3 Small-Cap Altcoins Poised to Gain Big from the Rising Neobank Trend

Jakarta, Pintu News – The crypto community has been discussing the concept of Neobank in Web3 with increasing frequency lately. Investors are starting to focus more on projects that have real-world applications, and this sector is attracting considerable attention.

Small-cap altcoins in Neobank’s narrative may still not be fairly valued, which opens up new opportunities for investors.

What Potential Does Neobank Have?

Web3’s Neobank is a fully digital bank that operates on blockchain technology without the need for physical branches. It integrates DeFi (decentralized finance) features, such as self-custody of assets, yield-bearing accounts, and Visa or MasterCard-based crypto spending cards.

Read also: 6 Hottest Altcoins of the Week with Important Events Worth Paying Attention to!

Unlike traditional neobanks, Neobank Web3 emphasizes transparency, elimination of middlemen, and cross-chain connectivity.

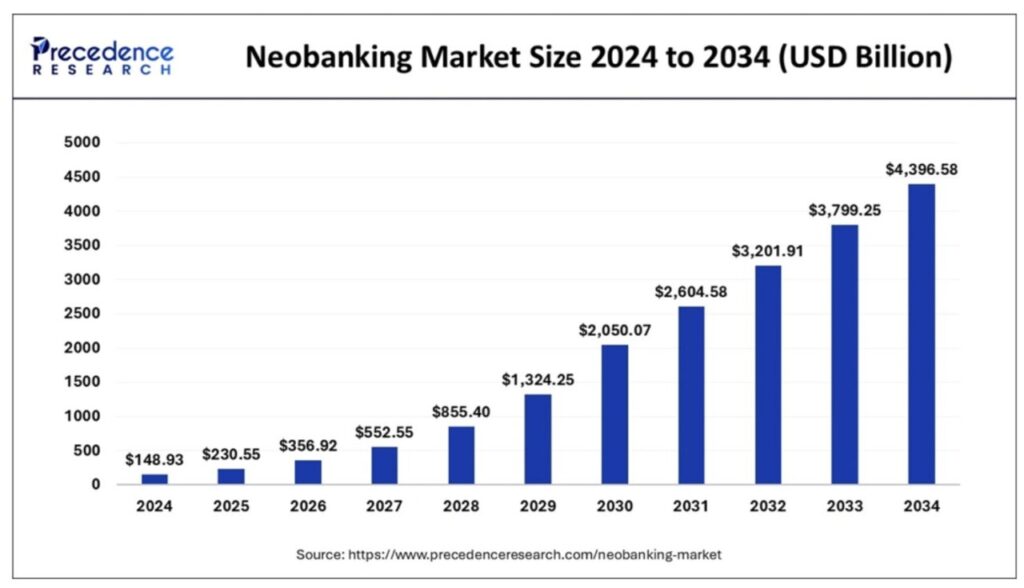

According to a report from Precedence Research, the global neobanking market reached a value of $148.93 billion in 2024. This market is projected to grow at a CAGR (compound annual growth rate) of 40.29% and reach $4,396.58 billion by 2034.

This huge growth opens up huge opportunities for Web3-based Neobanks. First, because of the widespread adoption of stablecoins in various use cases. Second, because of the changing mindset of investors who now prefer crypto projects with real-world utility over those that rely solely on hype.

“If stablecoins are going to be Neobank’s main driver on the blockchain, then Web2’s current identity infrastructure won’t be able to keep up,” predicted investor Mike S.

According to data from Coingecko, the Neobank category currently has a total market capitalization of $4.19 billion, consisting of 13 main projects. Mantle leads with a market capitalization of $3.31 billion, followed by Ether.fi with $412 million.

