Bitcoin Stands at $90,000: Is this consolidation a trigger for an increase? (12/15/25)

Jakarta, Pintu News – Bitcoin (BTC) showed resilience by staying in the $90,000 range for 18 consecutive days, making it one of the longest consolidation phases this year. This stability comes amid mixed signals from on-chain indicators and derivatives markets. The key question is whether this consolidation will lead to a continuation of the bull run or a reversal.

On-Chain Indicators Hint at Recovery Opportunities

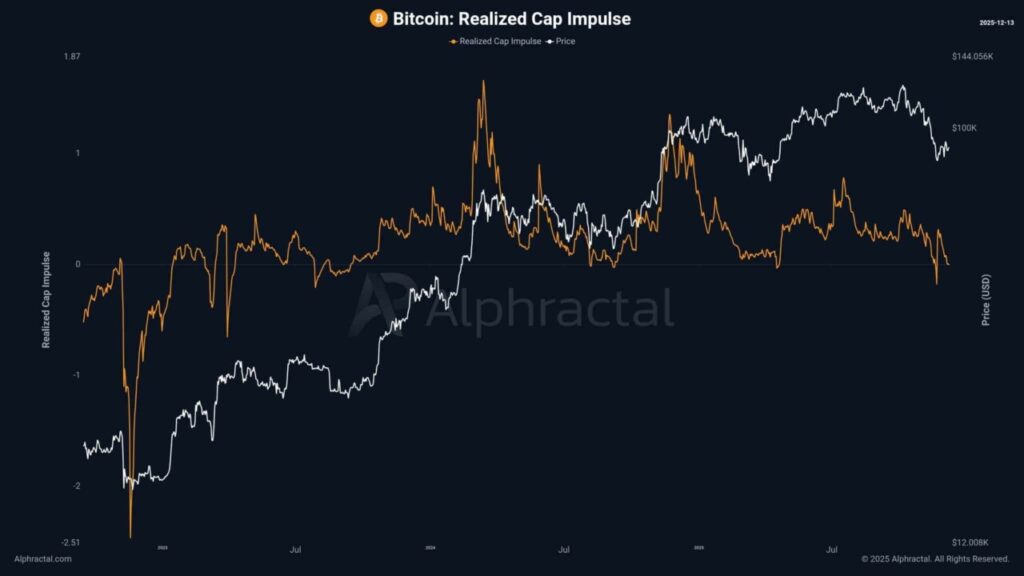

The Bitcoin (BTC) Realized Cap Impulse indicator-whichmeasures the momentum of changes in realized capitalization-recently entered a crucial support zone. Historically, this area has often been the point where demand re-emerges and triggers the next upside push. Similar patterns have previously served as reversal catalysts after a pressure phase.

However, risks remain if the support fails to hold. Failure at this level could potentially increase selling pressure and widen the distribution of losses in the market. As such, the sustainability of the on-chain support becomes the deciding factor for the near-term direction.

Also Read: Charles Hoskinson Shares Cardano 2026 Big Plan: It’s the Future of ADA!

