Bitcoin Climbs to $92,000 Today — Is a Downturn Still Looming?

Jakarta, Pintu News – Bitcoin (BTC) has been trading almost flat this week. In the past month, BTC has dropped nearly 21% in the last 30 days. Over the past 7 days, Bitcoin’s price movement has barely changed.

This narrow price behavior suggests a clear range: Bitcoin is stuck in the same 6% zone, where buying and selling neutralize each other. Beneath the surface, this balance looks fragile.

The combination of technical analysis and on-chain data still suggests downside risk, unless conditions change very quickly. So, how will Bitcoin price move today?

Bitcoin Price Up 7.00% in 24 Hours

On December 3, 2025, Bitcoin was trading at $92,759, equivalent to IDR 1,546,681,810 — marking a 7.00% gain over the past 24 hours. During this time, BTC dipped to a low of IDR 1,440,431,570 and reached a high of IDR 1,548,622,949.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 30,633 trillion, while its 24-hour trading volume has increased by 3% to IDR 1,410 trillion.

Read also: Altcoin Season Coming in 2026? Signs to Watch Out For

Triangle Range still holding, but Bitcoin near downside risk line

Bitcoin price is currently moving in a large triangle pattern on the 12-hour chart. The upper trendline has rejected all breakout attempts that occurred on November 28 and 30. Meanwhile, a breakdown attempt also briefly appeared on December 1, but buyers managed to lift the price back up before the candlestick closed.

Now, the price is very close to the rising lower trend line – which is almost parallel to the support level at $85,664. From its current position around $86,949, Bitcoin only needs to drop about 1.5% to break this structure.

On the contrary, for an upward breakout, the price needs to increase by about 5% towards $91,637, which makes the short-term upside path more difficult.

Fund Flow Adds Context

The Chaikin Money Flow (CMF) indicator, which measures whether large funds are flowing in or out, has shown a rise since November 21.

CMF is still printing higher lows and remains above the zero level. This is the main reason why Bitcoin price hasn’t seen a drop so far – it could be due to ETF inflows orwhale buying.

However, the CMF is also now close to its own uptrend line. If it falls below that line or drops back below zero, the downside risk to the price will increase significantly.

Until then, Bitcoin continues to move between the levels of $85,664 and $91,637 – the upper and lower limits of the 6%-wide uncertainty zone.

Short-term Buyers vs Long-term Sellers: A Fragile Tug-of-War

On-chain data also explains why Bitcoin price remains stuck and has yet to show a clear direction.

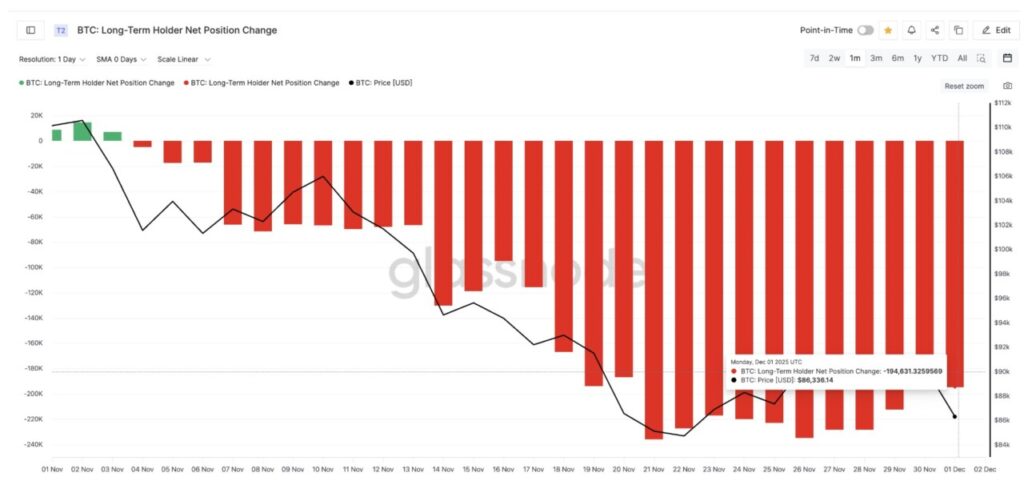

Long-term holders continued to sell off. The Long-Term Holder Net Position Change indicator has remained in the red all month and has even worsened since early November. On November 4, the net outflow was recorded at around 48,620 BTC.

