3 Reasons Monad (MON) is in the Spotlight: Down 47%, Pi Coin Lookalike, Whale Signal Missing?

Jakarta, Pintu News – New altcoin Monad (MON) is attracting market attention after experiencing a decline of more than 47% in just 4 days post listing. Many analysts are comparing this pattern of decline to what happened to Pi Coin (PI) which also slid sharply shortly after its debut.

The BeInCrypto report as of November 30, 2025 mentions several important technical indicators that show weak money inflows into MON and the dominance of selling forces. Will MON follow in the footsteps of Pi Coin which plummeted more than 90%?

The following are 3 important findings from the technical analysis of the Monad price.

1. Price Down 47% Since Listing, Pattern Similar to Pi Coin

Monad (MON) dropped by 47.57% in 4 days after reaching its highest price. This pattern is very similar to Pi Coin (PI), which also showed a quick spike at the beginning followed by a sharp drop.

Pi Coin itself fell 86.57% in the six weeks after listing and has so far lost over 91% of its peak value. If this pattern continues to repeat itself, then investors need to be wary of the possibility of a deeper drop in MON, especially amid the currently sluggish crypto market conditions.

Also Read: 7 Proper Ways to Save Money to Make Your Finances Safer

2. Whale Retreat: CMF and Bull-Bear Power Show Weak Support

The Chaikin Money Flow (CMF) technical indicator shows that since October 27, 2025, big money flows into MON have steadily decreased by more than 270%. A negative CMF number indicates that large market participants or whales are no longer adding positions to this token.

In addition, Bull-Bear Power (BBP) also indicates that the selling force is more dominant. The combination of these two indicators is usually a bad sign as the signals are consistent: there is no significant buying interest from institutions or large investors.

Arthur Hayes, one of the leading crypto figures, even expressed his doubts about Monad by calling it an “untrustworthy blockchain”.

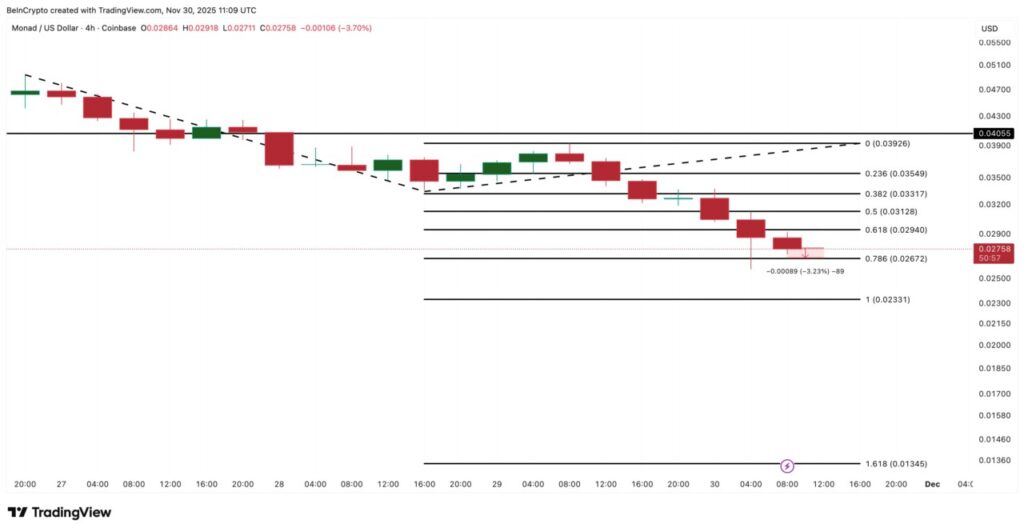

3. Target for further correction could be $0.013 if pressure continues

In terms of price, MON is currently in a short-term downward trend that started on November 26. If it is unable to hold above $0.026 (approx. IDR434), then the next correction target is at $0.023, and could even drop to $0.013 (approx. IDR217) if the selling pressure does not stop.

In order to reverse the trend, MON needs to break back through the $0.029 level and then $0.039-$0.040 for the price structure to start stabilizing. But with big money flows yet to return, the chances for a short-term recovery are still weak.

Also Read: When will the Gold Price Drop Drastically? This is the Full Explanation

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Buying and selling crypto carries high risk and volatility, always do your own research and use cold hard cash before investing.

FAQ

Why did the Monad (MON) price drop dramatically after listing?

The sharp decline was caused by large sell-offs from early investors and weak inflows of new money (money flow), as indicated by the CMF indicator.

What does MON have in common with Pi Coin?

Both experienced the same price pattern: a quick spike after listing followed by a sharp drop in a short period of time. Pi Coin alone has dropped more than 90% since its launch.

Can MON recover from this downturn?

A short-term recovery is difficult without the support of large volumes and whale buying. MON needs to break the $0.029 and $0.039 resistance levels to reverse the trend.

How do technical indicators affect investors’ outlook?

Indicators such as CMF and Bull-Bear Power show buying or selling interest from large market participants. If both are negative, it usually signals continued pressure.

Reference:

- Ananda Banerjee/BeInCrypto. Monad (MON) Crashes 47% From Post-Launch Highs – Is This A New Pi Coin In The Making? Accessed December 1, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.