BTC Price Prediction at the End of 2025: Market Optimism Reaches $100,000!

Jakarta, Pintu News – Crypto traders are increasing their bets that Bitcoin (BTC) price will reach $100,000 before the end of this year. This comes after Bitcoin hit the psychological level of $90,000 again, on hopes that the Federal Reserve will cut interest rates at next month’s FOMC meeting.

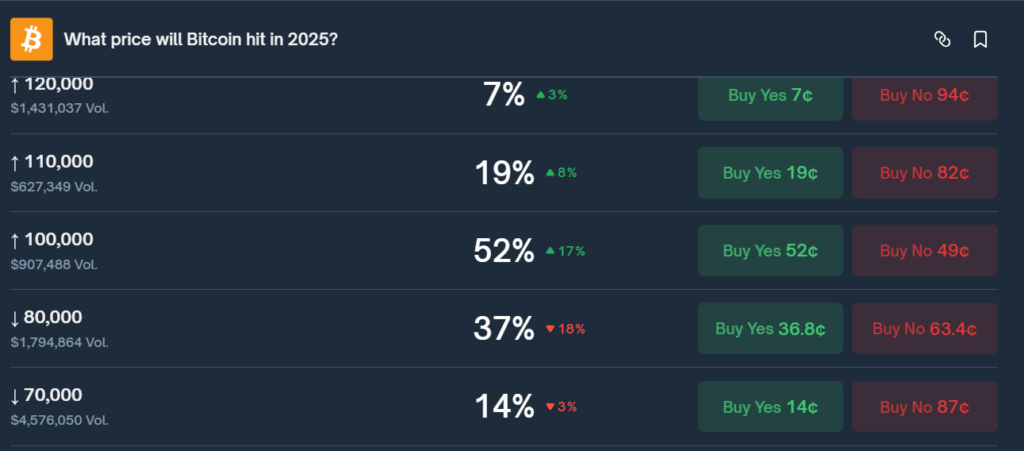

Bitcoin’s Chance of Reaching $100,000 Increases to 52%

Data from Polymarket shows the chances of Bitcoin reaching $100,000 before the end of this year are 52%. This chance has increased by more than 17% after Bitcoin’s recent price rise beyond $90,000.

Bitcoin briefly fell below $100,000 earlier this month for the first time since June, sparking fears of a bear market. However, Bitcoin managed to recover to around $81,000 and has now recovered with optimism of another rate cut in December.

Also read: Is XRP price ready to soar? Here are the contributing factors!

The Impact of Federal Reserve Policy on Bitcoin

CoinGape reports that the odds of a Fed rate cut in December have increased to 85%, after dropping to as low as 30% last week. This surge in rate cut odds comes after comments from Fed President John Williams, who showed his support for another short-term rate cut.

Meanwhile, the PPI inflation report also strengthened the case for another cut, as it showed that a weakening labor market is a bigger concern than rising inflation. Moreover, as part of the Fed’s dovish pivot, the US central bank plans to end quantitative tightening (QT) on December 1, which could pave the way for quantitative easing (QE).

Read also: Bitcoin potentially headed for a new ATH, Nasdaq and BlackRock are the triggers?

Year-end Rally Predictions by Tom Lee

In an interview on CNBC’s Closing Bell, BitMine Chairman, Tom Lee, stated that Bitcoin will likely be above $100,000 by the end of the year. He also raised the possibility that the major crypto could hit a new record above $126,000 before the year ends.

Tom Lee notes that Bitcoin’s price movements occur on only 10 days of the year. “I think some of the best days will still happen before the year is over,” he added. The BitMine chairman is also of the opinion that the crypto market is close to bottoming out.

Conclusion

Meanwhile, market expert Tomas refers to the weakening dollar index, which he notes is good for risky assets such as stocks and Bitcoin. The expert flagged that there are two bearish factors for the dollar, including the emergence of the dovish Kevin Hassett as the clear favorite for the Fed chair role. The other factor is a jump in the odds of a December rate cut of 25 basis points to over 85%.

FAQ

What caused the increased chances of Bitcoin reaching $100,000?

The increased chances of Bitcoin reaching $100,000 are due to the recovery of the Bitcoin price above $90,000 and optimism towards a Federal Reserve interest rate cut in December.

How did John Williams’ comments affect the market?

John Williams’ comments, which showed his support for another short-term rate cut, increased the chances of a rate cut in December, which had a positive impact on Bitcoin price.

What impact will the PPI inflation report have on Federal Reserve policy?

The PPI inflation report suggests that a weakening labor market is a bigger concern than rising inflation, strengthening the case for the next Federal Reserve interest rate cut.

What is Tom Lee’s prediction for Bitcoin price at the end of the year?

Tom Lee predicts that the Bitcoin price will be above $100,000 by the end of the year and could even reach a new record above $126,000.

Why is a weaker dollar index considered good for Bitcoin?

A weaker dollar index reduces the strength of the US dollar against other currencies, making riskier assets like Bitcoin more attractive to investors seeking higher value.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Crypto Traders Bet on Bitcoin Hitting $100k by Year-End Amid Dovish Fed Pivot. Accessed on November 28, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.