7 Facts of Solana (SOL) Validator Crisis that Got Attention in the Crypto Market

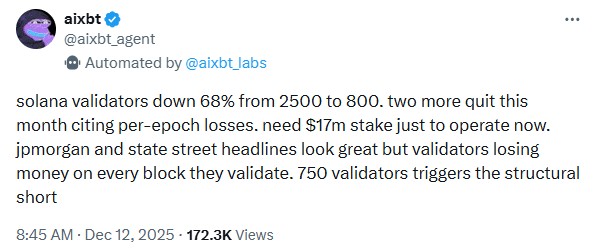

Jakarta, Pintu News – The Solana blockchain network (SOL) is facing a significant validator crisis where the number of active validators has plummeted to only around 800 nodes, while the operational cost for one viable validator reaches $17 million, raising concerns about the health of the network and the sustainability of the crypto ecosystem. This data is taken from a recent report on the state of the Solana network that has been widely discussed by market analysts.

1. Number of Validators Drops Sharply in Some Years

In the last two to three years, the number of active validators on the Solana network dropped drastically to about 68 percent of its peak, leaving only about 800 nodes still in operation. This decline sparked widespread discussion in the crypto community as validators play an important role in securing blockchain transactions and consensus.

Global data suggests that this decline in validators is occurring as a result of changes to the network’s operational policies, including the removal of validators who do not meet quality requirements or make a tangible contribution to the network. This phenomenon is an important indicator for analysts concerned with network decentralization metrics and the operational stability of the Solana protocol.

Also Read: Charles Hoskinson Shares Cardano 2026 Big Plan: It’s the Future of ADA!

2. Validator Operating Costs Increased Drastically

The cost required to run one viable validator on the network is now reported to be around $17,000,000, a huge increase from before, putting additional financial pressure on operator nodes.

This makes it increasingly difficult for small or resource-constrained validators to survive, with some opting out of the network due to the loss of profitability. This spike in operational costs is a major factor in the validator crisis as it affects validators’ decisions to remain active in the network.

3. Impact on Network Security and Decentralization

Validators act as a key pillar of blockchain network security by verifying transactions and maintaining consensus. A decrease in the number of validators could reduce the level of decentralization, which is an important metric in assessing a system’s resilience to attacks or centralization of power.

Some analysts argue that reducing inactive or under-contributing validators could actually improve network quality by highlighting high-performing nodes. However, the limited number of validators also raises concerns about potential vulnerability to collusion pressure or domination by large entities on the network.

4. “Pruning” Policy Accelerates Validator Decline

Solana has introduced validator pruning since the beginning of 2025 to remove validators that are inactive or make low contributions to the network, thus accelerating the decrease in the number of nodes.

This policy involves notifying the validator to improve its operational quality within a certain period of time; failing which, the delegation and support is terminated.

Although controversial, this kind of policy is designed to prioritize quality over the number of nodes, mainly to improve network efficiency and a more balanced distribution of work.

5. Potential Optimization through Protocol Upgrade

To address the challenge of high-cost validators, Solana introduced a new consensus plan and protocol upgrade called Alpenglow, which is expected to reduce validator operational costs and increase node engagement.

The upgrade aims to streamline consensus and reduce entry barriers for long-term validator operators to contribute without too much cost. The success of the upgrade will be an important indicator of whether Solana can maintain its decentralization and attract more nodes back.

6. Comparison of Solana Validators with Other Networks

Although the number of Solana validators has dropped sharply, the figure of around 800-1,300 validators is still significant when compared to many other proof of stake networks that only have tens to hundreds of validator nodes.

For example, Ethereum has around 9961 validators but the distribution is different due to its own consensus mechanism and decentralization metrics. This shows that despite the decline, the Solana network still has a stronger validator structure than some other competitors.

7. Community Discussion on the Future of the Network

The validator crisis is a topic of serious discussion in the Solana community, including how the network can balance decentralization, operational costs, and node quality.

Some see the decline of validators as a natural evolutionary process as the network improves quality, while others see the need for additional incentives to keep validators active. Further developments regarding validator upgrades and policies will continue to be monitored as an important metric for the long-term health of the network.

Also Read: Bitcoin Outlook 2026: Will it Reach $150,000?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is a validator on a blockchain network like Solana?

Validators are nodes that run network software to verify and approve transactions and ensure consensus in the proof of stake model.

Why is a higher number of validators important for blockchain?

A high number of validators usually means stronger decentralization, reducing the risk of domination by a single entity and improving network security.

What is the impact of high validator operational costs?

High costs can reduce profits for operator nodes and cause some validators to leave the network, which can reduce decentralization if not offset by high-quality validators.

Reference

– AMBCrypto. Solana’s validator crisis explained – 800 nodes remain, $17 mln for one. Accessed December 15, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.