Will Crypto Explode if Kevin Hassett Leads the Fed in 2026?

Jakarta, Pintu News – Kevin Hassett, who currently serves as the head of the White House National Economic Council, has become a leading candidate for the position of the next chairman of the Federal Reserve. This speculation has sparked conversations among crypto investors about the possible impact on the crypto market if Hassett is actually selected.

Hassett’s Impact on the Crypto Market

According to a report from Bloomberg, Kevin Hassett has emerged as President Donald Trump’s front-runner to lead the Federal Reserve. Hassett is known to have views that favor low interest rates, which is in line with Trump’s wishes.

Hassett also has direct experience in the crypto industry, including as an advisor to Coinbase and a shareholder of at least $1 million in Coinbase. This combination of dovish macro policy and direct involvement with major US exchanges is the main reason for crypto investors’ optimism.

Juan Leon, senior investment strategist at Bitwise, stated on X that if Kevin Hassett becomes Fed Chair, the impact on crypto will be very bullish. Hassett is known as an aggressive “dove” who has criticized current interest rates for being too high and supports deeper and faster cuts.

Also Read: JPMorgan Predicts Oil Price Fall to $30 by 2027

New Framework Under Hassett

However, Hassett’s potential policy cannot be separated from the plans being developed by Finance Minister Scott Bessent. Bessent has publicly questioned the post-crisis operational framework. According to CNBC’s Walter Bloomberg, Bessent criticized the “ample reserves regime” that may be getting fragile.

Felix Jauvin, host of Forward Guidance, described that Bessent wants a Fed chair who can return policy to a time before the “ample regime”. This means dovish interest rates but with a hawkish balance sheet policy.

While this creates a more benign macro environment compared to the post-2022 tightening cycle, it will not automatically repeat the liquidity wave that boosted all risk assets simultaneously in 2020-2021.

Market and Crypto Outlook under Hassett’s Leadership

The political logic behind Hassett’s ascension has been clearly explained by macro commentator EndGame Macro on Twitter. Hassett was chosen not because of his academic background or experience as a central banker, but because he met Trump’s desired criteria.

Trump wanted someone he already trusted, who had spent years publicly defending Trump, and who had publicly criticized the Fed for being too slow, too cautious, and too political. The market is starting to agree with this speculation.

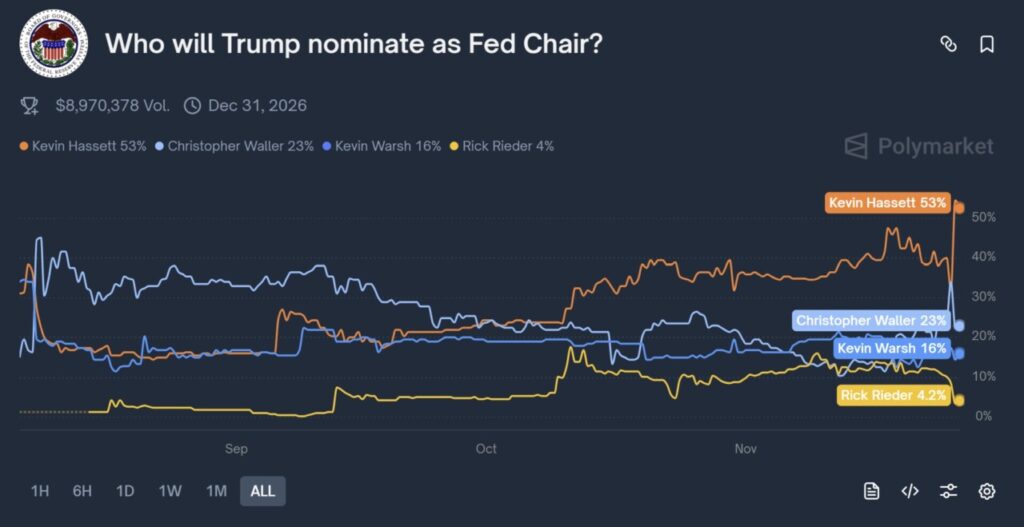

At Polymarket, contracts tracking the Fed chair race showed Hassett around 53% at press time, reinforcing the shift from speculation to a probabilistic base case.

However, whether this will mean an actual “boom” in crypto will depend not only on personalities but also on the interplay between how aggressively the Fed under Hassett cuts rates, how far Bessent is willing to go in shrinking or simplifying the balance sheet, and how the market reassesses inflation, term premiums, and fiscal risks under a more overtly political central bank.

Conclusion

Ultimately, the success of crypto under Hassett’s leadership will be determined by how he balances “dovish interest rates” with “hawkish balance sheets” in practice. The strength and direction of the crypto market in 2026 will be heavily influenced by the current economic cycle and the policies pursued by the Hassett-led Fed.

Also Read: True XRP Holders Keep Calm Amid Weak Markets, Here’s the Outlook for December 2025!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: Who is Kevin Hassett?

A1: Kevin Hassett is the head of the White House National Economic Council who is the leading candidate for the position of the next chairman of the Federal Reserve.

Q2: Why is Kevin Hassett considered a candidate who supports crypto markets?

A2: Hassett has direct experience in the crypto industry as an advisor to Coinbase and a large shareholder in the company, and is known to have views that favor low interest rates.

Q3: What is an aggressive “dove” in the context of monetary policy?

A3: An aggressive “dove” in monetary policy is someone who favors deeper and faster interest rate cuts to stimulate the economy.

Q4: What is Scott Bessent’s role in the new monetary policy framework?

A4: Scott Bessent, Minister of Finance, has questioned the post-crisis operational framework and wants more simplistic policy changes with a hawkish balance sheet.

Q5: What is meant by “hawkish balance sheet”?

A5: “Hawkish balance sheet” refers to tighter policies in terms of the balance sheet, such as reducing or not expanding massive asset purchases by central banks.

Reference

- NewsBTC. Will Crypto Explode? Kevin Hassett, Fed 2026. Accessed on November 28, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.