5 Reasons Bitcoin Failed to Break $108,500 – and How a Breakout Could Still Happen

Jakarta, Pintu News – Bitcoin (BTC) price rose 2.8% to around $92,500, but still failed to break the $108,500 technical target despite an inverse head and shoulders pattern forming. Two major obstacles stand in the way of this breakout, but both can still be overcome.

1. Neck Line $93,700 Becomes the Main Barrier

The inverse head and shoulders pattern formed since November 16 is still valid, but the breakout is yet to happen as the neck line at $93,700 continues to reject the price. Until BTC closes a daily candle above this level, the bullish structure will not be confirmed. This failure leaves the market in a phase of waiting for the next strong trigger.

Also Read: Will Dogecoin (DOGE) be back in the hands of the bulls by early 2026?

2. Whale Support Weakens in Recent Weeks

The number of wallets holding more than 1,000 BTC fell since November 19 and hit a monthly low of 1,303 on December 3. The lack of whale group participation weakens the bullish momentum. Without their support, a breakout to the higher zone requires alternative drivers from the market structure.

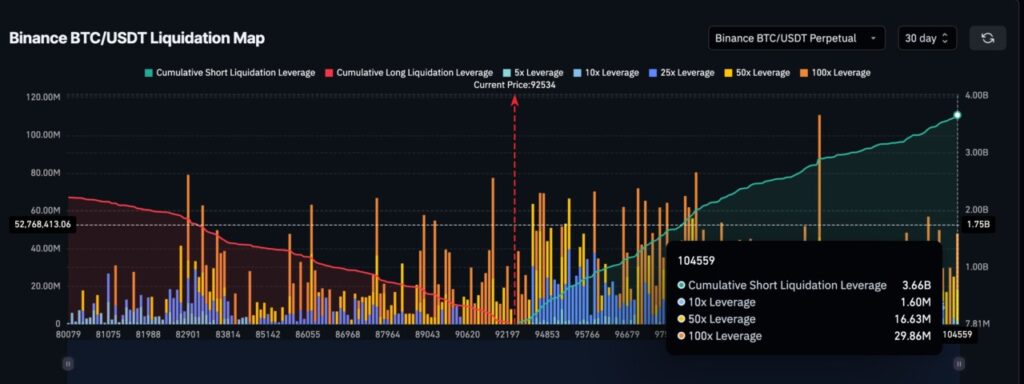

3. Short Squeeze Potentially a Driving Catalyst

Despite the whale’s absence, Binance data shows the last 30-day short leverage reached $3.66 billion – almost 50% higher than the long position. This imbalance creates a short squeeze opportunity. If BTC pushes decisively above $93,700, short liquidation could trigger a quick spike towards $94,600 and open up more upside room without the whales’ help.

4. Breakout Momentum Could Trigger Whale Participation

If BTC manages to break $93,700 and $94,600, the technical momentum is likely strong enough to attract whale participation again. Momentum-based bulls often create a re-confidence effect, making large entities re-enter and reinforcing the uptrend.

5. Roadmap to $108,500 Technical Target

After $94,600, the next target is $105,200 before reaching the full target of the inverse head and shoulders pattern at $108,500. The structure remains valid as long as BTC holds above $83,800, but a drop below $80,500 will invalidate the pattern and increase the risk of a deeper correction.

Conclusion

Bitcoin faces two major obstacles: the hard resistance at $93,700 and the lack of whale support. However, the huge short squeeze opportunity gives BTC an alternative path to the breakout. If buyers push the price past the key level, the technical momentum could open a path towards $108,500 without having to wait for whale action.

Also Read:Michael Saylor Signaled New Bitcoin Purchases, BTC Price Ready to Skyrocket?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Why did Bitcoin fail to break $93,700?

The neck line of the inverse head and shoulders pattern at $93,700 is a strong resistance that has yet to be broken on a daily basis.

What role do whales play in breakout failure?

Large wallets holding >1,000 BTC have declined, providing less buying support to confirm the breakout.

What is a short squeeze in the context of Bitcoin?

A short squeeze occurs when many short positions are forced to close due to price increases, pushing the price up even faster.

What price levels pave the way to $108,500?

BTC needs to break $93,700, then $94,600, and after that target $105,200 before reaching $108,500.

When is a bullish pattern considered void?

The inverse head and shoulders pattern is invalidated if BTC drops below $80,500.

Reference

- BeInCrypto. Bitcoin Price Prediction: $108,500 Failure in Two Reasons. Accessed on December 10, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.