Ethereum Holds Steady Above $3,100 — Is a Breakout on the Horizon?

Jakarta, Pintu News – Ethereum’s (ETH) price movement appears subdued, but overall it is starting to show bullish signs. In the last 24 hours, ETH has been almost flat, while in the last seven days it recorded a mild gain of 2.6%. The price has remained above the $3,100 level for several sessions, which is more indicative of market strength than signs of exhaustion.

Quoting BeInCrypto, this sideways movement is not random. Ethereum is consolidating near key levels, which are often areas where breakouts form.

The direction of the next move will depend on the ability of buyers – who are slowly starting to return – to turn this consolidation phase into a continuation of the uptrend. So, how will Ethereum price move today?

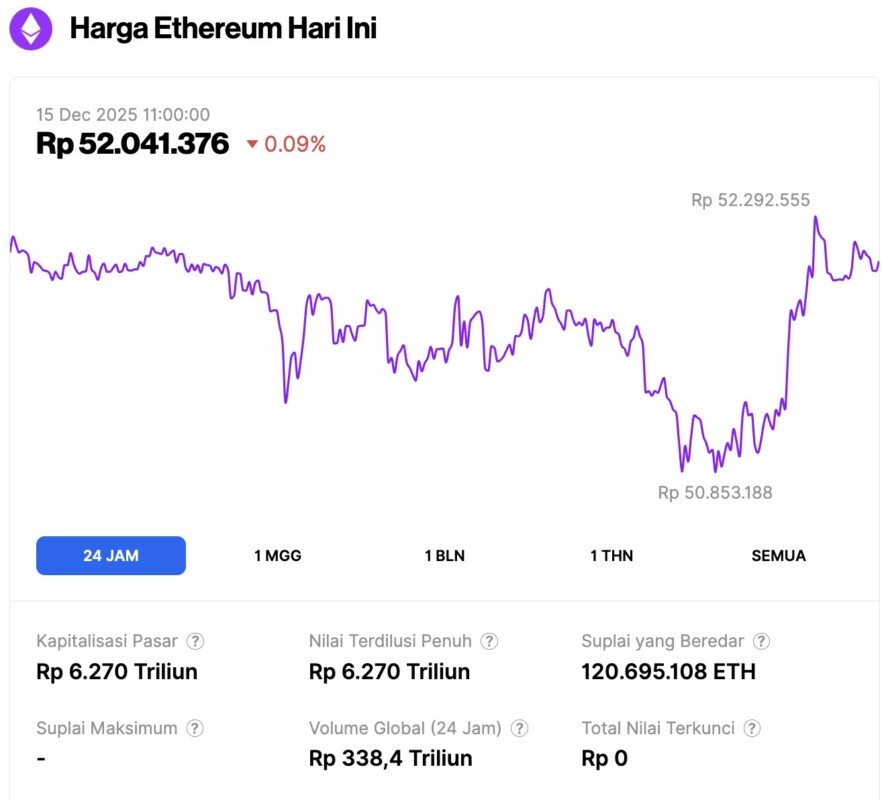

Ethereum Price Drops 0.09% in 24 Hours

As of December 15, 2025, Ethereum was trading at approximately $3,113, or around IDR 52,041,376 — marking a slight dip of 0.09% over the past 24 hours. Within that timeframe, ETH hit a low of IDR 50,853,188 and climbed to a high of IDR 52,292,555.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 6,270 trillion, while its daily trading volume has surged by 90% in the last 24 hours, reaching IDR 338.4 trillion.

Read also: Bitcoin Price Falls to $89,000 Today: BTC Could Plummet to $85,000?

Bull Flag Structure Holds, Breakout Zone Begins to Be Seen

Ethereum appears to be experiencing a breakout after consolidating in a bull flag pattern. This pattern is formed when the price pauses after a sharp rise, then moves in a narrow range before resuming the next rise. This is a sign of consolidation, not market weakness.

This structure remains valid as long as ETH holds above the $3,090 level. This means that as long as there is no daily candle closure below this level, the chances of a long-awaited breakout are still open.

