Shiba Inu Price Prediction: SHIB Remains Under Pressure as Recovery Attempts Fall Short

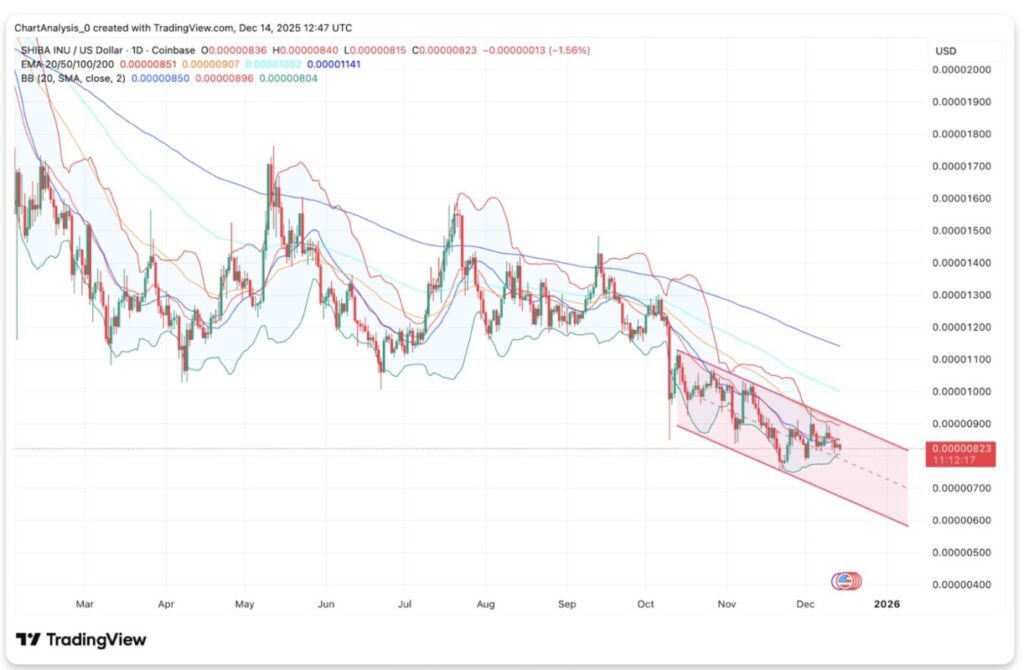

Jakarta, Pintu News – The price of Shiba Inu (SHIB) briefly traded around $0.00000823 on December 15 after continuing its decline in a clear descending channel pattern. This movement shows that the pressure from sellers is still dominant, as the price struggles to hold at the short-term support level.

In addition, outflows from the spot market and weak momentum also dampened investor sentiment.

Descending Channel Determines Trend Direction

On the daily chart (15/12), SHIB is still moving inside the descending channel that has restricted price movement since early October. Any recovery attempts in the past two months have always failed to break the upper limit of this channel, confirming that selling pressure continues to dominate.

Read also: Meme Coin is Not Dead, MoonPay President Says Meme Coin is Ready to Return in a Different Form

SHIB price is currently below the 20, 50, 100, and 200-day EMAs. The structure of these EMAs reinforces the bearish view and limits the potential for sustained price gains.

The 200-day EMA at $0.0000114 is still very far above the current price, showing how much movement is needed to change the overall trend direction.

The lower limit of the channel is currently in the range of $0.0000078 to $0.0000076. This area becomes the next important support if selling pressure increases again. If the price breaks this area downwards, then the next target is the psychological level of $0.0000070, where buyers will likely try to hold.

Short-Term Chart Shows Weakening Recovery Efforts

On the 30-minute chart (15/12), SHIB briefly attempted a rebound within a short-term rising channel, but the structure started to fail. The price is now back near the lower limit of the intraday moving range.

The RSI on the low timeframe is in the mid-30s, reflecting weak demand with no signs of major capitulation. Momentum has not managed to recover, and any price bounce is immediately responded to by selling pressure. This pattern suggests that buyers are still on the defensive, rather than aggressively building positions.

MACD also remains flat to negative, with no meaningful bullish crossover. The absence of confirmation from the momentum side indicates that the recent price stabilization is more of a temporary pause, rather than the beginning of a trend reversal.

Fund flow data from the spot market also reinforced the negative outlook. In recent sessions, there has been a consistent net outflow, with the latest daily value close to minus $600,000. This pattern suggests that SHIBs tend to move to exchanges for trading, instead of being stored for the long term.

Surge in Burn Activity Fails to Boost Prices

Shiba Inu’s burn rate surged by over 1,500% in the last 24 hours, with over 1.1 million tokens removed from circulation. While this increase is quite striking compared to previous activity, the absolute volume is still relatively small when compared to the total supply in circulation.

Read also: Will Bittensor Price Surge to $400 After the First TAO Halving?

The absence of a significant price reaction suggests that traders tend to ignore short-term burn data and focus more on overall market conditions. As risk appetite in the crypto market is still weak, symbolic supply reductions have not been able to boost demand in a tangible way.

While burn activity may support the long-term narrative, the current price movement suggests that it is not yet a major trigger in the short-term.

Markets look forward to the launch of futures from Coinbase

Market focus is now turning to upcoming developments. Coinbase is scheduled to launch perpetual-style futures products for a few select altcoins, including SHIB, on December 15.

In addition, the exchange also gave a sneak peek at the system update to be announced on December 17, which is being closely watched by the community.

These events have the potential to increase market activity and volatility, but not necessarily change the overall direction of the trend. In the current environment, catalysts such as these tend to reinforce existing momentum, rather than create new changes in direction.

Outlook: Will Shiba Inu Prices Rise?

SHIB’s price structure still shows a bearish trend as long as it stays inside the descending channel.

- Bullish Scenario: If SHIB manages to reclaim the $0.0000086 level and closes above the midpoint of the channel with increasing trading volume, then there is an opportunity to test the $0.0000095 level. This could signal the beginning of a short-term momentum shift in a positive direction.

- Bearish Scenario: A daily close below $0.0000078 will confirm the continuation of the downtrend and open up a potential drop towards the next demand area at $0.0000070.

- Neutral Zone: Holding above $0.0000080 will keep the consolidation pattern intact. But if this level is lost, the downward trend is likely to continue until the end of the year.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Shiba Inu Price Prediction: SHIB Slides Inside Channel As Every Bounce Gets Sold. Accessed on December 16, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.