The Giants of Ethereum: Top 10 Wallets with the Most ETH

Jakarta, Pintu News – Ethereum price is currently above $2,900, with a market capitalization of $353.71 billion and a total circulating supply of 120.69 million ETH. As the second largest cryptocurrency by market capitalization, Ethereum continues to grow after switching to a proof of stake (PoS) consensus mechanism as well as through various ongoing technical improvements.

Adoption of Ethereum is increasing as major investments from institutions, ETF products, and Web3-native companies come in. This increased demand has significantly affected the distribution of Ethereum.

Ethereum (ETH) ownership is also undergoing changes, as major owners and staking activities impact the total supply of ETH in 2025.

The wallets with the largest number of holdings-included in the list of richest Ethereum owners-play an important role in determining the future direction of Ethereum.

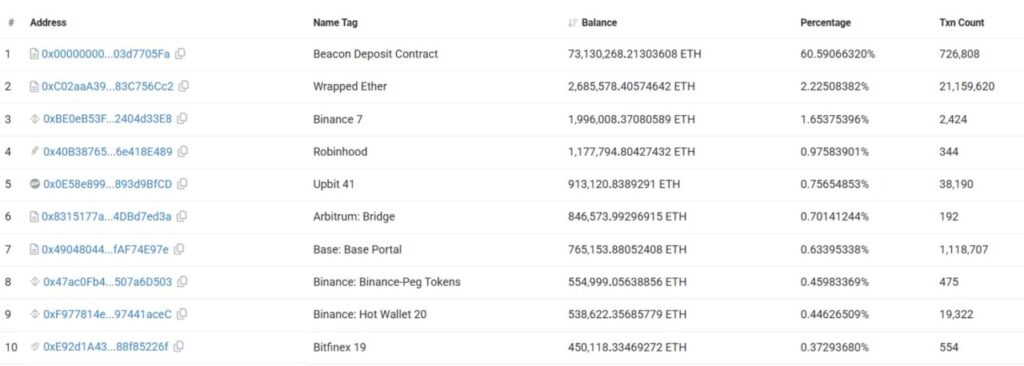

10 Largest Ethereum Holders

Ethereum holders continue to shape the crypto landscape with massive amounts of ETH stored in various wallet addresses. By 2025, Ethereum wallets with large holdings held hundreds of thousands to millions of ETH, with some accounting for a significant percentage of the total ETH supply.

Read also: November 2025 Crypto Crisis: Is it Worse Than the FTX Era?

Here are the 10 largest Ethereum holders by ETH balance amount:

1. Beacon Deposit Contract – The Backbone of Ethereum

Beacon Deposit Contract is the largest holder of Ethereum at the moment. It holds more than 73 million ETH, or about 60.59% of the total supply locked up in it. This contract plays an important role in Ethereum’s proof-of-stake system, where ETH is locked up to help keep the network secure.

This massive amount of staking is key to the sustainability and decentralization of the Ethereum network.

2. Wrapped Ether (WETH) – DeFi’s Main Asset

Wrapped Ether (WETH) is another large holder of ETH, with over 2.68 million ETH. Through this contract, ETH is wrapped into ERC-20 tokens for use in various decentralized finance (DeFi) applications.

WETH is essential for supporting various protocols, serving as collateral for loans, as well as providing liquidity in the DeFi market.

3. Binance 7 – Holdings from Major Exchanges

Binance has a large amount of ETH in various wallet addresses. One of its wallets known as Binance 7 holds almost 2 million ETH. As one of the largest crypto exchanges in the world, Binance plays an important role in providing Ethereum liquidity. This wallet is also used in ETH trading and staking activities.

4. Robinhood – A haven for retail investors

Robinhood holds over 1.17 million ETH in their custodial wallet. The platform is known for its user-friendly approach that allows trading of crypto assets without fees. This growth in holdings reflects retail investors’ growing interest in Ethereum in an expanding market.

Read also: Pi Network ready to explode, signs of bull market emerging?

5. Upbit 41 – Crypto Exchange from South Korea

Upbit, one of the largest exchanges in South Korea, manages around 913,000 ETH. This wallet is part of the large crypto assets held by Upbit and is used to support exchange operations and user transactions.

With a strong user base, Upbit remains an important player in providing Ethereum liquidity.

6. Arbitrum: Bridge – Bridging Layer-2 Transactions

Arbitrum’s bridge contract holds more than 846,000 ETH. Arbitrum (ARB) is a prime example of Ethereum’s Layer-2 solution that enables faster and cheaper transactions.

The assets stored in these bridges facilitate smooth switching between the Ethereum mainnet and Arbitrum’s Layer-2 network.

7. Base: Base Portal – Layer-2 Center for Ethereum

Base Wallet: The Base Portal holds approximately 765,000 ETH. It is part of Ethereum’s growing ecosystem of Layer-2 solutions. Its goal is to reduce network congestion and improve transaction efficiency for both users and developers in the Ethereum ecosystem.

8. Binance: Binance-Peg Tokens – The Pegged Asset Giant

Another Binance wallet, Binance: Binance-Peg Tokens, holds nearly 555,000 ETH. This wallet contains Ethereum-based tokens that are pegged to other assets, allowing Binance to support a wide array of decentralized applications (dApps) on the Ethereum network.

9. Binance: Hot Wallet 20 – Liquidity Center

Binance Wallet: Hot Wallet 20 holds approximately 539,000 ETH. This wallet plays an important role in maintaining liquidity in the Binance ecosystem and handles large transactions on the exchange.

10. Bitfinex 19 – Custodian and Exchange for Institutions

Bitfinex 19 is a Bitfinex-owned wallet that holds approximately 450,000 ETH. The wallet is part of the institutional-grade custody services that Bitfinex offers, and caters to both retail and institutional investors. As one of the older players in the crypto world, Bitfinex still has a significant amount of Ethereum.

FAQ

What is Ethereum (ETH)?

Ethereum (ETH) is a blockchain platform that allows developers to build and run decentralized applications and smart contracts. ETH is a digital asset used to pay for transactions and services on the Ethereum network.

Why is staking important for Ethereum?

Staking is the process by which Ethereum holders can lock up a certain amount of their ETH to support network operations and security. It’s essential to Ethereum’s transition to Proof of Stake, which aims to improve network efficiency and scalability.

How do large holders affect the price of Ethereum?

Large holders can influence the price of Ethereum through large transactions that can increase or decrease the supply of ETH in the market, as well as through their participation in network decisions that can affect investor perception and trust.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Top 10 Biggest Ethereum Holders: Which Wallets Hold the Most ETH. Accessed on November 28, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.