5 Important Signals of the Bitcoin Bear Cycle: What Will Happen Next?

Jakarta, Pintu News – Amid great expectations that Bitcoin (BTC) will set new records this year, market analyst Axel Adler asserts that Bitcoin is instead at the midpoint of a bear cycle, giving rise to various speculations about the next direction of the market.

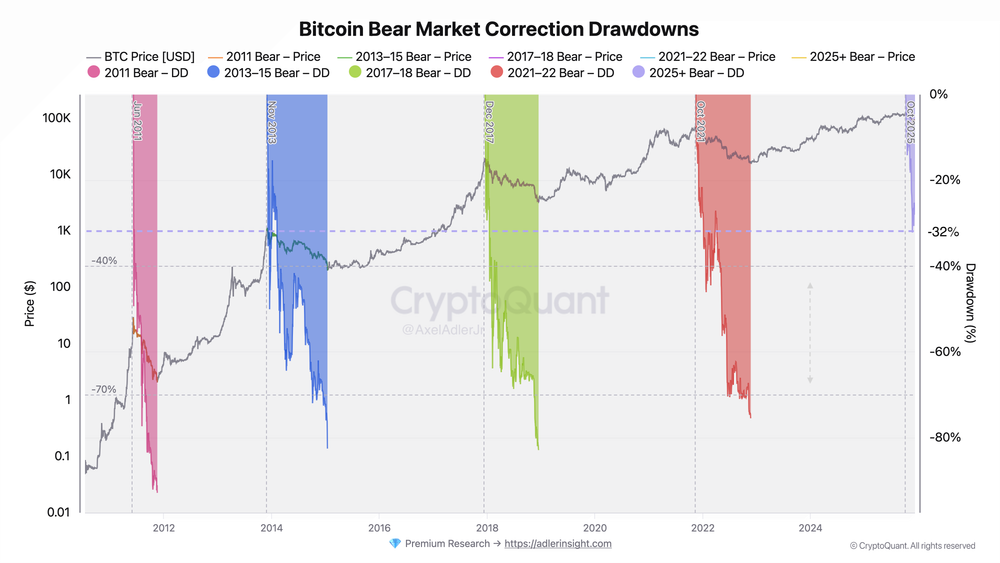

1. Bitcoin’s Decline This Time is Milder than Previous Bear Cycles

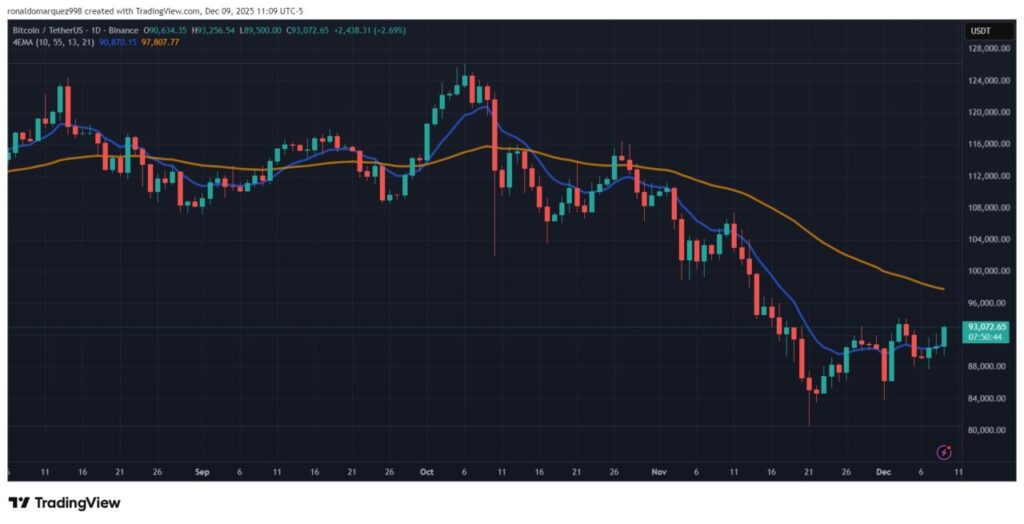

Adler notes that Bitcoin has only dropped about 4% since the beginning of the year and is still consolidating steadily in the $89,000-$94,000 zone. The total decline of -32% is considered quite mild when compared to previous bear markets which are usually followed by extreme corrections.

The stability around $90,000 indicates that many investors still hold profitable positions that have not been realized, so the selling pressure is not as strong as in previous cycles. This gives market participants some room for optimism.

Also Read: Will Dogecoin (DOGE) be back in the hands of the bulls by early 2026?

2. Risk of Deeper Downturn May Be Less than Expected

In the last bearish cycle, only 17% of Bitcoin’s supply was at a loss – a figure much lower than the usual three to four times the standard for large capitulations.

Adler mentioned that the current pattern resembles a healthy correction within a bullish supercycle more than a shift to a full-fledged bear market. If the price still does not drop past -35% and unrealized losses remain moderate, the chances of a flat correction become stronger.

3. Price Resilience Supported by Institutional Demand

The consolidation of Bitcoin price in the high zone is partly influenced by the growing institutional demand as well as the structural supply deficit in the market. Both of these factors provide a natural “buffer” that restrains the aggressive decline.

As a fixed-supply asset, the combination of declining stock exchange reserves and increasing long-term accumulation helped strengthen the market structure amid the turmoil.

4. Classic Bear Market Threat Remains Lurking

Although the structural signals are quite strong, Adler warns that a correction break below -40% could trigger a classic bear market. In that scenario, a further decline to the -60% to -70% range becomes very likely.

This could potentially trigger a phase of total capitulation, especially if unrealized losses increase dramatically-a pattern that often appears before Bitcoin’s biggest turning points.

5. Market Still Shows Signs of Short-Term Strength

Bitcoin is currently trading around $93,000, registering a 5% gain in the last 24 hours and 9% in the last 14 days. Despite being in the dynamics of a trend intersection, the price movement data suggests a recovery attempt.

These short-term gains are helping to alleviate downward pressure, although not enough to reverse the overall market structure.

Conclusion

Reading Bitcoin’s position in the bear cycle is important for investors to understand the true context of the market. With indicators showing a mix of risk and opportunity, vigilance and careful analysis will be key in navigating this uncertain market phase.

Also Read:Michael Saylor Signaled New Bitcoin Purchases, BTC Price Ready to Skyrocket?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is a bear cycle in Bitcoin?

A bear cycle is a period when Bitcoin price experiences a sustained downtrend and selling pressure dominates the market.

How much Bitcoin is currently at a loss?

About 12% of the total Bitcoin supply is at a loss, a much lower figure than the classic capitulation phase.

What is capitulation in crypto markets?

Capitulation occurs when investors sell large amounts of their assets out of panic, causing a sharp drop in prices.

At what price is Bitcoin currently trading?

Bitcoin is currently in the range of $89,000-$94,000, with a tendency to consolidate in recent days.

What is the impact of the bear cycle on investors?

Bear cycles can cause losses for investors who sell when prices drop, but they also provide accumulation opportunities for those with a long-term orientation.

Reference

- NewsBTC. Expert Declares Bitcoin Has Reached Midpoint of Bear Cycle, What Lies Ahead. Accessed on December 10, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.