Bitcoin struggles to break $90,000, is it the right time to buy?

Jakarta, Pintu News – Bitcoin (BTC) is attempting to gain upward momentum after its recent decline, but this recovery is being met with caution from investors. Although sentiment has weakened, the current structure suggests consolidation rather than a major bearish reversal.

Bitcoin Investor Apprehension

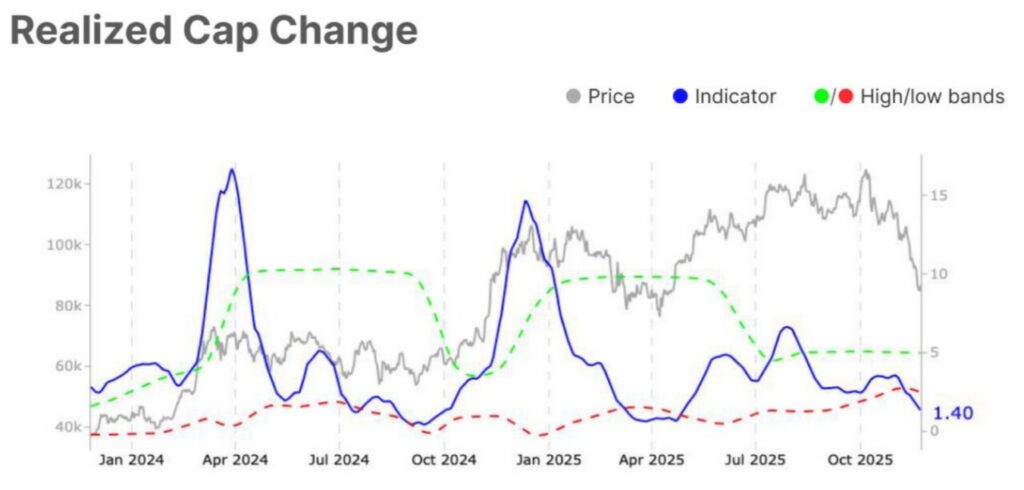

One of the clearest signals of declining momentum was the sharp drop in Realized Cap Change, which fell to 1.4%. This marked a decline of 28.1% and put the metric below its lower bound. This change reflects weaker net inflows and lighter demand across the market. These conditions are consistent with a consolidation phase, where investors prefer to observe rather than aggressively accumulate.

This decline also indicates that Bitcoin’s recent price weakness stems not from capitulation, but from a reduced urgency among buyers. Historically, periods like this precede re-accumulation rather than a dramatic price collapse. As long as demand remains steady – albeit subdued – BTC will likely maintain its structural stability.

Also Read: 7 Ways to Buy and Sell Tokenized Gold at the Door, Starting from Rp11,000 and Can be 24/7

Short-Term Holder Participation Increases

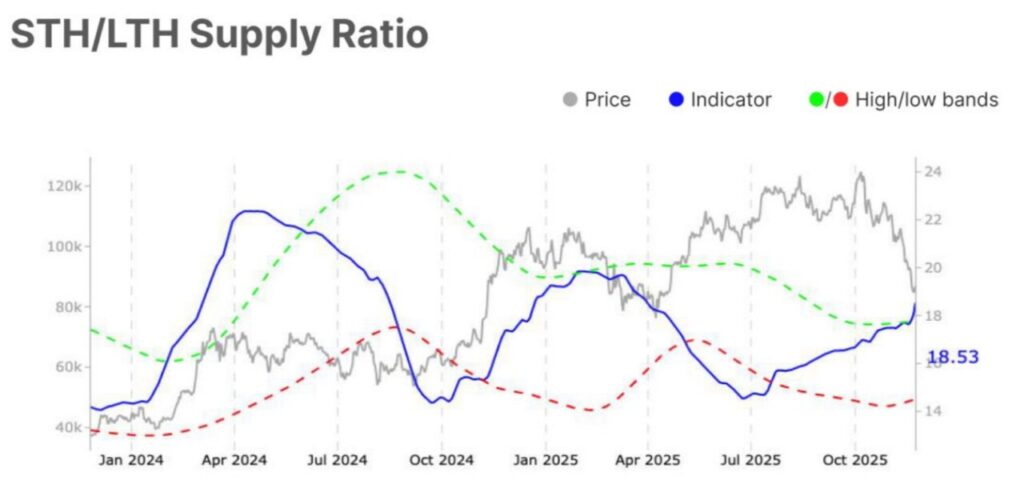

The Short-Term Holders to Long-Term Holders (STH-LTH) Supply Ratio has risen to 18.5%, breaking its upper limit and signaling increased participation from short-term holders. This development indicates that speculative liquidity is entering the market at a faster pace.

While this can favor volatility and trading activity, it also increases the likelihood of sharper and shorter price swings. A higher proportion of short-term Bitcoin holders usually indicates a liquid market, but does not necessarily indicate a strong direction. An increased presence of speculative traders often goes hand in hand with a consolidation phase, where the price fluctuates within a defined range rather than a firm trend upwards or downwards.

BTC Price Increase Potential

Bitcoin is currently trading at $87,236, holding above the crucial support level of $86,822. Despite several attempts, BTC has remained stuck below the $89,800 resistance for several days. This range-bound behavior reinforces the idea of consolidation rather than reversal.

Given the combination of soft demand and rising short-term speculation, Bitcoin is likely to remain below the $89,800 resistance unless stronger buying pressure emerges. The near-term outlook is bearish-neutral, with BTC expected to maintain stability above $85,000 most of the time.

If broader market conditions improve, Bitcoin could break the $89,800 barrier. A successful breakthrough would pave the way towards $91,521, with the potential to extend to the $95,000 resistance. Such a move would invalidate the consolidation thesis and reaffirm the bullish momentum.

Conclusion

In the face of current Bitcoin price fluctuations, investors and market watchers should consider various on-chain indicators that point to a consolidation phase. While there is potential for price increases, the market currently seems to be gearing up for a period of observation rather than massive accumulation.

Also Read: A Complete Guide to Saving Digital Gold in 2025 – Simple, Safe, Can Start from Rp11,000!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Realized Cap Change?

A1: Realized Cap Change is a metric that measures the change in the total market value of Bitcoin that has been realized by its holders, indicating inflows or outflows from the market.

Q2: How do short-term holders affect the price of Bitcoin?

A2: Short-term holders tend to increase market volatility as they often buy and sell within short time frames, which can lead to sharper and more frequent price fluctuations.

Q3: What does $89,800 resistance mean for Bitcoin?

A3: The $89,800 resistance is a price level where Bitcoin has had difficulty breaking upwards in recent days, indicating a point where selling is likely to increase.

Q4: What does consolidation mean in the context of the Bitcoin market?

A4: Consolidation in the Bitcoin market refers to a period where the price moves in a relatively stable range without a clear upward or downward trend, often an observation phase before the next price movement.

Q5: Is it possible for Bitcoin to reach $95,000 in the near future?

A5: While possible, Bitcoin’s achievement of the $95,000 price will depend largely on broader market conditions and a significant increase in demand and trading volume.

Reference

- BeInCrypto. Bitcoin Price in Consolidation, Not Reversal. Accessed on November 26, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.