Aave Ownership Crisis: DAO’s Annual Revenue Slashed by Over $10 Million!

Jakarta, Pintu News – The Aave community is facing an ownership polemic that has sparked a sharp debate between Decentralized Autonomous Organizations (DAOs) and protocol service providers. At the center of this issue lies Aave Labs, the main contractor developing features of Aave’s DeFi lending protocol. The dispute focuses on the fundamental question of who is entitled to the revenue and fees generated by the Aave ecosystem.

Revenue Rights Dispute between DAO and Contractor

Some governance participants argued that contractors, including Aave Labs, receive payments directly from the Aave DAO. Under such a scheme, user interfaces, brands, as well as features built using DAO funds should belong entirely to the DAO. However, the recent integration of CowSwap changes this dynamic, as the swap fee stream no longer goes to the DAO coffers.

The change sparked discontent among governance delegates. They estimated that DAO Aave lost potential annual revenue of at least $10 million. Criticism was also directed at the fact that the previous provider, ParaSwap, implemented a revenue sharing mechanism with the DAO. In contrast, the latest arrangement is considered to be more favorable to private service providers, raising concerns regarding the partiality of the incentive structure towards AAVE token holders.

Also Read: Charles Hoskinson Shares Cardano 2026 Big Plan: It’s the Future of ADA!

Community Leaders’ Response and Aave Labs’ Defense

Marczeller, founder of the Aave-Chan Initiative and AAVE token delegate, calls the privatization of protocol revenue a serious threat to the interests of token holders. He believes that the practice could weaken the DAO’s position in the long run. A similar view was expressed by Louis, a venture capital partner, who highlighted the risk of independent equity entities competing directly with DAOs.

On the other hand, Aave Labs defended its position by emphasizing their contribution to the development of the protocol for over eight years. Stani Kulechov, founder of Aave, stated that innovations such as Aave V4 and the GHO stablecoin have provided significant value and revenue to the DAO. Amidst this debate, the AAVE token price has remained relatively stable at around $200 in the past week, reflecting the limited market response.

On-Chain Data and Community Support

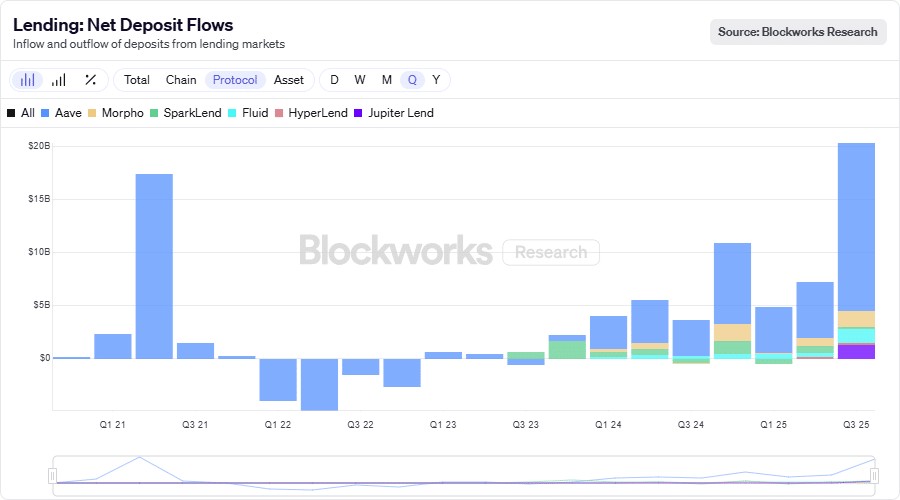

On-chain data from Blockworks Research shows that Aave recorded a net deposit flow of over $15 billion during the third quarter of 2025. This figure indicates that, despite the governance controversy, user confidence in the protocol remains strong. Such activity reflects Aave’s role as one of the key pillars in the DeFi ecosystem.

In addition, Aave continues to run a token buyback program as one of the value accumulation mechanisms for AAVE holders. However, the debate over revenue ownership remains a structural issue that could potentially affect the long-term perception of the protocol’s governance.

Conclusion

The ownership crisis engulfing Aave highlights the fundamental challenges in the relationship between DAOs and service providers in the DeFi ecosystem. How the community resolves these disputes will be an important determinant for the sustainability of the protocol and the level of investor confidence in the decentralized governance model. This issue also sets a precedent for other DeFi protocols in balancing innovation, incentives, and the collective interests of token holders.

Also Read: Bitcoin Outlook 2026: Will it Reach $150,000?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is Aave?

Aave is a DeFi lending protocol that allows users to borrow and lend crypto assets without a centralized middleman.

Who should own Aave’s revenue and costs?

According to some delegates, the revenue and fees should belong to DAO Aave since the development of the protocol was funded by the DAO.

Why has the CowSwap integration been controversial?

The integration of CowSwap was questioned because the flow of swap fees no longer went to the DAO treasury, potentially reducing the DAO’s collective income.

What is DAO Aave’s estimated annual revenue loss?

Delegates estimated DAO Aave’s annual revenue loss to be at least $10 million.

Has this debate impacted the AAVE token price?

In the short term, the AAVE price is relatively stable at around $200 despite the ongoing governance debate.

Reference

- AMB Crypto. Over $10M lost annually:Why Aave Labs is under fire. Accessed December 15, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.