3 Important Facts Behind the Massive Liquidation of Crypto Markets Today (12/16)

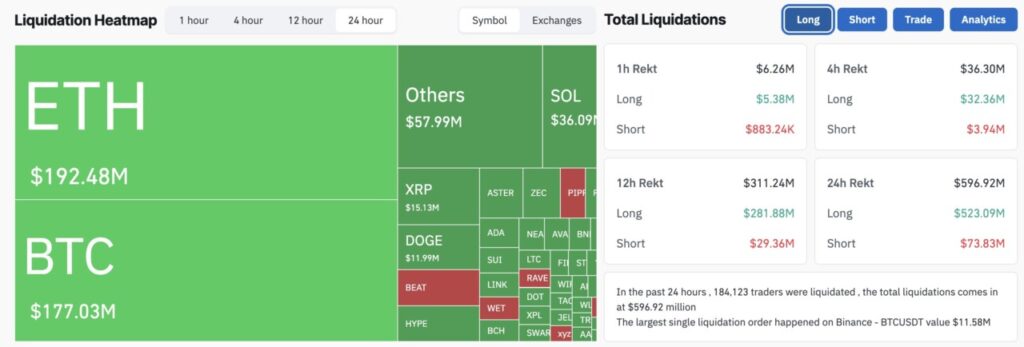

Jakarta, Pintu News – The crypto market has come under pressure again in the past 24 hours, reflected by a surge in liquidations across a range of major assets. Liquidation heatmap data shows a predominance of liquidation of long positions, signaling that many traders were overly optimistic before the market moved in the opposite direction. This condition usually arises when volatility increases and market liquidity is depleted.

Ethereum and Bitcoin Dominate the Biggest Liquidations

Ethereum (ETH) recorded the highest liquidation value totaling around $192.48 million, followed by Bitcoin (BTC) at $177.03 million. The dominance of the two largest assets shows that market pressure is not only on altcoins, but also on major crypto assets. Most of the liquidation came from long positions, indicating the failure of prices to continue the short-term uptrend.

This situation often occurs after a consolidation phase or a short rally, when traders use high leverage in the expectation of continued price gains. When prices move in the opposite direction, forced liquidation accelerates selling pressure in the market.

Also read: Will Bitcoin Be Uprooted by Quantum Computers? Here’s the Explanation!

Altcoins take a hit, SOL and XRP stand out

Outside of BTC and ETH, Solana (SOL) and Ripple (XRP) also recorded significant liquidations. SOL saw liquidations of around $36.09 million, while XRP was in the range of $15.13 million. Dogecoin (DOGE) also made the list with nearly $12 million in liquidations, reflecting the weakening sentiment in higher-risk assets.

This pattern suggests that altcoins tend to experience more impact when the market enters a risk-off phase. When Bitcoin weakens or goes sideways, traders often close altcoin positions first to reduce risk exposure.

Read also: Vitalik Buterin raises the issue of Algorithm X, Transparency is considered the key to public trust

The Dominance of Long Liquidation and its Impact on the Market

The total liquidation data shows a clear imbalance between long and short positions. In the last 24 hours, the total liquidation amounted to approximately $596.92 million, with the majority coming from long positions. More than 184,000 traders were affected, signaling the breadth of the effects of this price movement on the crypto market.

The dominance of long liquidation is often a healthy “leverage clearing” phase for the market. Once this pressure subsides, volatility usually decreases and prices can potentially find a new equilibrium. However, as long as liquidation remains high, the market tends to move volatile and it is difficult to form a clear trend.

FAQ

What is liquidation in the crypto market?

Liquidation occurs when a trader’s leveraged position is automatically closed due to insufficient margin as a result of opposing price movements.

Why does liquidation of long positions dominate?

The predominance of long liquidations means that many traders bet the price to rise, but the market actually moves down or weakens.

Why did Bitcoin and Ethereum record the biggest liquidations?

Because BTC and ETH have the most trading volume and use of leverage in the crypto market.

Why are altcoins more depressed when the market is down?

Altcoins are generally higher risk so they are often released first when market sentiment turns risk-off.

Are large liquidations always negative?

Not always, as liquidation can clear excess leverage and help the market find a new equilibrium.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coinglass

- Featured Image: Generated by Ai

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.