Grayscale Takes Next Step Toward Spot ETF, Files to Convert Zcash Trust with SEC

Jakarta, Pintu News – Grayscale has filed an S-3 registration statement with the United States Securities and Exchange Commission (SEC). The aim is to convert the existing Grayscale Zcash Trust into a spot Zcash exchange-traded fund (ETF).

This filing is an important milestone in the effort to bring privacy-focused cryptocurrencies into the officially regulated ETF market.

Grayscale Advances ZEC ETF Through Simple Filing

As stated in the filing documents with the SEC, the proposed product will physically hold Zcash (ZEC) and track the price of Zcash based on the CoinDesk Zcash Price Index. The filing also includes a proposed rule 19b-4 amendment, which would allow the ETF to be listed and traded on NYSE Arca upon approval.

Read also: Zcash Surges, Reliance Global Shifts Investments from Bitcoin and Ethereum!

This strategy has the support of two other Grayscale ETFs that were recently approved by the NYSE. Experienced issuers are utilizing the S-3 form as it makes the conversion process easier than regular ETF registration. Grayscale is qualified to make this transition due to its size, reporting record and previous experience in converting trusts into ETFs.

The company has successfully converted its Bitcoin and Ethereum trusts into spot ETFs in 2024. This sets a regulatory and operational precedent for Zcash products. Currently, Grayscale’s Zcash trust holds around $150 million in ZEC, which will be moved to the new ETF structure if it receives approval.

Growing ZEC Demand Supports ETF Plans

The ETF proposed by Grayscale will allow in-kind creation and redemption of shares using the ZEC pool. Zcash’s popularity continues to rise after Reliance Group announced that their entire crypto portfolio has been fully transitioned to ZEC.

This planned Zcash ETF follows the standard model used by the majority of spot ETFs in the US. The fund will charge an annual sponsor fee of 2.5%. Once it starts trading on major exchanges, this ETF will be accessible to more regions globally.

Read also: Gold Price Shows Weak Signals, Bitcoin and Ethereum Surge!

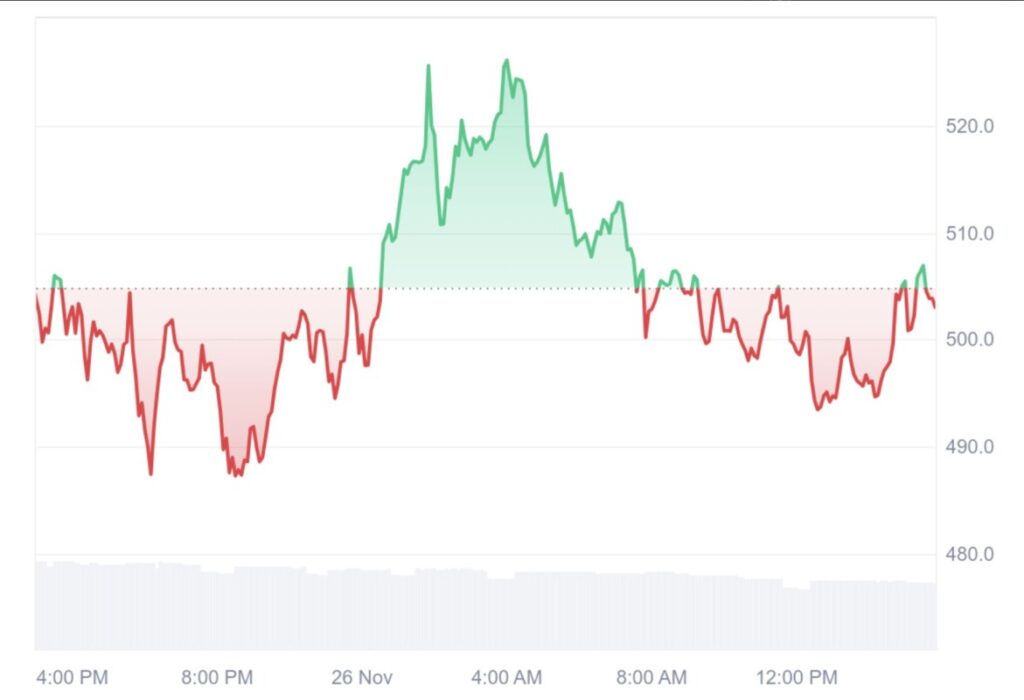

ZEC price rises as investor demand increases

Zcash’s market performance reflects growing attention. Currently, the ZEC price stands at $505 after a slight increase in the last 24 hours according to data from CoinMarketCap. High demand and great interest from investors have also pushed ZEC into the top fifteen cryptocurrencies by market capitalization.

The filing document also describes a number of key risks associated with Zcash as a privacy-first cryptocurrency. Zcash protects transaction information with zero-knowledge proof technology, which could potentially attract the attention of regulatory agencies for regulatory compliance purposes.

In addition, the Grayscale document mentions that these assets can experience sharp price movements as trading in small volumes can have a large impact on the price, compared to tokens that have a larger capitalization.

FAQ

What is the Zcash spot ETF proposed by Grayscale?

The Zcash spot ETF proposed by Grayscale is a financial product that will physically hold Zcash (ZEC) and follow the price of Zcash according to the CoinDesk price index. This ETF aims to give investors easier and more organized access to invest in Zcash.

Why is Grayscale proposing a change to a spot ETF for Zcash?

Grayscale proposed these changes to provide investors with more organized and easy access to Zcash, as well as capitalize on the growing interest and demand for privacy-focused cryptocurrencies.

How is the Zcash market currently performing?

Currently, the Zcash price is at $505, with an increase in the last 24 hours. This increase reflects great interest from the market and has pushed Zcash into the top fifteen cryptocurrencies with the largest market capitalization.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Grayscale Files S-3 to Convert Zcash Trust into Spot ETF. Accessed on November 27, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.