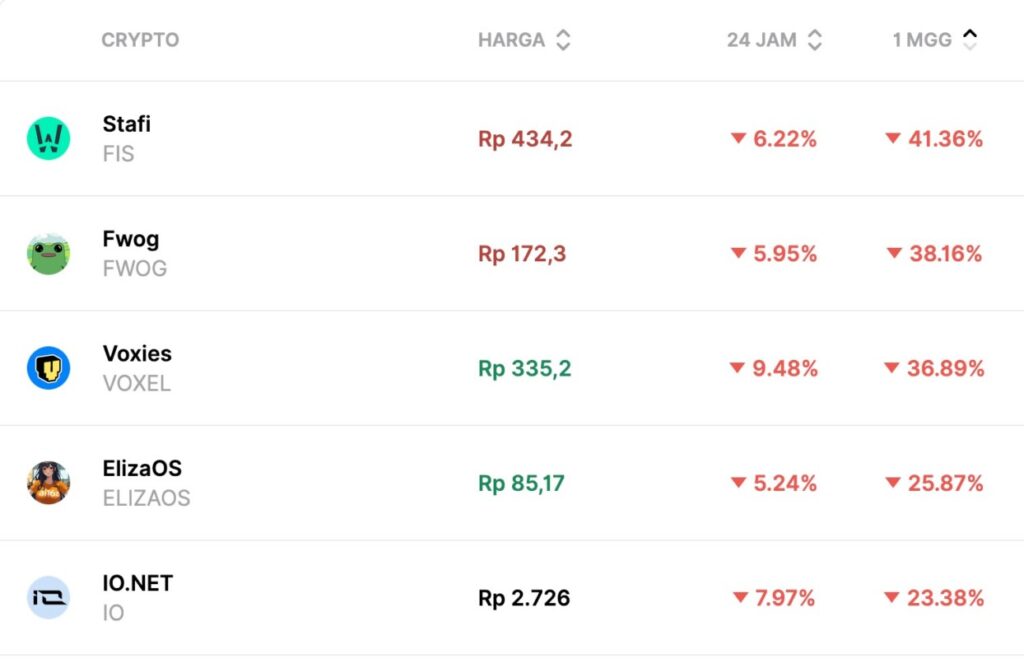

5 Crypto with the Biggest Drop in the First Week of December 2025

Jakarta, Pintu News – Entering the first week of December 2025, the crypto market has been volatile again. Several altcoins recorded sharp corrections, influenced by risk-off sentiment, liquidity outflows, as well as a decline in trading volumes on the spot market.

Under these conditions, some market participants utilize derivative instruments such as Pintu Futures to open short positions when the market weakens or maximize long opportunities when bullish momentum begins to form. Based on weekly price data in the Pintu application, here are the 5 crypto assets with the biggest decline in the last 1 week.

1. Stafi (FIS) – Down 41.36%

Stafi (FIS) was the asset with the deepest correction this week after plummeting more than 41%. The liquid staking-focused token is still facing pressure due to declining investor interest in alternative staking products and limited positive catalysts.

- Price: IDR 434.2

- 24 hours: -6,22%

- 1 week: -41,36%

For traders looking to respond to these market conditions, sharp volatility in assets like Stafi can be capitalized on through derivative instruments. Through Pintu Futures, traders can open short positions when prices show weakness or capitalize on potential rebounds with long positions.

Also Read: Will Dogecoin (DOGE) be back in the hands of the bulls by early 2026?

