Tom Lee: If Hassett Becomes Fed Chair, Bitcoin Will Set a New Record in January 2026!

Jakarta, Pintu News – In the dynamic world of cryptocurrency, Bitcoin (BTC) seems to be preparing to reach a new peak. Fundstrat’s Tom Lee predicts that Bitcoin could reach a new high as soon as January 2026.

With policy changes and favorable global economic conditions, these opportunities are opening up even more. This analysis is also supported by potential changes in Federal Reserve leadership that could affect cryptocurrency-related policies.

Tom Lee’s Prediction About Bitcoin

Tom Lee, co-founder of Fundstrat, has an optimistic view of Bitcoin’s future. According to him, while achieving a new record in December seems unlikely, January 2026 is still a realistic target. Lee added that Bitcoin could surpass $100,000 before the end of this year, and then challenge its previous peak of nearly $125,000.

With an in-depth analysis, Lee argues that current economic and political factors favor Bitcoin’s price rise. The readiness of the market and investors to adapt to possible monetary policy changes in the future provides a positive boost to the value of Bitcoin.

New Leadership at the Federal Reserve

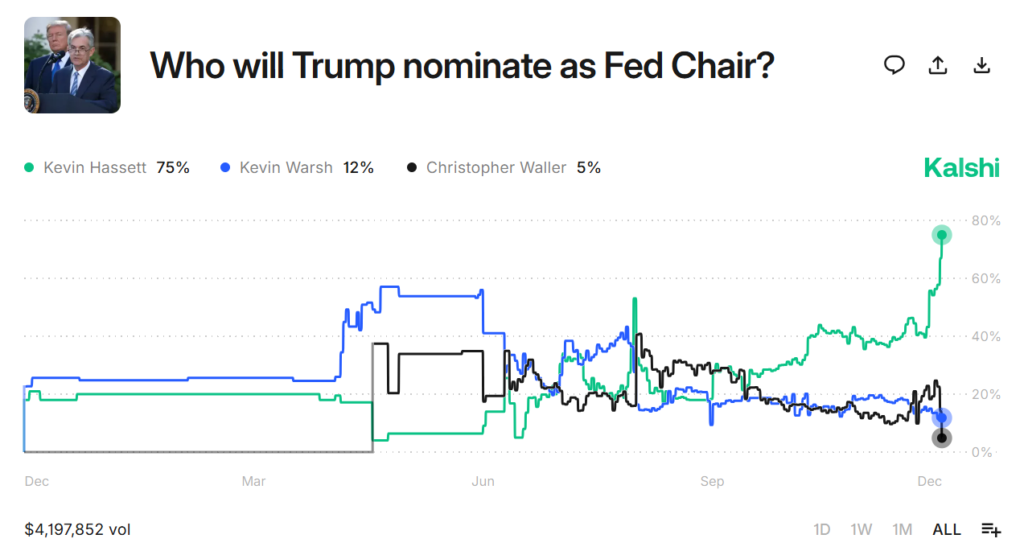

The possible appointment of Kevin Hassett as the next Chairman of the Federal Reserve adds a new dimension to Bitcoin market analysis. Hassett, who is known for his supportive views on the growth of the cryptocurrency industry, could bring a breath of fresh air to this market. Kalshi, a political betting platform, suggests that Hassett has a strong chance of landing the position.

Also read: Bitcoin Surges to $92,000, Fed Rate Cut Speculation Increases!

If Hassett does become the Chairman of the Federal Reserve, this could be a positive signal for the cryptocurrency market. More crypto-friendly policies are expected to support the overall growth of the industry, including an increase in Bitcoin’s value.

Analysis of the Fed-BOJ Pattern and its Impact on Bitcoin

Benjamin Cowen, a leading analyst, adds another perspective by showing the pattern of policy interaction between the Federal Reserve and the Bank of Japan (BOJ). In July 2024, Bitcoin price dropped significantly when the Fed cut interest rates while the BOJ raised them.

Cowen predicts that Bitcoin will hit a new low around mid-December, then rise again in January. This pattern suggests that Bitcoin is highly responsive to changes in interest rate expectations. By understanding these dynamics, investors can be better prepared for market fluctuations and capitalize on opportunities that arise.

Conclusion

With various analyses and predictions from experts, the outlook for Bitcoin seems very promising in the months to come. Although the cryptocurrency market is known for its volatility, proper analysis and understanding of global policy influences can help investors make more informed decisions. January 2026 will probably be an interesting month for Bitcoin and the crypto community as a whole.

FAQ

Who is Tom Lee and what are his predictions about Bitcoin?

Tom Lee is the founder of Fundstrat who predicts that Bitcoin (BTC) could reach a new high in January 2026, with the potential to surpass $100,000.

How has Kevin Hassett affected the cryptocurrency market?

Kevin Hassett, potentially the next Chairman of the Federal Reserve, is known to support the growth of the cryptocurrency industry, which could bring more friendly policies towards this market.

What is the Fed-BOJ pattern described by Benjamin Cowen?

The Fed-BOJ pattern refers to the interest rate policy dynamic between the Federal Reserve and the Bank of Japan, which, according to Benjamin Cowen, affects the price of Bitcoin, especially in July 2024.

When is Bitcoin expected to hit a new low according to analysis?

According to Benjamin Cowen’s analysis, Bitcoin (BTC) is expected to hit a new low around mid-December, before rising again in January.

What is the potential impact of the leadership change at the Federal Reserve on Bitcoin?

A change in leadership at the Federal Reserve, particularly with the appointment of someone pro-cryptocurrency like Kevin Hassett, could influence policy in favor of Bitcoin’s value growth and stability.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Tom Lee Says Bitcoin Could Hit New ATH in January. Accessed on December 21, 2025

- Featured Image: CNBC

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.