Pepe Price Prediction: PEPE Pauses as Bullish Signals Build from On-Chain and Derivatives Data

Jakarta, Pintu News – Pepe (PEPE) is trading in the red zone on Tuesday after failing to record a daily close above the psychological level of $0.00000500 on Monday (8/12). The technical outlook still shows mixed signals as the frog-themed meme coin is undergoing consolidation.

Even so, derivatives and on-chain data indicate a resurgence of interest from retail investors that could potentially drive the next rally.

Derivative and On-Chain Data Show Bullish Signals for PEPE

Demand from retail investors for Pepe (PEPE) is recovering as risk exposure by derivatives traders increased overnight.

Read also: Dogecoin Price Up 4% Today: On-chain data shows surge in activity!

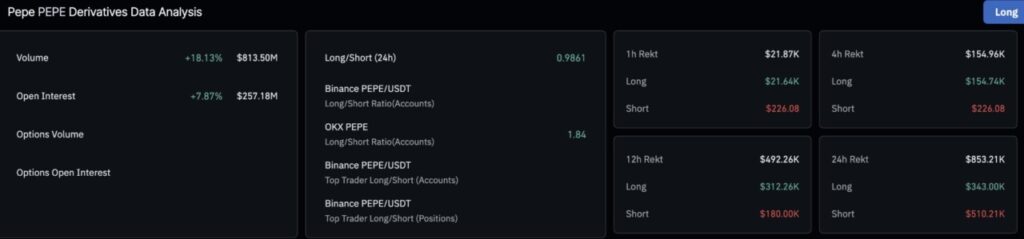

Data from CoinGlass shows that Open Interest (OI) for PEPE futures jumped 7.87% in the last 24 hours, reaching $257.18 million. In general, the price rally on PEPE and other meme coins has been largely driven by retail demand and market speculation.

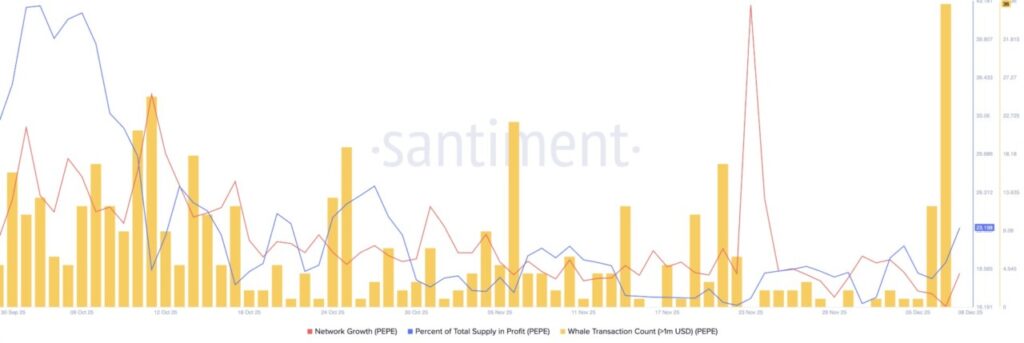

On the on-chain side, data from Santiment shows a spike in network growth to 623 new addresses on Monday, up from 448 on Sunday. This indicates an increase in the number of addresses transferring PEPE for the first time. Meanwhile, the percentage of PEPE supply that was in good standing was recorded at 23.20% on Monday, up from 20.14% the previous day.

Large-cap investors, often referred to as whales, made 36 trades worth more than $1 million on Sunday. This signaled increased interest from the whales which pushed up the price of PEPE by 7% on Monday.

If the whale interest continues, PEPE has the potential to reclaim the price levels it lost.

Technical Outlook: Could PEPE Strengthen Toward 200-Day EMA?

Currently, Pepe (PEPE) is trading below the $0.000005000 level, down about 3% on Tuesday, and is likely testing the support level at $0.00000395 – which is in line with the low on November 21.

Read also: Pi Network Price Weakened Today: Pi Coin Aiming for 15% Increase?

However, the momentum indicator on the daily chart shows a neutral-to-bullish stance. The Relative Strength Index (RSI) stands at 45 and is starting to rise towards the midpoint after previously being inoversold territory, indicating that selling pressure is starting to ease.

Also, the Moving Average Convergence Divergence (MACD) indicator remained steady near the zero line, with a histogram dominated by green bars – signaling a boost in bullish momentum.

If PEPE manages to register a daily close above the $0.00000521 level, which was the low point on November 4, then the coin could potentially target the supply area around $0.00000650. If the buying pressure continues, the next target would be the 200-day Exponential Moving Average (EMA) at $0.00000839.

FAQ

What is Pepe Coin (PEPE)?

Pepe Coin (PEPE) is a meme coin inspired by the internet’s famous frog meme. The coin is often traded by retail investors and speculators in the crypto market.

How did Pepe Coin perform on Monday (8/12)?

On Monday, Pepe Coin failed to close above the psychological level of $0.00000500 and experienced a decline the following day.

What does CoinGlass data show about Pepe Coin?

Data from CoinGlass shows that the Open Interest (OI) for Pepe Coin futures increased by 7.87% in the last 24 hours, reaching $257.18 million.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FXStreet. Pepe price forecast: PEPE stalls as on-chain derivatives data flash bullish signals. Accessed on December 10, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.