Ethereum Could Hit a Price Floor Below $2,000? Check out the Analysis!

Jakarta, Pintu News – Ethereum, as the largest altcoin, has experienced a sharp decline over the past month, losing 27.63% in value. Currently, Ethereum is trading at around $2,800, a far cry from its last cycle peak of $4,800. With the continued price drop triggering a wave of liquidation, analyst Ali Martinez gives a prediction of the upcoming market bottom.

MVRV Analysis Shows Up to 28% Drop

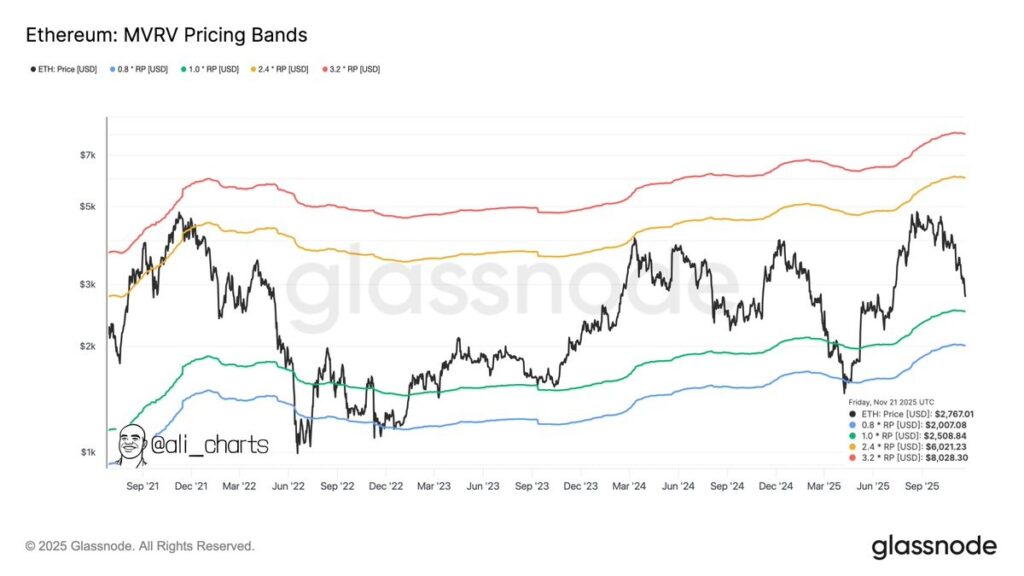

Ali Martinez, in a post on X on November 22, shared on-chain data suggesting that Ethereum (ETH) may be about to hit a local bottom at around $2,000. MVRV Pricing Bands, which are valuation bands derived from the ratio of MVRV and Realized Price (RP), are designed to show when cryptocurrencies like ETH are undervalued, fairly valued, or overvalued based on an on-chain investor’s cost basis.

According to historical data, Ethereum tends to form a local bottom only when the price drops below the lowest price band, which is 0.8× RP. This pattern has consistently occurred over the past three years, with notable examples in June 2022, December 2022, and March 2025. Currently, the 0.8x RP band is at $2,007.08, indicating a potential of another 28% drop to $2,000 before a price rebound.

Also Read: Robert Kiyosaki Sells Bitcoin at $90,000: From $250K Target to Real Business, Here’s Why!

Realized Price Shows Investors Are Still Profiting

The Realized Price is defined as the average acquisition price of all ETH tokens in circulation. It can be thought of as the true on-chain value of ETH, with any price increase above this level indicating a gain for the average investor, and vice versa for a loss.

Martinez’s on-chain analysis shows that the current market price of ETH is only slightly above its realized price of $2,508. While this suggests that most investors are still in profit, the latest correction and prolonged downward trend is cause for concern, especially as positive market sentiment weakens further.

Potential Price Rebound After Reaching $2,000

If the price of ETH falls below $2,500, it could draw many investors into losses, which could accelerate the token’s decline to $2,000 and trigger a price rebound. Staring at the mid-cycle target, the next bullish wave could push Ethereum to trade around $6,021. Currently, Ethereum is valued at $2,820, reflecting a small gain of 1.73% in the past day.

Conclusion

Taking into account on-chain analysis and historical patterns, investors and market watchers should pay attention to the $2,000 level as a potential price floor for Ethereum. A drop to this level would not only mark an opportunity for a rebound but could also be an important indicator of the overall crypto market conditions.

Also Read: Cardano Predicted to Drop Out of Top 20 by 2026, Nansen CEO Mentions ‘Ghost Chain’

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Ethereum (ETH)?

A1: Ethereum (ETH) is the largest altcoin that functions not only as a digital currency but also as a platform for running smart contracts.

Q2: Why is the price of Ethereum (ETH) expected to fall?

A2: On-chain analysis suggests that Ethereum (ETH) might hit a price floor at around $2,000, based on historical data and MVRV Pricing Bands.

Q3: What is Realized Price (RP)?

A3: The Realized Price (RP) is the average acquisition price of all Ethereum tokens (ETH) in circulation, which is considered the true on-chain value of ETH.

Q4: What is the current price of Ethereum (ETH)?

A4: Currently, Ethereum (ETH) is trading around $2,820, showing a small increase in the past day.

Q5: What could happen if Ethereum (ETH) reaches $2,000?

A5: If Ethereum (ETH) reaches $2,000, this could trigger a price rebound, with the next potential bullish target around $6,021.

Reference

- NewsBTC. On-Chain Metric Tips Ethereum to Form Price Bottom Below $2000, Here’s Why. Accessed on November 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.