MSTR Buyout Speculation & Its Impact on Bitcoin (BTC) Price at the End of 2025!

Jakarta, Pintu News – In recent weeks, the Bitcoin market has shown a worrying pattern with a significant difference between trading sessions in the US and Asia. Trading sessions in the United States often register a decline in the price of Bitcoin, while market participants in Asia tend to buy Bitcoin when the price drops.

This phenomenon led to speculation and rumors, including an alleged buyout of MicroStrategy that could potentially affect market dynamics.

Bitcoin Market Dynamics: US vs. Asia

Bitcoin’s recent trading patterns show a stark difference between trading sessions in the US and Asia. In the United States, the trading session is often the time when Bitcoin prices experience the sharpest declines. In contrast, market participants in Asia appear to be more optimistic, tending to buy Bitcoin during price drops, suggesting a divergence of investment strategies between regions.

On the other hand, this phenomenon also raises questions about the factors that influence these market dynamics. Market analysts suggest that macroeconomic factors, monetary policies from central banks, and investor sentiment may play a role in shaping this pattern. However, no definitive conclusions can be drawn without further analysis of the data and trends.

Also Read: Robert Kiyosaki Sells Bitcoin at $90,000: From $250K Target to Real Business, Here’s Why!

MicroStrategy Buyout Rumors and Their Effects

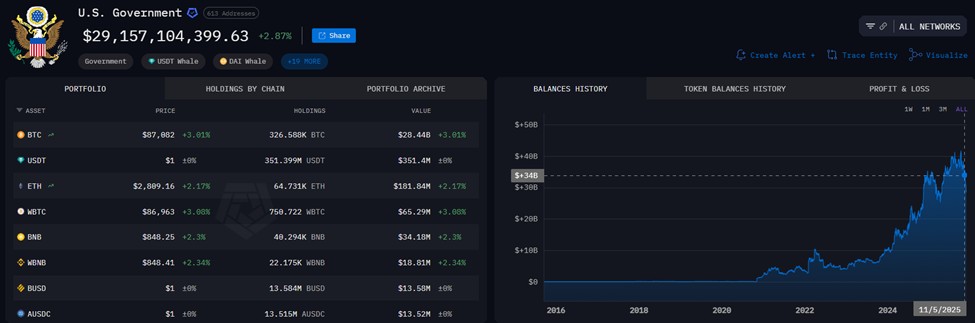

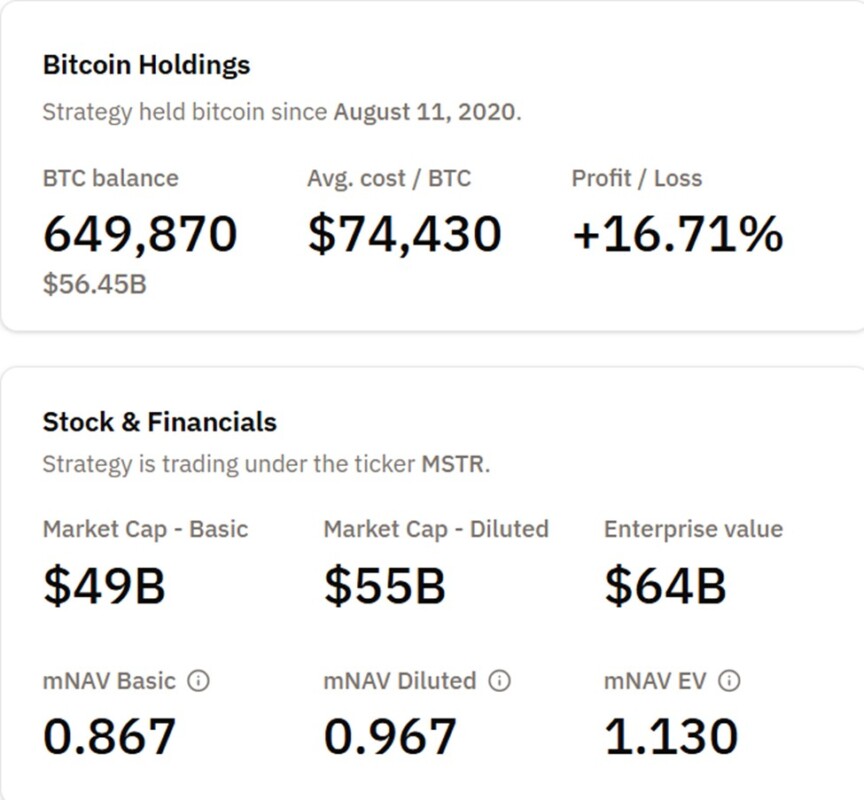

Rumors are circulating that MicroStrategy may be a buyout target by a large entity in the US, which has raised concerns among investors. MicroStrategy, known as one of the largest Bitcoin holders in the corporate world, is in the spotlight for its aggressive investment strategy in crypto assets.

If this rumor is true, it could significantly affect the price of Bitcoin, especially if the buyout involves a change in the company’s crypto asset ownership strategy.

In addition, MicroStrategy also faces risks from MSCI’s new index policy, which may exclude companies from the index if more than 50% of their assets are in Bitcoin or similar cryptocurrencies. This policy could trigger an $8.8 billion outflow of passive funds from the company’s shares, which would add pressure to the value of the stock and possibly the price of Bitcoin.

Long-term Implications for the Crypto Market

The long-term impact of this dynamic on the crypto market remains unclear. However, if the US continues to register declines during its trading sessions, and Asia continues to buy at low points, this could lead to a shift in Bitcoin’s global market power. This change may affect investor strategies and could also affect regulatory policies in various countries.