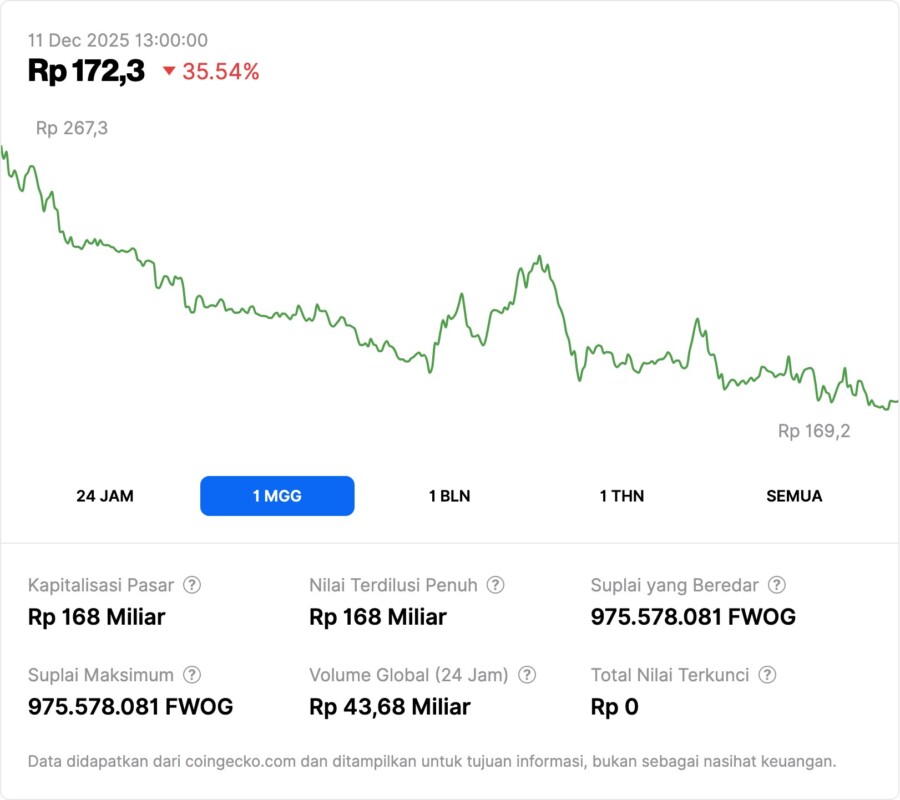

2. Fwog (FWOG) – Down 38.16%

FWOG (FQOG), a community-based memecoin, recorded a sharp decline after a brief rally earlier. A drop in transaction volume and reduced trader interest saw the token weaken significantly.

- Price: IDR 172.3

- 24 hours: -5,95%

- 1 week: -38,16%

For traders looking to capitalize on this kind of memecoin volatility, derivative instruments such as Pintu Futures can provide more flexibility. Through the futures feature, traders can open short positions in anticipation of weakness or go long when a potential reversal emerges.

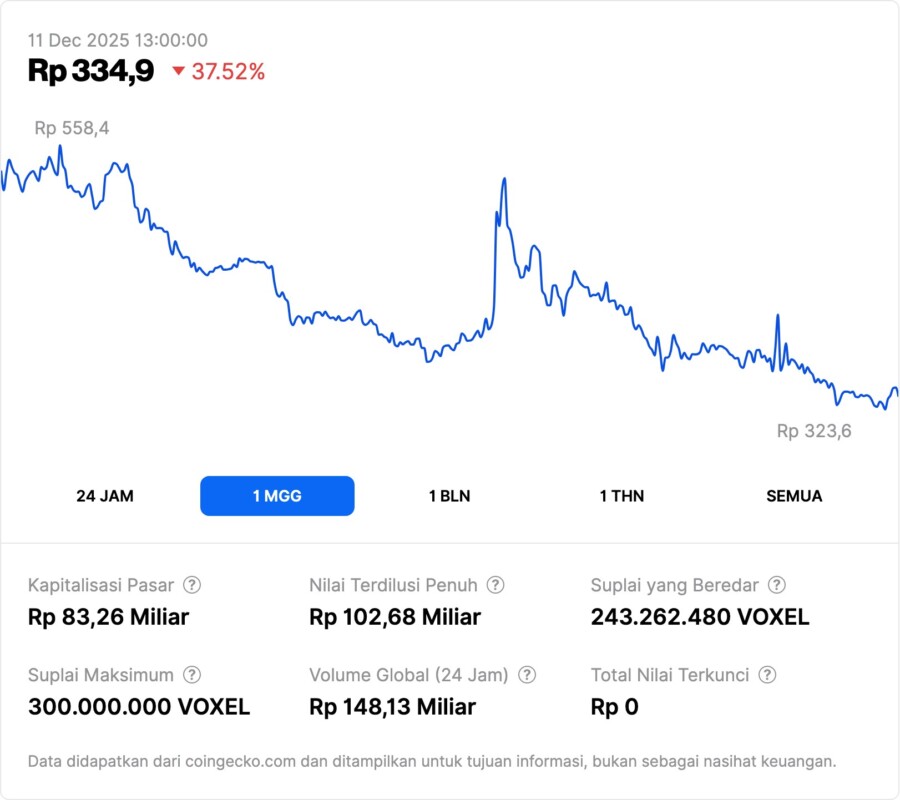

3. Voxies (VOXEL) – Down 36.89%

The gaming token Voxies (VOXEL) is in third place with a drop of almost 37%. The lack of project updates and reduced sentiment on the GameFi sector continue to pressure VOXEL prices.

