SUI Price Prediction: Poised to Break Past $5.36 Following Strong Rebound

Jakarta, Pintu News – Sui (SUI) is showing positive momentum with a current trading price of $1.57. This is supported by a 24-hour trading volume of $1.20 billion, a market capitalization of $5.78 billion and a market dominance of 0.19%.

In the past 24 hours, the token has risen by 1.44%, indicating early signs of renewed interest after the previous price drop.

Price May Return to $1.50 Before Resuming its Rise

TXG Crypto Analysts highlighted that SUI is experiencing its first significant bounce after falling to strong support levels around $1.35.

Read also: Crypto Market is Greening Up, these 5 Altcoins Explode up to 75% Today

In his post, he stated that stronger support is needed in this area for the price to move up towards the $1.73-$1.815 level, which could change the structure of the SUI movement to a more positive one.

Otherwise, the price risks retreating back to around $1.50.

SUI Returns to 2024 Rally Starting Zone

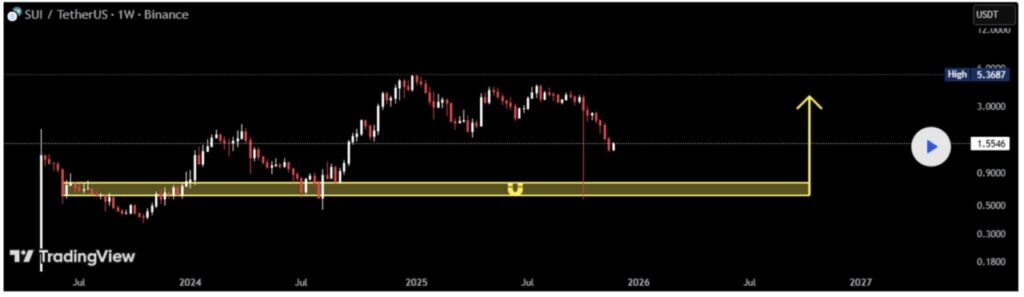

Market data suggests that Sui has just completed a rather remarkable pattern of a sharp decline, liquidity sweep, and an immediate retest of the demand area that sits in the $0.75-$0.60 price range.

This area was the starting point of the huge rally that took place in 2024, making it one of the most important zones in the history of SUI price movements.

This $0.75-$0.60 support range is much more significant than other support levels. This level marks the end of one of SUI’s biggest selling phases, where large buyers entered the market with high intensity. High trading activity occurred here, providing a major influence on SUI’s macro price movements throughout 2024.

In recent weeks, the price briefly touched the area with a strong weekly candle but bounced back with a long wick, indicating a stop-loss sweep and strong liquidity withdrawal.

A solid trend reversal is highly likely if the weekly candle can close firmly within the $0.75-$0.60 demand area, accompanied by a strong breakout above $1.55 and increased trading volume.

However, the continued strength of this trend could be seen in a reversal to $1.20-$1.30, then an intermediate rise to $2.20-$2.50, and potentially even $3.50 or higher.

Read also: Analysts Say XRP Price Won’t Break $100 in 2025, Why?

If the momentum remains strong, SUI might even retest the significant highs around $5.36.

Bearish Outlook: Breakdown Phase

The downside risk will increase sharply if the weekly candle closes below $0.60. If this happens, the historical demand zone will be considered no longer valid and instead turn into a supply area.

Failure to hold above this level could form a macro bearish pattern, signaling a possible long-term downward market trend for the SUI token.

In this scenario, the next downside target is expected to be around $0.40, then $0.28, and under extreme capitulation conditions, the price could fall to as low as $0.20.

A close below $0.60 would be a strong signal of a new “lower-low” level forming on SUI, confirming a bearish period for the asset.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TronWeekly. SUI Price Prediction: Could Hit $5.36 After Strong Bounce. Accessed on November 27, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.