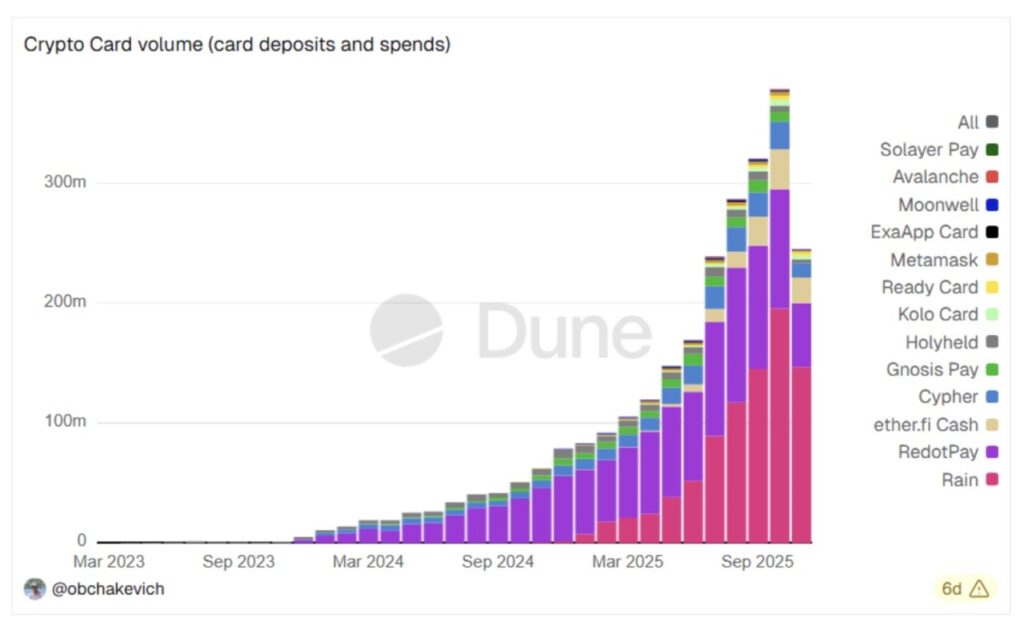

In addition, data from Dune shows that the transaction volume of physical cards from the Neobank Web3 project reached a record high last month, surpassing $379 million.

Although the volume of these transactions is still relatively small, analysts consider that the growth potential is huge. At the same time, the relationship between Web3 projects and traditional payment companies is strengthening.

Crypto investors believe that Neobank will experience a surge in growth thanks to AI agents and privacy technology on the blockchain. Some experts even go so far as to predict that Neobank will be one of the main narratives shaping crypto trends by 2026.

Can Small-Cap Altcoins in the Neobank Sector Make a Profit?

Despite optimistic market predictions, the top three Neobank projects on Coingecko – Mantle (MNT), ether.fi (ETHFI), and Plasma (XPL) – experienced long price drops throughout November.

However, some small-cap altcoins (under $100 million) have started to attract new capital and show strong performance.

1. Avici (AVICI)

Avici (AVICI) is a self-custody-based crypto banking project built on the Solana (SOL) network. The project focuses on spending cards and on-chain asset swaps.

Read also: 3 Big Crypto Token Unlocks that will Happen This Week!

In the past two months, its market capitalization has increased tenfold to $77 million, and its price has broken the $6 mark.

According to reports from Stalkchain, AVICI purchases have increased sharply in recent days. One wallet was even recorded as actively accumulating around $35,000 worth of AVICI at a rate of $266 per minute.

The project announced that the Avici Card had reached 100,000 transactions in November, and mentioned that the card is starting to become a daily habit for its users. Some investors are optimistic, predicting AVICI’s price could reach $50 to $100 in the future.

The growth potential of altcoins like AVICI reflects that the Neobank sector still holds great opportunities, especially for investors who got in early before the projects gained mass adoption.

2. Cypher (CYPR)

Cypher is a protocol built on the Base Chain network, where users can earn CYPR tokens as rewards for card-based transactions. The project aims to create an open economic model that drives growth among brands, service providers, online influencers, AI agents, and crypto card users.

- Current market capitalization: under $10 million

- Analyst assessment: still undervalued

According to Alea Research, there are several reasons why CYPR is considered to have great potential:

- The volume of payments processed by Cypher is about double its current market capitalization.

- Ranked second in card transaction volume, losing only to EtherFi.

- However, low liquidity and a lack of listings on a major exchange (CEX) have hampered price growth so far.

3. Machines-cash (MACHINES)

Machines-cash (MACHINES) is a new privacy-focused crypto payment platform, also built on the Base network.

- Current market capitalization: under $5 million

Analysts see this project as having the potential to attract capital flows similar to those of AVICI, with a possible upside of up to 10 times. Some supporting factors:

Read also: Pi Network Price Pattern Hints at Big Rally as Leading Whale Reaches 381 Million Tokens

- The development team includes experienced people from MetaMask, Trust Wallet, DARPA, Flipside Crypto, Paxful, and Polygon (POL).

- One of AVICI’s advisors is also involved in this project.

Machines-cash’s flagship feature is:

- Visa payments are anonymous and secure, using an alias account that hides the wallet address, transaction history, and user identity.

- It fits with the trend of increasing interest in privacy in the crypto finance sector.

However, the general market sentiment is still sluggish, which can have a big impact on the potential of small projects like this. Also, with more and more Neobank projects popping up, selecting high-quality projects is becoming increasingly difficult.

According to Jay Yu, researcher at Pantera Capital, the factors that will determine the winner in the Neobank Web3 sector include user retention, card transaction volume, and number of active users.

Overall, altcoins like CYPR and MACHINES show that even in a bear market, projects with strong fundamentals and real utility still have a chance of generating substantial returns for early investors.

FAQ

What is Neobank on Web3?

Neobank on Web3 is a digital bank that operates entirely on blockchain, without physical branches, and integrates DeFi features such as yield-generating accounts and crypto spending cards.

What is the projected growth of the global neobanking market?

The global neobanking market is expected to grow from $148.93 billion in 2024 to $4,396.58 billion in 2034, at a CAGR of 40.29%.

Which low-cap altcoins are showing impressive performance in the Neobank sector?

Avici (AVICI) and Cypher (CYPR) are examples of altcoins with low market capitalization that have shown impressive performance in the Neobank sector.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Low Cap Altcoins Benefit the Most from Growing Interest in the Neobank. Accessed on November 28, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.