In addition, this incident also highlights the importance of diversification in crypto investments and the risks associated with a high concentration of assets in one type of investment. Investors may need to consider more carefully the distribution of their assets to avoid unnecessary risks due to sharp market fluctuations.

Conclusion

In conclusion, the current Bitcoin market dynamics suggest a high degree of uncertainty and speculation, especially in relation to the divergence between the US and Asian markets and the MicroStrategy buyout rumors. Investors are advised to follow market developments and analyze the potential impact of these events on their investment strategies.

Also Read: Cardano Predicted to Drop Out of Top 20 by 2026, Nansen CEO Mentions ‘Ghost Chain’

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

How do Bitcoin trading patterns differ between the US and Asian markets?

According to a report by Pintu News, the US market tends to see Bitcoin prices drop during trading sessions, while Asian market participants buy when prices drop, creating a divergence of investment strategies between regions.

Who are the alleged parties involved in the MicroStrategy buyout rumors?

Market rumors suggest the possibility of a large entity in the United States intending to make an acquisition of MicroStrategy, one of the largest Bitcoin (BTC) holders in the corporate sector, although there has been no official confirmation to date.

What is the potential impact of the MicroStrategy buyout on the crypto market?

If the buyout does happen and involves a change in crypto asset holding strategy, the price of Bitcoin could be significantly impacted. In addition, MicroStrategy risks being excluded from the MSCI index if more than 50% of its assets are crypto, which could trigger a passive fund outflow of $8.8 billion.

How do these different trading sessions impact global crypto investors?

This phenomenon signals a shift in the strength of the global Bitcoin market. If the trend continues, global investment strategies may change, and regulators in different countries may reconsider policies regarding cryptocurrency trading.

Why is MicroStrategy in the spotlight in the current crypto market dynamics?

MicroStrategy is known as one of the public companies with the largest Bitcoin (BTC) holdings. Its aggressive policy of crypto asset accumulation makes it an important indicator of Bitcoin price movements in the market.

Reference

- BeInCrypto. US Government Bitcoin Crash MicroStrategy Fact Check. Accessed on November 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.