend indicators that continued to hold any price bounce.

The consistent selling pressure was also reinforced by the Supertrend signal, which continued to show a strong bearish tendency. However, this calm trend came to an end when the price of TNSR suddenly jumped sharply, rising from $0.04 to above $0.20 in just one strong push.

Read also: Ethereum Stalls at $2,800 Today — Is a Move Back to $3,000 Still Possible?

This spike managed to break through several Fibonacci levels before finally getting stuck in an area of heavy resistance around the 0.618 retracement at $0.26. The zone became the first strong reaction area after the vertical rise.

On November 21, the chart shows that $0.15 became the closest support level. This area is in line with the tail of the previous breakout and the 0.382 retracement level. If the price drops below this area, the next target will be at $0.10, before a possible retest of the old base zone around $0.04.

Conversely, on the upside, buyers will be eyeing a break above $0.22 to open up opportunities towards the next resistance around $0.30.

Traders Jump Back in as Open Interest Rises

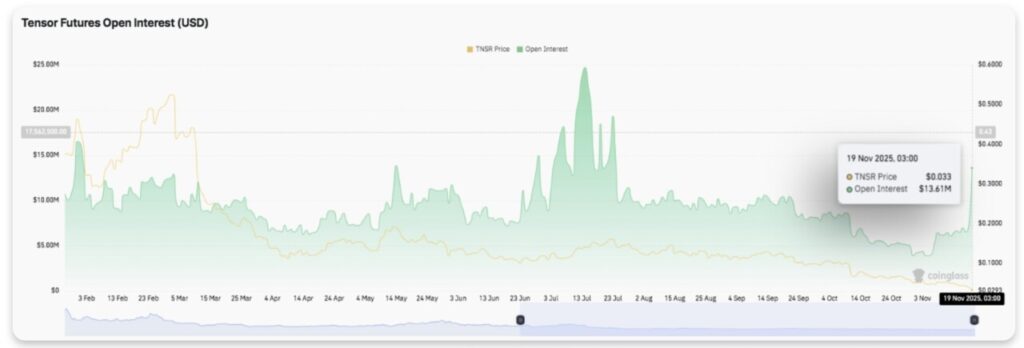

Open interest also showed significant changes. Since peaking at $17.5 million in March, the number of futures positions has continued to decline due to weakened market participation.

Activity remained sluggish until late summer, with open interest rarely exceeding $10 million during September and October.

However, entering November, the market started to show signs of recovery. Traders started to come back in, and the latest data recorded open interest at $13.61 million, while the TNSR price was around $0.033.

This increase indicates that traders are starting to prepare for higher volatility, as interest in TNSR’s future price movements increases.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Tensor Price Prediction: TNSR Breakout Sparks New Interest After Months of Decline. Accessed on November 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.