3 Altcoins to Watch Heading Into the End of 2025: Breakout or Breakdown?

Jakarta, Pintu News – The crypto market is still showing caution, but some tokens face important tests this week. Amidst flat price movements, focus is starting to fall on three altcoins worth keeping an eye on at the end of 2025.

Each altcoin has specific triggers that are approaching, ranging from supply changes, network events, to changing token holder behavior. These situations could trigger sharp movements if buyers or sellers take control in the next few days.

Sei (SEI)

Sei (SEI) continues to come under pressure as we approach mid-December, and its price movements reflect that cautious attitude. In the past month, the token has dropped around 23%, and over 60% in the past three months, which keeps market sentiment towards it fragile as the market searches for a clear direction.

Read also: XRP Price Prediction: Bullish Structure Maintained, ETF Assets Top $1.18 Billion

On December 15, SEI was trading around $0.124, and was consolidating within a broader falling wedge pattern on the daily chart. This pattern often appears at the end of a downward trend, when selling pressure begins to ease and prices begin to narrow.

Currently, SEI is slightly above the lower boundary of the pattern, making the next few trading sessions crucial. This tension makes SEI one of the altcoins worth monitoring.

The momentum indicators showed mixed but interesting signals. Between December 5 and 14, SEI prices recorded new lows, while the Relative Strength Index (RSI) recorded higher lows. The RSI measures the strength of momentum, and this positive divergence suggests that selling pressure may be starting to weaken, although prices are still moving weakly.

However, short-term risks remain high due to SEI’s scheduledtoken unlock on December 15. Around 55.56 million SEIs, or about 1.08% of the total outstanding supply, will be released to the market. Token unlocks like this often increase selling pressure in the short term, especially when the general market sentiment is still cautious.

Key price levels help clarify the scenario. If the price is able to break $0.159 on a net basis, it could be a signal that buyers managed to absorb the selling pressure from the token’s release, and open up an upside opportunity towards higher resistance zones, such as $0.193 or above.

Conversely, a drop of around 3% from the current level, to around $0.120, risks triggering a break below the trend line. If that happens, the argument regarding a potential bullish divergence-based reversal could weaken.

Bittensor (TAO)

Bittensor’s (TAO) price action has narrowed in a tight range ahead of its upcoming halving moment, creating a clear decision point.

TAO is currently moving in a symmetrical triangle pattern on the daily chart, showing a balance between buying and selling pressure after several weeks of downward pressure. This tug-of-war between buyers and sellers makes TAO one of the altcoins to watch in the third week of December.

In the past month, TAO is down about 15.5%, and about 6.6% in the past seven days. Short-term pressure is still visible, but volatility has decreased – a situation that often occurs before big moves. Such a structure reflects market indecision rather than complete dominance on the part of sellers.

The main factor that forms the background of this analysis is halving. Bittensor’s halving process will reduce token emissions, so new supply will be tighter. Historically, such events don’t always trigger instant price increases, but they often act as a catalyst when prices are already compressed.

From a technical point of view, the first upside trigger is around $301. A daily close above this level would break the upper trendline of the triangle pattern and signal renewed strength.

If the momentum continues and market conditions are favorable, the upside potential could be towards $321, even up to $396.

Read also: Pi Network Can Still Break $1? This Analyst Reasons

However, downside risks remain. The $277 level is a crucial support area. If the price drops below this point, the technical structure will weaken and open the risk of a drop to $255, even to $199 if market sentiment deteriorates.

Aster (ASTER)

Aster (ASTER) is becoming one of the altcoins to watch towards the end of 2025 due to a clear power struggle between large investors(whales) and the general retail market.

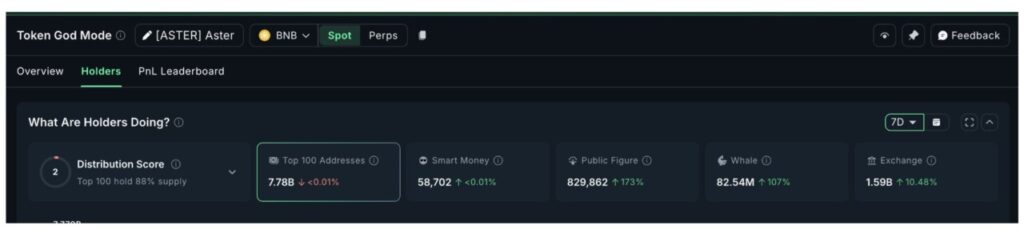

On-chain data shows aggressive accumulation by whale ahead of this week. In the last seven days, the amount of ASTER held by whale jumped by around 42.7 million tokens – from around 39.85 million to 82.54 million ASTER. This is an increase of 107%, signaling strong confidence from large holders ahead of the third week of December.

However, data from exchanges showed a different story. ASTER’s balance on the exchange increased by 10.48%, indicating a possible sell-off from retail investors, despite the whales’ accumulation.

This conflict between buyers and sellers is also reflected in the price chart. ASTER has been correcting since November 19, but is now beginning to narrow in a triangular pattern, reflecting market indecision.

During this phase, a hidden bullish divergence formed – between November 3 and December 14, the price printed higher lows while the RSI printed lower lows, a signal that often indicates selling pressure is starting to weaken.

This often leads to a price bounce. If this scenario materializes, the first level to watch is $0.94. A daily close above this level would break the triangle resistance and open up an opportunity towards $0.98, with further upside potential to $1.08 (approx. 16%) if momentum holds and whale support continues.

However, if the price drops below $0.88, the bullish divergence signal will fail and open the risk of a drop to $0.81, which returns the dominance to the sellers.

FAQ

What is halving mentioned in the context of Bittensor (TAO)?

Halving in the context of Bittensor (TAO) is an event where the block reward for miners is reduced to half, which typically impacts the supply and price of the token.

Why did Sei (SEI) experience a significant price drop?

Sei (SEI) experienced significant price declines due to market pressure and fragile sentiment, reflecting investor caution and negative speculation in the market.

What is the percentage increase in the ASTER balance held by whale?

The ASTER balance held by whales increased by 107%, from 39.85 million to 82.54 million ASTER within seven days.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins to Watch in the Third Week of December 2025. Accessed on December 19, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.