- Price: IDR 335.2

- 24 hours: -9,48%

- 1 week: -36,89%

4. ElizaOS (ELIZAOS) – Down 25.87%

ElizaOS (ELIZAOS), an AI-as-a-service based token, fell by more than 25% as market conditions were less favorable for risky assets. This correction is still moderate compared to other tokens on the list.

- Price: IDR 85.17

- 24 hours: -5,24%

- 1 week: -25,87%

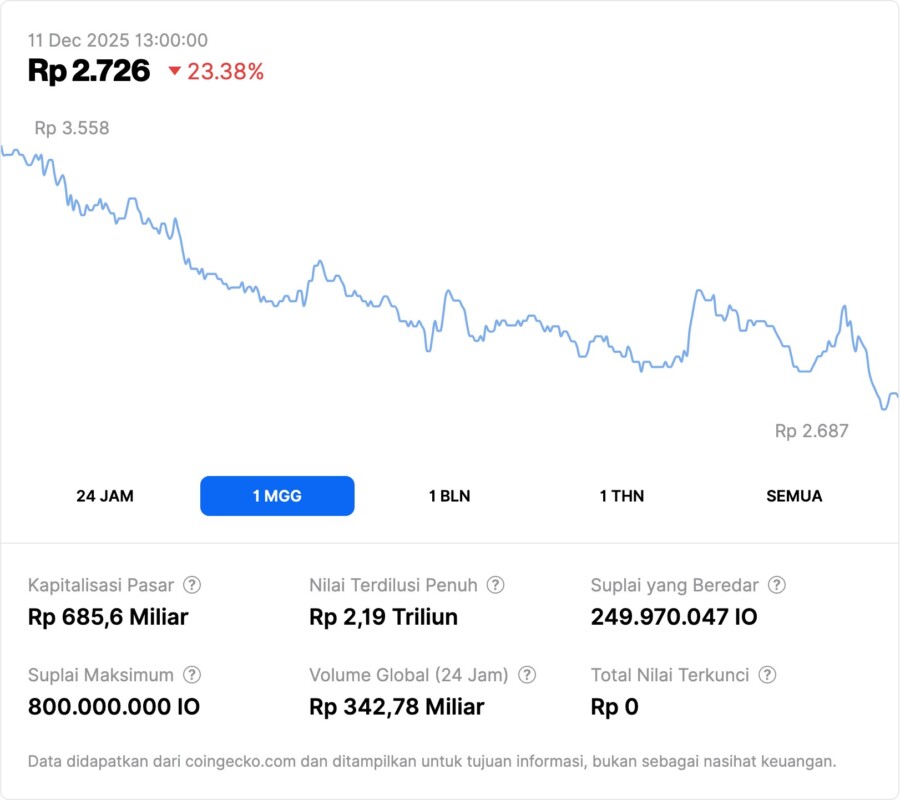

5. IO.NET (IO) – Down 23.38%

IO.NET (IO) is experiencing sustained selling pressure after a period of high volatility. Although the decline is the smallest on this list, the asset remains in a weekly corrective trend.

- Price: IDR 2,726

- 24 hours: -7,97%

- 1 week: -23,38%

Conclusion

The significant declines in all five assets show that the first week of December 2025 was still dominated by bearish sentiment. While sharp corrections can provide accumulation opportunities, risk management strategies are crucial – especially for those looking to capitalize on market volatility. For investors who want to seize opportunities in both rising and falling prices, Pintu Futures can be an alternative.

Through this feature, traders can utilize leverage, open both long and short positions, and establish more structured risk management with the help of features such as stop loss and take profit. As such, the volatility seen in the first week of December is not only a challenge, but can also be strategically utilized by experienced traders.

Also Read: Michael Saylor signals new bitcoin purchases, BTC price ready to skyrocket?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What was the main cause of the crypto correction in the first week of December 2025?

The correction was triggered by weak market sentiment, decreased liquidity, profit-taking, and the lack of positive catalysts from each project.

Does the weekly decline signal a long-term bearish trend?

Not always. Weekly drops can be temporary, especially in highly volatile crypto markets. However, it is still important to monitor long-term price trends and macro data.

Which are the high-risk assets on this list?

Stafi (FIS), Fwog (FWOG), and Voxies (VOXEL) have higher volatility due to lower capitalization and reliance on community sentiment.

Is a correction like this a buying opportunity?

It is possible, but it really depends on the investor’s risk analysis. Investors are advised to review the fundamentals, roadmap, and ecosystem activities of the asset.

How to monitor crypto prices in real-time?

Prices can be monitored through the Pintu app in the Market section, including price charts, percentage changes, and other data.

Reference

- Door. Crypto Price Data – Market Overview. Accessed today’s date.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.