Will Bitcoin bounce back from its huge losses soon? Here’s the latest analysis!

Jakarta, Pintu News – The Bitcoin (BTC) market is currently experiencing increasing selling pressure, characterized by bearish dominance in recent price action. The latest on-chain analysis shows that panic-induced selling is further aggravating market conditions. With losses tripling compared to realized gains, the big question that arises is: is there any hope of recovery in the near future?

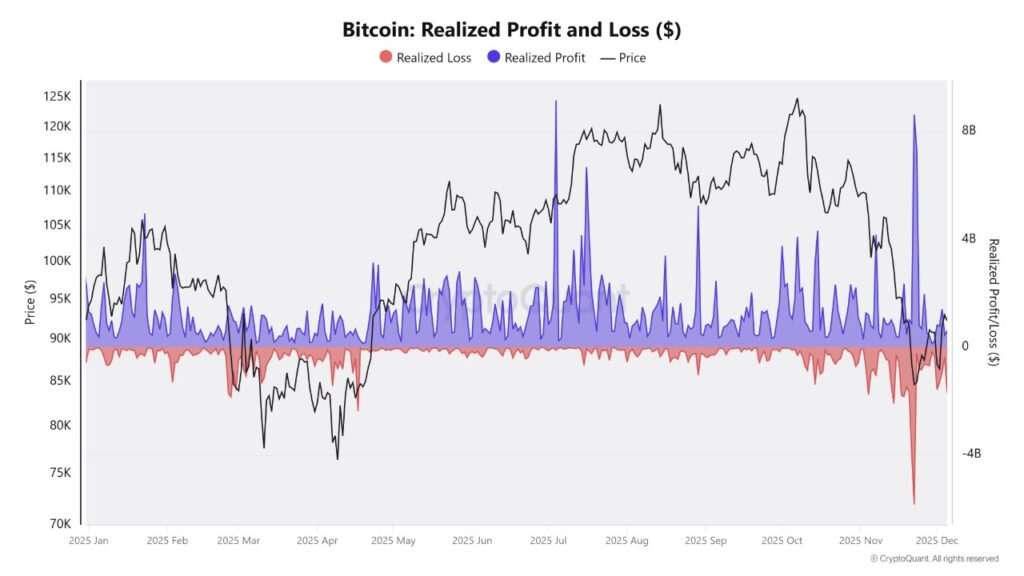

Real Bitcoin Losses Reach $1.7 Billion

According to a recent post on the CryptoQuant platform, analyst GugaOnChain revealed that the Bitcoin market is in a capitulation phase. The Bitcoin Real Gains and Losses ($) metric used shows that investors incurred real losses of $1.7 billion compared to gains of only $605 million.

This signals that many investors are choosing to sell their assets amid market uncertainty. This reflects a strong negative sentiment among Bitcoin holders, which may continue to exacerbate the selling pressure. Further analysis suggests that if this trend continues, Bitcoin may face a deeper price drop.

Also Read: 5 Important Facts from Bitcoin’s (BTC) Latest Prediction: US$125,000 Target?

Critical Price Levels to Maintain

In its analysis, GugaOnChain emphasized several price zones that are critical for the future of Bitcoin. One of the levels that bulls must defend is $71,450, which is the realized price for investors who bought Bitcoin between 12 and 18 months ago. If the price drops below this level, there could be a significant further decline. Additionally, the next key support lies at $58,940, which is the realized price for investors with Bitcoin holdings between 18 months to 2 years. This zone is very important as it could be a turning point in case of further declines.

Ethereum and XRP Market Movements

While Bitcoin is under pressure, Ethereum (ETH) is showing signs of strength with indicators suggesting the possibility of a big move ahead. On the other hand, CEO of Digital Ascension Group, Jake Claver, revealed that ultra-rich families are now turning to Ripple (XRP) as a key investment asset, leaving Bitcoin behind.

This shift indicates a diversification in investment preferences among crypto investors, which might affect the overall market dynamics. With this change, XRP may get more attention and investment, which could affect its exchange rate in the market.

Conclusion

With selling pressure mounting and losses outpacing gains, the Bitcoin market is currently in a critical phase. However, an understanding of key price levels and changing investor preferences can provide insight into the market’s next direction. Whether Bitcoin will bounce back or continue to slide, only time will tell.

Also Read: 10 Ways to Learn Crypto from Zero: Basic Guide to Start Investing Safely

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is the capitulation phase in the context of the Bitcoin market?

A1: The capitulation phase is a period where asset prices fall significantly and rapidly, often due to massive selling by investors who panic or lose confidence.

Q2: What are the total losses and gains realized in the Bitcoin market recently?

A2: The Bitcoin market recently recorded an apparent loss of $1.7 billion, while realized gains were only $605 million.

Q3: Why are the price levels of $71,450 and $58,940 important for Bitcoin?

A3: The price levels of $71,450 and $58,940 are important because they represent the realized price for investors who bought Bitcoin within a certain time frame, and a drop below these levels could trigger further price declines.

Q4: How does the current Bitcoin and Ethereum market compare?

A4: Currently, Bitcoin is under heavy selling pressure, while Ethereum is showing signs of strength with indicators suggesting a possible big move ahead.

Q5: What caused uber-rich investors to switch from Bitcoin to Ripple?

A5: The uber-rich investors may turn to Ripple (XRP) as they look for different asset diversification and growth potential, which they may find more promising compared to Bitcoin at the moment.

Reference

- NewsBTC. Bitcoin Realized Losses Jump 3X Profits, Is Relief Coming? Accessed on December 8, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.