Ethereum Surges to $3,000 as Network Activity Rises with More New Addresses

Jakarta, Pintu News – Ethereum (ETH) is struggling to regain momentum after a sharp 6% drop on December 2, which saw the altcoin king retreat from the crucial $3,000 level.

The level acts as an important area of resistance, both psychologically and technically. This latest rejection comes amidst withdrawals from some of Ethereum’s most influential holders.

Then, how will Ethereum price move today?

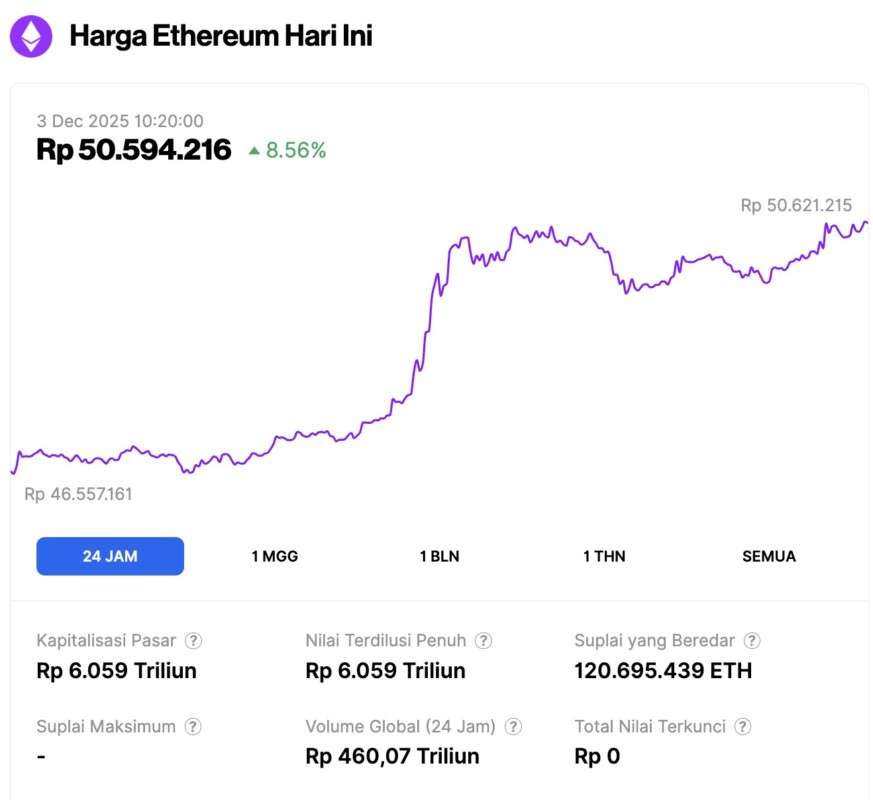

Ethereum Price Rises 8.56% in 24 Hours

On December 3, 2025, Ethereum was trading at approximately $3,035, or around IDR 50,594,216—marking an 8.56% increase over the past 24 hours. During this time, ETH dipped to a low of IDR 46,557,161 and climbed to a high of IDR 50,621,215.

At the time of writing, Ethereum’s market capitalization is estimated at roughly IDR 6,059 trillion, while its 24-hour trading volume has risen by 11% to IDR 460.07 trillion.

Read also: Bitcoin Climbs to $92,000 Today — Is a Downturn Still Looming?

Ethereum Supply from Existing Holders Declines

HODL Waves data shows that Ethereum’s long-term holders (LTHs) have started offloading their holdings since early November. This selling pressure intensified around November 19, leading to a significant drop in the supply held by the 2 to 3-year asset holder group.

Their share of total outstanding supply fell from 8.51% to 7.33%. This is a clear indication that the group is taking steps to mitigate losses and reduce risk exposure.

Given that LTHs are generally the most stable participants in the Ethereum ecosystem, their sell-off had a direct impact on price movements. More importantly, their positions have not recovered since the sell-off. This creates a supply vacuum that needs to be filled by new investors for ETH to re-establish upward momentum.

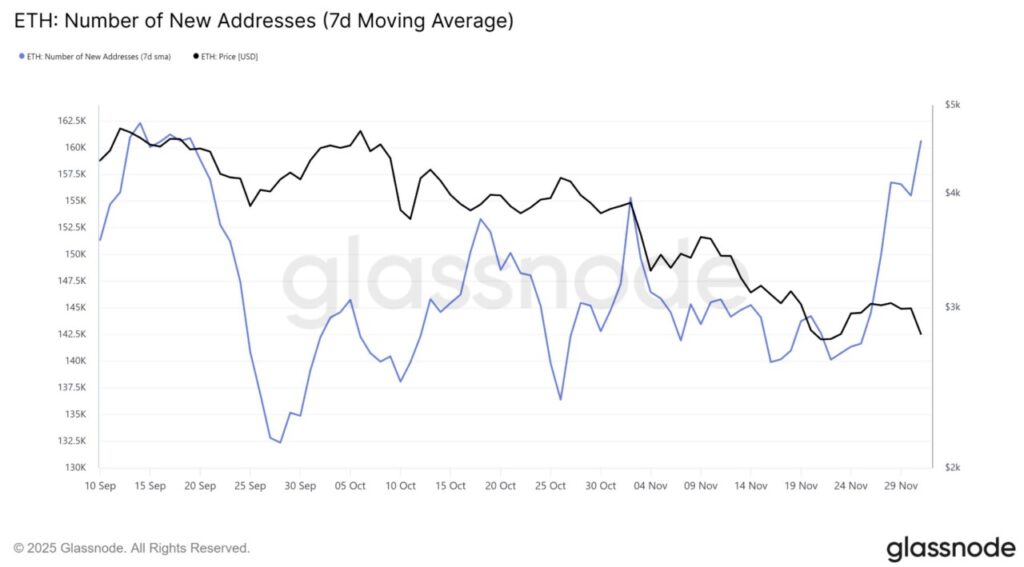

New Addresses on Ethereum Increase 13.4%

The good news is that Ethereum is starting to show promising signs of renewed demand.

Read also: Arthur Hayes: Bitcoin Could Break $500K and 5 Top Altcoins to Watch in 2026

In the past seven days, the number of new addresses on the network increased by 13.4%, from 141,650 to 160,690. This is the highest weekly jump in more than two and a half months, signaling renewed interest from investors despite the recent price correction.

New addresses often reflect an influx of fresh capital into the market – something that is crucial for Ethereum as it tries to hold above key support levels. However, it’s important to sustain this growth.

If the inflow of new holders slows down, the market may not be able to cover the void left by LTH participation.

ETH price still has no direction

As of December 2, Ethereum is trading at around $2,805, reflecting a daily decline of 6%. The asset is slightly below the $2,814 resistance level, after its latest attempt to break the $3,000 mark failed again.

Based on the current market sentiment and structure, ETH may try to stabilize first and have a chance to rebound. However, for it to recover strongly, it needs consistent investor support.

In the short term, Ethereum price is likely to move between $2,814 and $3,000, while looking for a clearer direction.

If the bullish momentum strengthens and new demand remains steady, Ethereum has the potential to break the psychological barrier of $3,000. If this breakout is successful, an upward path could open up towards $3,131 and even $3,287, while invalidating the short-term bearish scenario.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Struggles Below $3,000 as Long-Term Holders Cash Out. Accessed on December 3, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.