Bitcoin is stuck below $94,000: When Will Price Recovery Happen?

Jakarta, Pintu News – In recent weeks, the price movement of Bitcoin (BTC) has remained below the psychological level of $100,000 or around Rp1,665,800,000. Despite accumulation activity by a number of large addresses, the impetus has not been strong enough to bring the price out of the short-term pressure zone around $94,000. This situation raises questions about the time and factors needed for Bitcoin to re-enter the recovery phase.

Consolidation Phase and Weak Demand

Based on market analysis, Bitcoin (BTC) is currently in a relatively long consolidation phase with no clear trend direction. Data shows that although some accumulator addresses continue to add to BTC holdings, their impact on the price is still limited. This reflects the imbalance between demand and supply in the cryptocurrency market.

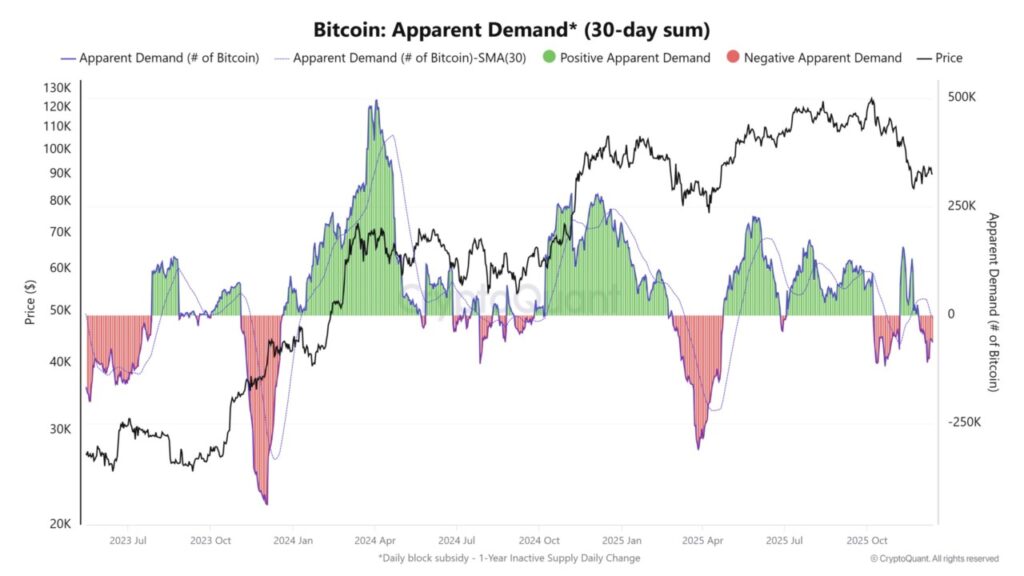

According to demand metrics, buying pressure has not been able to keep up with supply from newly mined Bitcoin nor distribution from long-term holders. Since late November, the demand indicator has been trending negatively. This indicates that selling pressure still dominates and limits the room for price recovery in the short term.

Also Read: Charles Hoskinson Shares Cardano 2026 Big Plan: It’s the Future of ADA!

Short-term Investor Losses and Market Pressure

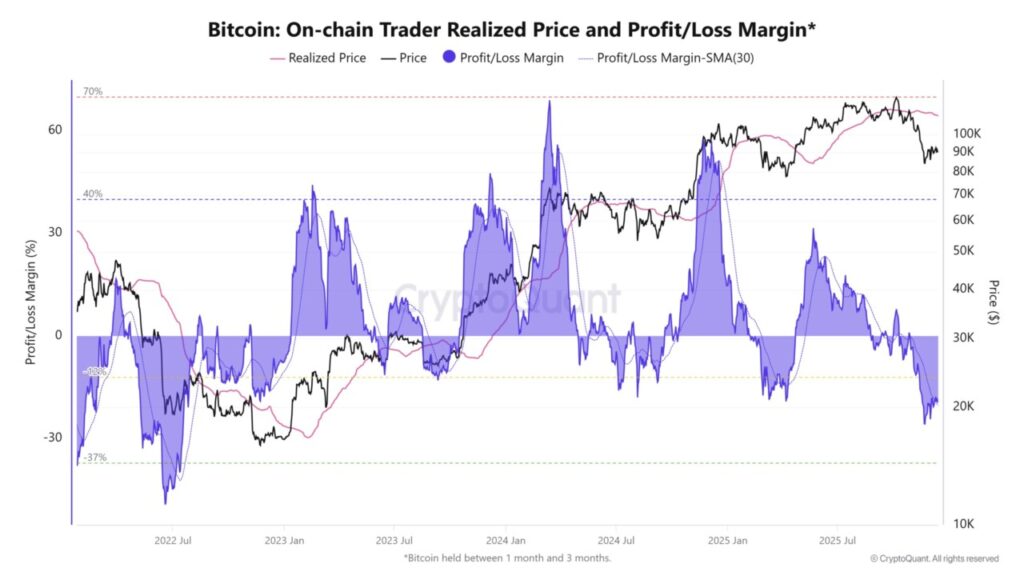

In November, there were signals of increased demand, but the momentum did not last long. Data on realized gains and losses for Bitcoin held for 1 to 3 months shows that most investors in this category are in a losing position. This reflects the weak market sentiment and capital outflows from the crypto market.

The pressure was even more pronounced when the Bitcoin price dropped to $84,000, the lowest level since July 2022. This decline emphasizes that the selling pressure has not subsided and buyers are still having difficulty absorbing the existing supply. This price action illustrates that the market is still in a bearish phase.

On-Chain Signals and Long-term Outlook

While short-term conditions remain challenging, a number of on-chain indicators paint a relatively more constructive picture for the long term. Global liquidity, including the M2 indicator, is at record highs, which some analysts see as a potential driver of a crypto rebound in the coming years. However, this signal is not yet strong enough to trigger a price recovery in the near future.

Alphractal’s CEO stated that Bitcoin is currently in a crucial area of on-chain support. The realized cap impulse metric, which measures the rate of change in BTC’s realized capitalization, is still holding at multi-month support levels despite the price moving below $94,000. This suggests a potential recovery, but still requires additional capital inflows for the price movement to continue in a sustainable manner.

Conclusion

Given the current market dynamics, Bitcoin still faces challenges to return to higher price levels. Market participants continue to wait for a catalyst capable of changing the balance between demand and supply. Without the support of significant capital inflows, the consolidation phase could potentially continue. Therefore, monitoring market data and on-chain indicators remains an important factor in understanding Bitcoin’s future direction.

Also Read: Bitcoin Outlook 2026: Will it Reach $150,000?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is Bitcoin (BTC)?

Bitcoin (BTC) is a blockchain-based digital currency that enables peer-to-peer transactions without intermediaries.

Why is the Bitcoin price struggling to break $100,000?

Bitcoin price is restrained as market demand is not yet strong enough to absorb the supply from new mining and distribution of long-term holders.

What is Bitcoin’s consolidation phase?

The consolidation phase is a period when the price moves in a narrow range without a clear upward or downward trend.

What is the long-term outlook for Bitcoin according to the latest data?

The long-term outlook is considered relatively more positive based on liquidity indicators and on-chain support, although short-term recovery is still limited.

What factors are needed for Bitcoin to recover?

Price recovery requires increased capital inflows and a consistent strengthening of demand in the cryptocurrency market.

Reference

- AMB Crypto. Bitcoin stuck below $94k, demand fails to kickstart a recovery. Accessed on December 15, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.