Will Bitcoin Break $90,000 This Week? Read the Prediction!

Jakarta, Pintu News – After experiencing a sharp decline last week, Bitcoin (BTC) price has started to stabilize above $86,000. The weekend recovery has improved market sentiment. The crypto market has gained about 1% in the past 24 hours, suggesting that selling pressure has eased. With the momentum improving, Bitcoin price is now eyeing the $90,000 level. Here are the BTC price predictions according to Coingape!

Bitcoin price recovery strengthens market outlook

Major crypto markets such as Ethereum (ETH), Ripple (XRP), Solana (SOL), and Dogecoin (DOGE) also started the week with small gains. These assets are above key support levels, signaling that the recent recovery is likely to continue. However, analysts warn that market sentiment is still weak and could be disrupted if market momentum starts to weaken.

Signals from the US Federal Reserve are also being monitored by traders. Federal Reserve Chairman Jerome Powell may come out in favor of cutting interest rates by 25 basis points at the December meeting. Some officials are still divided, and the decision is still uncertain. Powell’s positive stance could ease the financial situation and possibly boost riskier assets like Bitcoin prices.

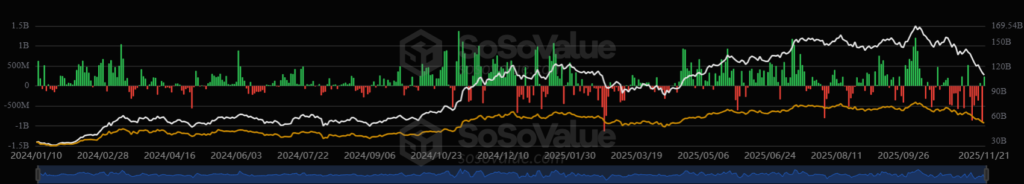

Bitcoin ETFs Experience Large Fund Withdrawals

Last week, spot Bitcoin ETFs in the US experienced $1.22 billion in withdrawals, and this withdrawal trend has been ongoing for four weeks. Daily net withdrawals reached up to $238.47 million. Monthly net withdrawals increased to $3.55 billion, indicating continued investor caution during the recent market changes.

Also read: Polish Crypto Expert’s Bitcoin Prediction Analysis Fails, What Went Wrong?

Bitcoin Price Likely to Hit $100K

The price of BTC rose to $86,800 and stayed within a narrow range after the recent heavy selling. The MACD histogram also shows increasing bullish momentum with both MACDs crossing upwards. The RSI is around 47, indicating a neutral and slightly rising trend. If Bitcoin price can break the $90,000 ceiling, momentum could support a push towards $92,000.

A stronger continuation would probably put the $100,000 region back in focus for medium-term targets, as Bitcoin’s long-term forecast is still bright. However, a fall below $84,000 could derail the rebuild. The second important support close to $80,000 is crucial in the broader bullishness. A drop in that zone could open up more downside risks in the market.

Conclusion

With the price recovery taking place and market sentiment starting to improve, Bitcoin’s chances of reaching and even surpassing $90,000 seem increasingly open. However, investors should still be aware of the potential volatility that could occur at any time.

FAQ

What is the current Bitcoin price?

Bitcoin price is currently stabilizing above $86,000. Q2: What is a Bitcoin ETF?

Bitcoin ETFs are exchange-traded funds whose purpose is to mimic the price of Bitcoin, allowing investors to invest in Bitcoin without having to buy and store Bitcoin itself.

What effect does the Federal Reserve chairman have on the price of Bitcoin?

Federal Reserve Chairman, Jerome Powell, can influence the price of Bitcoin through interest rate policy. A looser policy or interest rate cut could boost risky assets like Bitcoin.

What happens if Bitcoin price falls below $84,000?

If the price of Bitcoin falls below $84,000, it could shake investor confidence and open up the risk of further declines in the market.

What is the medium-term price target for Bitcoin if the positive momentum continues?

If the positive momentum continues, the medium-term price target for Bitcoin could reach $100,000.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. BTC Price Prediction: Bitcoin Crosses $86k, Is a Drop Over?. Accessed on November 25, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.