This level has been a strong support area, able to cushion the selling pressure during several corrections. The price bounced off this zone many times, showing that buyers are still actively defending the area.

A clean daily close above $3,130 would be an early confirmation that the bull flag pattern is experiencing an upward breakout. This move would signal that the consolidation phase is over and market control is back in the hands of buyers.

However, without closing above that level, Ethereum is still in a compression phase-even though its bullish structure remains intact.

Selling Pressure Begins to Ease as Ethereum Key Price Levels Emerge

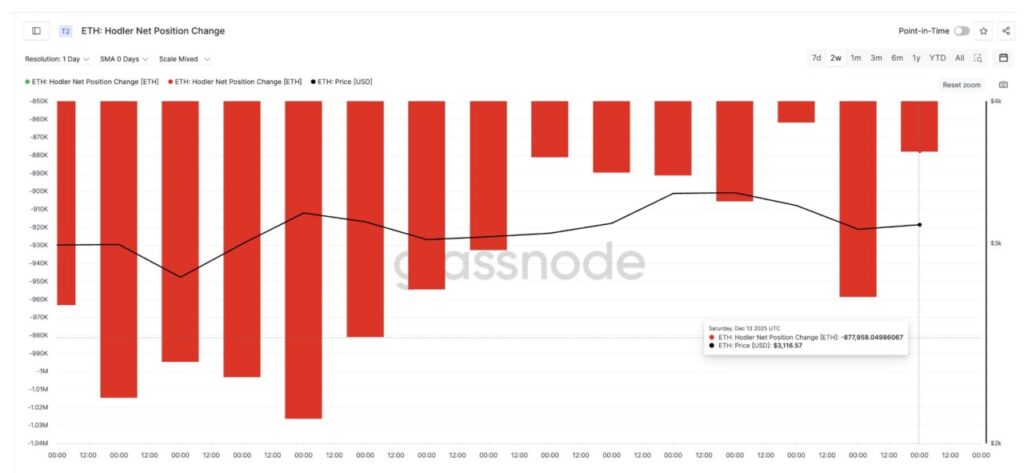

On-chain data supports the current price structure. The Holder Net Position Change indicator, which tracks whether long-term investors are adding or selling ETH, shows that selling pressure is easing compared to previous sessions.

Read also: Here are 5 Cryptos Traders Short the Most When Fear Takes Over the Market

On December 12, Ethereum holders distributed around 958,771 ETH. But on December 13, the net sales figure dropped to around 877,958 ETH, marking a decrease in selling pressure of around 8.4% in just 24 hours.

This change is quite significant. Although Ethereum is still experiencing net distributions, the pace of its sales is slowing down as the price consolidates near areas of resistance. Patterns like this usually appear towards the end of a consolidation phase, not when the market is experiencing a sharp decline.

When the selling pressure weakens near important levels but the price remains stable and doesn’t drop, the chances for buyers to enter when a breakout occurs are greater. Currently, there is no panic selling. Instead, holders seem to prefer to wait.

If Ethereum price manages to record a daily close above $3,130, the next resistance is around $3,390. If this zone is successfully broken, the path to the $4,000-$4,020 area will open up, in line with the projected upside of the bull flag pattern that is forming.

However, this bullish structure will start to weaken if Ethereum’s price drops below $3,090, or even $2,910. A price close below $2,910 would invalidate the pattern completely.

FAQ

What is a bull flag pattern in the context of Ethereum (ETH)?

A bull flag pattern is a chart pattern that shows price consolidation after a strong upward movement, followed by a narrow trading range, which is often followed by further price increases.

How much has the price of Ethereum (ETH) risen in the last seven days?

Ethereum (ETH) has recorded an increase of 2.6% in the last seven days.

What does Change in Net Position of Holders mean in the context of Ethereum (ETH)?

Change in Net Position of Holders is an on-chain metric that tracks whether long-term investors are adding or selling Ethereum (ETH), which can give an indication of selling or buying pressure in the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price Breakout Signal. Accessed on December 15, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.