Pi Network Price Falls to $0.23 Today – Is Bullish Momentum Still Building?

Jakarta, Pintu News – Pi Network (PI) started the week on a positive note, continuing the gains made over the weekend and approaching an important technical resistance level around $0.247 on Monday (24/11).

The increasing momentum, coupled with accumulation from large investors (whales), has strengthened market sentiment, so PI is in the spotlight and has the potential for a breakout if buying pressure gets stronger. Then, how will Pi Network price move today?

Pi Network Price Drops 1.6% in 24 Hours

On November 25, 2025, the price of Pi Network was recorded at $0.238, a decrease of 1.6% in 24 hours. If converted into the current rupiah ($1 = IDR 16,649), then 1 Pi Network is IDR 3,962. During this time, the PI price moved in the range of $0.2334 to $0.2424.

Read also: Dogecoin Price Touches $0.15 Level Today (11/25/25): DOGE ETF Triggers Rally!

Pi Network’s market cap currently stands at $1.98 billion, while its fully diluted valuation stands at $3.05 billion. Trading activity over the past 24 hours showed a volume of $26.1 million.

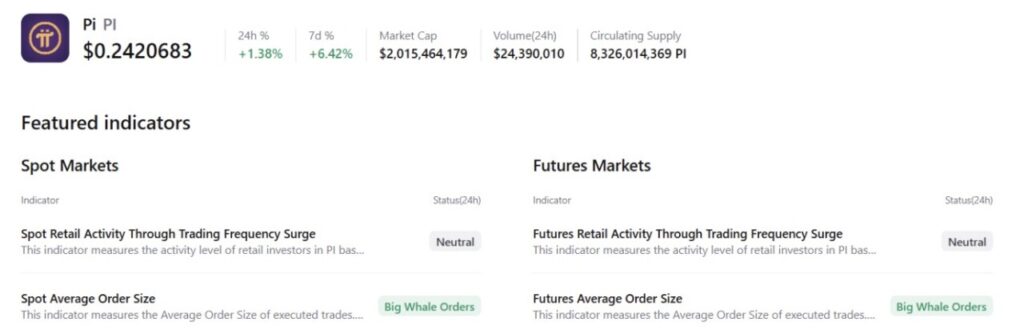

Large Whale Orders in Spot and Futures Markets

Summary data from CryptoQuant shows a positive outlook for Pi Network, due to large whale orders in the spot and futures markets, signaling a potential price rally.

Pi Price Prediction: PI Momentum Indicator Shows Bullish Bias

Pi Network fell nearly 5% on Friday (21/11) and retested the weekly support level at $0.221, but managed to recover most of its losses over the weekend.

Read also: Ethereum Price Rises to $2,900 Today: Can ETH Surge?

As of November 24, PI prices are near the 50-day Exponential Moving Average (EMA) at $0.242. This 50-day EMA level is almost aligned with the 38.2% Fibonacci retracement level at $0.247 (which is drawn from the August 30 high of $0.398 to the October 10 low of $0.153), and coincides with the descending trendline, making it an important resistance zone to watch.

If PI manages to break and close above the daily downtrend line, then the price rally could continue until it reaches the 50% retracement level at $0.276.

The Relative Strength Index (RSI) indicator on the daily chart reads 56, which is above the neutral level of 50, indicating that the bullish momentum is strengthening. In addition, the Moving Average Convergence Divergence (MACD) indicator is showing a bullish crossover since last week, and this signal is still persisting, reinforcing the positive view on PI.

However, if PI fails to break the 50-day EMA at $0.242 and experiences rejection, the price could potentially drop back towards the weekly support level at $0.221.

FAQ

What is Pi Network (PI)?

Pi Network is an emerging cryptocurrency, which is attracting the attention of investors and traders in the crypto market.

Why are large whale orders important?

Large orders from whales can influence price movements significantly, often signaling a potential change in market sentiment.

What is the 50-day EMA?

The 50-day EMA is an exponential moving average calculated over the last 50 days, often used to assess medium-term price trends.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FXStreet. Pi Network price forecast: Rising momentum and strong whale demand put Pi on breakout watch. Accessed on November 25, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.