Whale’s Big Ethereum Move, What Impact Will It Have?

Jakarta, Pintu News – An anonymous whale recently made a large move on the Ethereum (ETH) chain, drawing the attention of many. According to on-chain analytics platform Lookonchain, the whale with wallet address “0x97BD” has moved 10,000 ETH from the Bitget exchange. The move shows long-term confidence in Ethereum despite the asset’s price dropping more than 10% in the last 30 days.

Big Withdrawal by Whale Ethereum

The whale withdrew $31.91 million worth of Ethereum from the Bitget exchange, signaling a significant accumulation strategy. After the withdrawal, the total amount of ETH in the whale’s wallet increased to 34,188 ETH, with a value of approximately $108.8 million. This suggests that the whale may be planning to hold these assets for the long term.

This large withdrawal also shows the whale’s confidence in the future of Ethereum. By storing assets in a private wallet, the whale is indicating a preference for more controlled and secure asset management. This is a common strategy for large investors who want to avoid the risks associated with storing assets on exchanges.

Also Read: 5 Shocking Facts About Strategy: 650,000 BTC worth ±$60 Billion!

Ethereum Price Increase and Staking

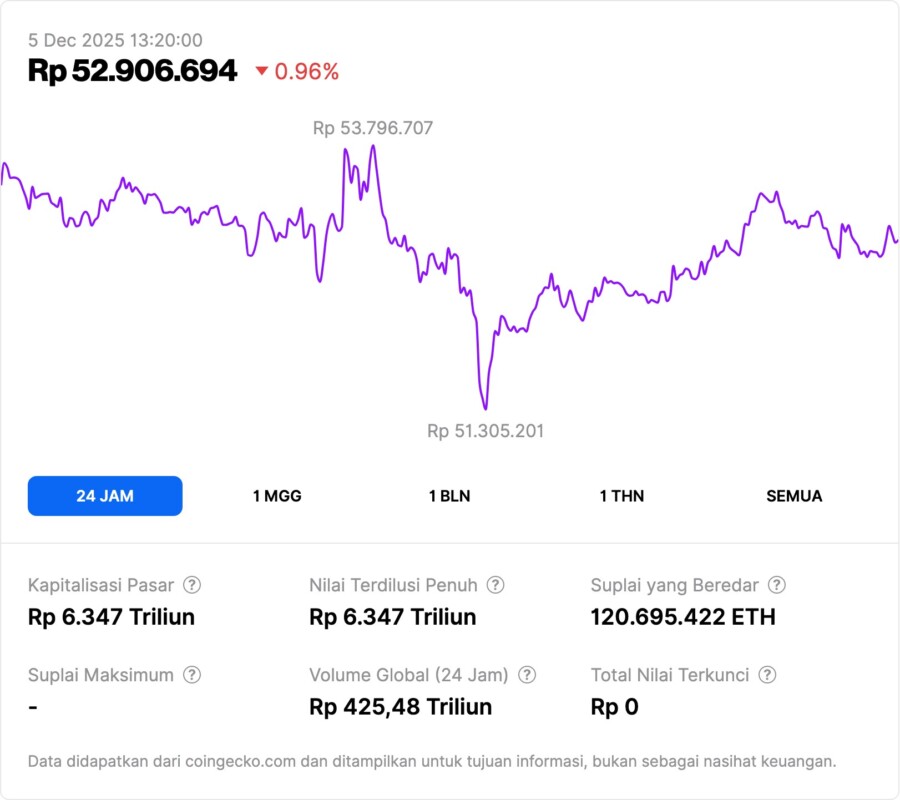

Despite price volatility, Ethereum (ETH) has risen in the last 24 hours, from a low of $3,059.98 to $3,238.56. At the time of writing, Ethereum is trading at $3,164.88, showing an increase of 2.02% in the period.

This suggests that the market may be responding positively to accumulation activity by whale. Data from Lookonchain also shows that whale has been staking Ethereum through Lido staking. This reaffirms that whale has confidence in Ethereum’s future price prospects, despite continued uncertainty in major crypto asset markets.

Network Disruption and Updates from Vitalik Buterin

Early on Thursday, some community members experienced network disruptions. According to an update from the Ethereum Foundation, there was an issue with the Prysm consensus client on the mainnet that took about 23% of network nodes offline. This shows the importance of ongoing maintenance and technical updates for network stability.

Meanwhile, Ethereum founder Vitalik Buterin has hinted at three crucial updates to be made to the blockchain. Buterin highlighted these include limits on the number of bytes of contract code accessed per transaction and changes to memory chunks. Another update is the limitation of the ZK-EVM prover cycle.

Conclusion

This massive action by Ethereum whales shows an interesting dynamic in the crypto ecosystem. With large withdrawals from exchanges and active staking, as well as an anticipated update from Vitalik Buterin, the future of Ethereum seems full of promising developments. Investors and market watchers will continue to monitor these movements to see how they impact the value and stability of Ethereum.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: How much Ethereum did the whale move from Bitget exchange?

A1: The whale moved 10,000 Ethereum (ETH) from the Bitget exchange.

Q2: What is the total value of Ethereum held by whale after the latest withdrawal?

A2: After the latest withdrawal, the whale has a total of 34,188 Ethereum (ETH), which is worth about $108.8 million.

Q3: What does whale confidence in Ethereum show?

A3: Whale is staking Ethereum through Lido staking, which shows confidence in Ethereum’s future price prospects.

Q4: What are the updates that Vitalik Buterin has hinted at for the Ethereum blockchain?

A4: Vitalik Buterin hinted at updates including limits on the number of bytes of contract code accessed per transaction, changes to memory chunks, and ZK-EVM prover cycle limits.

Q5: What is the impact of the recent network disruption on Ethereum?

A5: The disruption took approximately 23% of Ethereum network nodes offline, demonstrating the importance of technical maintenance for network stability.

Reference

- U.Today. Ethereum on the Exit of Popular Crypto Exchange as Whale Bet Grows. Accessed on December 5, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.