Satoshi Nakamoto’s fortune plummets by $43 billion, Bitcoin plunges!

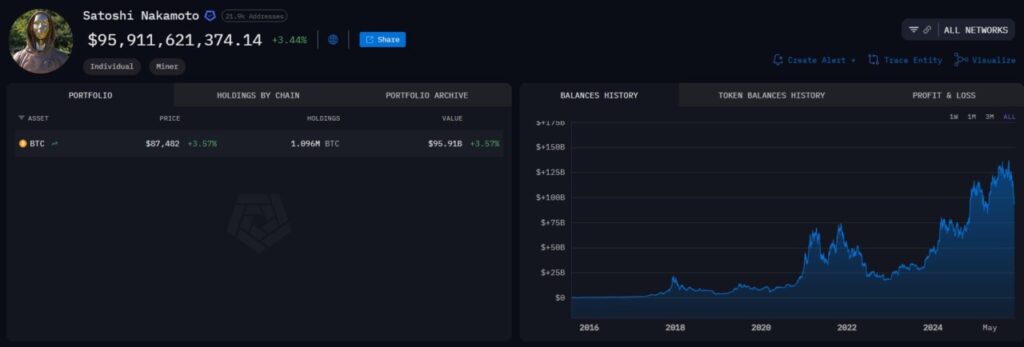

Jakarta, Pintu News – Bitcoin’s (BTC) dramatic price slump has eroded the wealth of Satoshi Nakamoto, the mysterious creator of Bitcoin, by $43 billion. From its highest peak in October, the value of Bitcoin has fallen by more than 30%, reducing the total value of Bitcoin owned by Satoshi to around $96 billion.

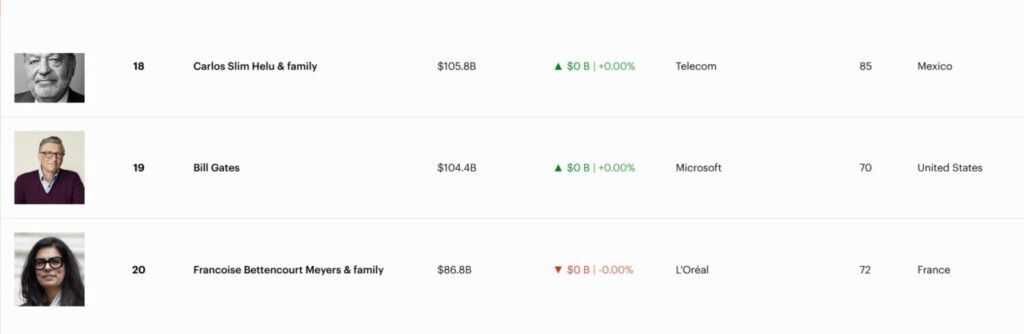

This event lowered Satoshi’s position in the list of the world’s richest people, from 11th to below Bill Gates in 20th place.

Bitcoin Price Drop

In early October 2025, Bitcoin reached an all-time high of $126,296 per unit, pushing the total value of Bitcoin held by Satoshi Nakamoto to $138.92 billion. However, in recent weeks, the price of Bitcoin has been in freefall to $87,390.

This price drop resulted in the loss of approximately $42.79 billion of Satoshi’s wealth. This slump not only impacted Satoshi’s asset value but also affected the market’s perception of Bitcoin’s stability. While Bitcoin is known for its volatility, sharp drops like this raise concerns among investors and analysts about the future of the cryptocurrency.

Also Read: Robert Kiyosaki Sells Bitcoin at $90,000: From $250K Target to Real Business, Here’s Why!

Satoshi’s Wealth Status and Speculation

Satoshi Nakamoto, whose identity remains a mystery, hasn’t touched the Bitcoins they’ve owned for over a decade. This fortune, which consists of approximately 1.1 million Bitcoins, was analyzed using the Patoshi pattern by Arkham Intelligence. Despite this immense wealth, magazines like Forbes do not include Satoshi in their billionaires list due to his legal status and unverified ownership.

Speculation about this wealth continues, with some experts suggesting that Satoshi’s Bitcoin may have been inaccessible or deliberately abandoned. This situation is unique among billionaires and adds to the mystery surrounding Bitcoin’s creator.

Quantum Threats and the Future of Bitcoin

Developments in quantum computing have sparked discussion about potential security risks to older Bitcoins, including those owned by Satoshi. Some experts suggest freezing or forking the Bitcoin network before a possible “Q Day” when quantum computers could crack Bitcoin’s cryptography.

If this risk becomes a reality, the true owners of these Bitcoins may need to reveal themselves. The upcoming movie, “Killing Satoshi,” scheduled for release in 2026, will hopefully bring more attention to this mystery and the geopolitical implications of Bitcoin’s untapped wealth.

Conclusion

Despite Bitcoin’s current decline in value, Satoshi Nakamoto’s wealth remains a symbol of Bitcoin’s origins and its biggest secret. This wealth, which is highly visible yet untouchable, continues to fuel speculation and theories. Only time will tell the fate of this fortune and its impact on the future of Bitcoin.

Also Read: Cardano Predicted to Drop Out of Top 20 by 2026, Nansen CEO Mentions ‘Ghost Chain’

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: How much has Bitcoin’s value fallen recently?

A1: Bitcoin price has fallen by more than 30% from its peak, from $126,296 per unit to $87,390.

Q2: Why did Forbes not include Satoshi Nakamoto in the list of billionaires?

A2: Forbes did not include Satoshi Nakamoto due to the unverifiable legal status and ownership of Bitcoin.

Q3: What is Patoshi pattern?

A3: The Patoshi pattern is a method used to identify the initial Bitcoin address most likely controlled by Satoshi Nakamoto.

Q4: What are the implications of Satoshi’s untouchable Bitcoin wealth?

A4: This untapped wealth gives rise to speculation that the assets may be lost, inaccessible or deliberately abandoned.

Q5: What does “Q Day” mean in the context of Bitcoin?

A5: “Q Day” refers to a time in the future when quantum computers may be able to crack Bitcoin’s cryptography, which could threaten the security of the network.

Reference

- BeInCrypto. Satoshi Nakamoto’s Bitcoin Fortune Drops. Accessed on November 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.