Derivative Dynamics and Market Sentiment

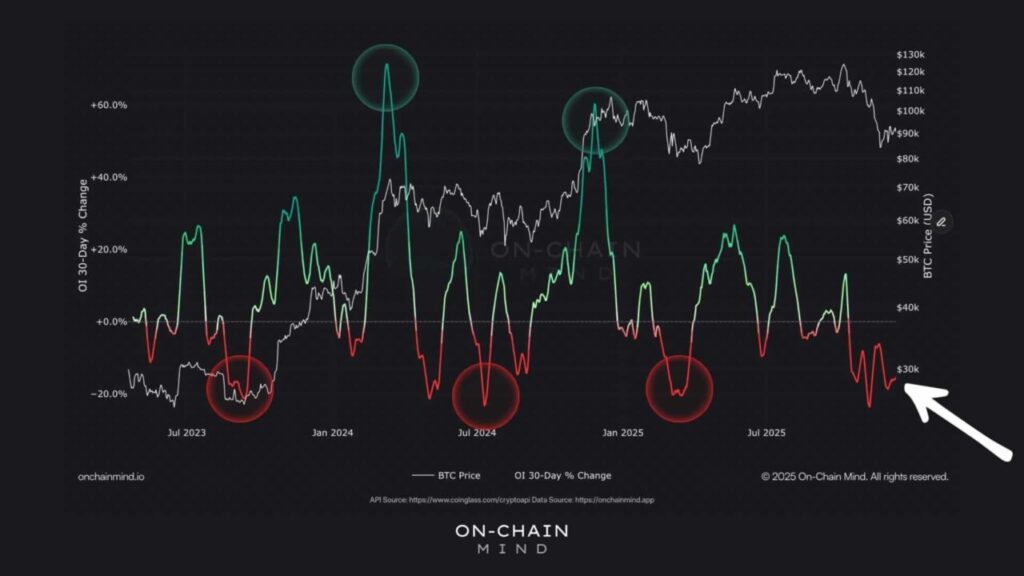

Bitcoin’s Open Interest movements add important context. Historical data shows Open Interest expansions of 40%-60% often coincided with local peaks, while contractions of 15%-20% repeatedly marked local bottoms over the past three years. Currently, Open Interest is down about 15%, in line with the bottom formation pattern.

This strengthens the chances of Realized Cap Impulse support persisting. Derivative positions tend to support the upside, albeit without excess aggressiveness, reflecting a cautious yet constructive sentiment.

Price Movement within the Liquidity Range

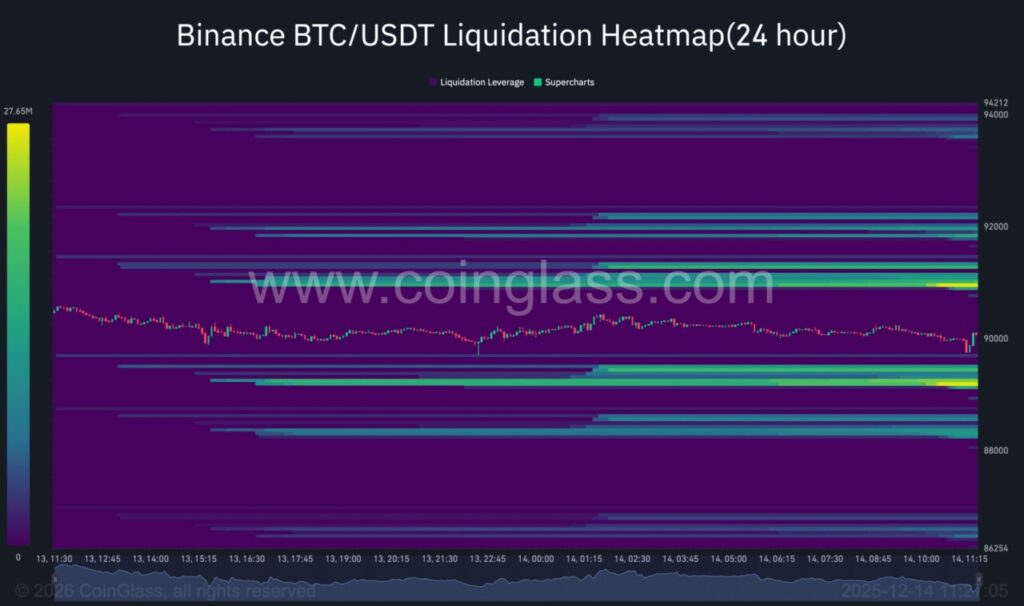

The liquidation map shows BTC moving between two dense liquidity clusters. Above, the area up to around $92,000 forms clear resistance. Below, the concentration of liquidity around $88,000 attracts buying interest and restrains further declines.

If the price moves up, the upper resistance is likely to be the first test and requires strong momentum for confirmation of bullish continuation. Conversely, a limited decline could still be neutral to positive if the lower cluster serves as a bounce cushion.

Conclusion

With momentum still trending positive but cautious, Bitcoin could potentially test the upper side of the consolidation range. However, small changes in on-chain indicators or derivatives dynamics could shift the balance quickly. Continuous monitoring of key support and liquidity remains crucial to read the next direction.

Also Read: Bitcoin Outlook 2026: Will it Reach $150,000?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is Bitcoin (BTC) Realized Cap Impulse?

An on-chain indicator that measures the momentum of changes in Bitcoin’s realized capitalization to assess the strength of demand and market phase.

How long can Bitcoin stay in the $90,000 range?

About 18 days in a row.

What are the risks if the Realized Cap Impulse support fails?

Failure may increase selling pressure and worsen the distribution of losses in the market.

What does the 15% drop in Open Interest mean?

Historically, such declines often coincide with local bottom formation.

What are the main challenges if Bitcoin goes up?

Price is likely to face resistance from the liquidity cluster above, which requires strong momentum to break.

Reference

- AMB Crypto. Bitcoin holds $90k for 18 days; can this finally trigger a breakout?. Accessed on December 15, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.