But by December 1, its value had jumped to around 194,600 BTC – up more than 300% compared to before. This shows that holders with high confidence in Bitcoin are still continuing to reduce their exposure.

Read also: Major Crypto Market Events to Keep an Eye on This Week

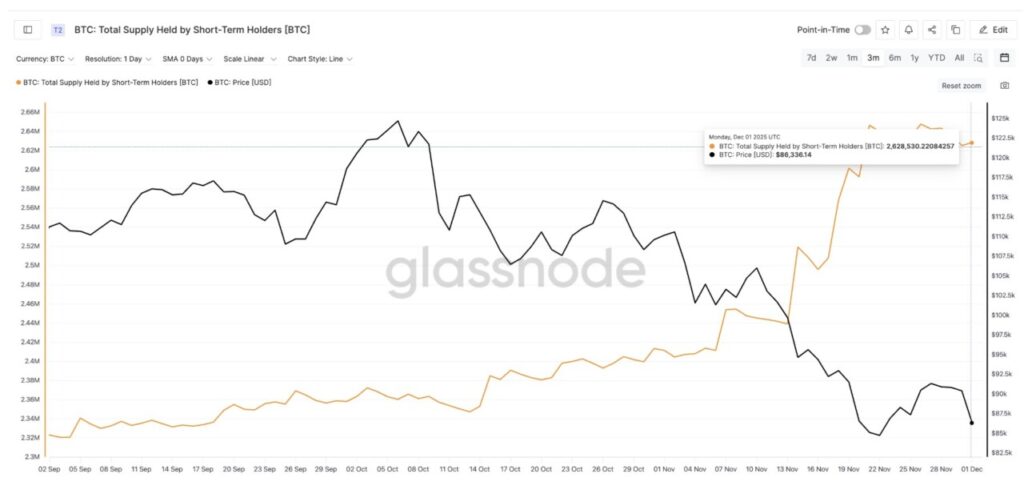

On the other hand,short-term holders continued to increase their holdings.

The total supply held by short-term holders now stands at around 2.63 million BTC – just less than 1% below its highest level in the last three months. Sounds optimistic, right? But not entirely so.

This group consists of speculative traders. They tend to exit the market quickly, which often magnifies the downward pressure when prices start to weaken.

So, the picture of the tug-of-war is like this:

- Long-term holders are selling (bearish signal)

- Short-term holders are buying (strong but speculative signal)

- CMF rises (favors stability, but position is prone to decline)

This keeps Bitcoin locked amidst pressure from both sides, with no clear trend for now.

Bitcoin Price Key Levels: Small Drops Could Trigger Bigger Moves

From this point on, Bitcoin price can go in two directions:

Downward Scenario (Bearish):

If the close of the 12-hour candle occurs below $85.664, then the triangle pattern will break and will most likely push the price down towards $83.811. If the selling pressure continues, the next support zone is at $80.599 – which is the current cycle low.

Upward Scenario (Bullish):

To trigger price consolidation, Bitcoin needs to break above $91,637. If this level is successfully passed and the CMF indicator rises close to the 0.11 zone, then there is a chance for the price to advance to $93,780. However, this path requires much greater buying strength than the selling pressure needed to break downwards.

For now, the chart is leaning more towards the downside. Long-term holders continue to sell, while the market is dominated by speculative short-term buyers.

Bitcoin price is also very close to the downtrend line, indicating the potential for increased downward pressure. Although the Chaikin Money Flow (CMF) indicator is still in positive territory and providing support, its position is already near the lower limit of the trend, meaning the strength of that support could weaken soon.

As long as the price is unable to break the upper boundary at $91,637, Bitcoin is likely to remain in a 6%-wide uncertainty zone, with the risk of a sharper move to the downside if the $85,664 support level is not successfully defended.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Trapped In ‘Indecision’ Zone As Downside Break Becomes More Likely. Accessed on December 3, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.