ASTER Price Faces Potential 10% Drop as Whale Setia Begins Offloading Shares

Jakarta, Pintu News – The price of Aster (ASTER) is under heavy pressure. The token is down almost 20% in the last seven days and almost 10% in 24 hours on December 17. What makes this movement different is who is selling.

After weeks of holding out, Aster’s largest investor group, the whales, have finally started to reduce their exposure. With spot and derivatives data giving cautionary signals, the chart currently shows another 10% downside risk if key levels fail to hold.

Loyal Whales Start Bearish in ASTER Spot and Derivatives Market

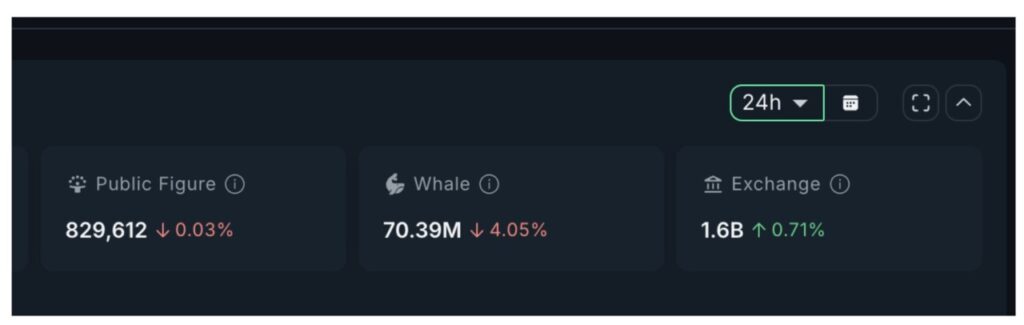

The clearest warning signal came from the behavior of whales in the spot market. In the past 24 hours, ASTER whales reduced their holdings by 4.05%. Following this reduction, the whale balance dropped to 70.39 million ASTER, which means around 2.97 million tokens have been sold. At current prices, that equates to more than $2 million in sales on the spot market.

Read also: Chainlink vs XRP: Who will Dominate the Next Decade?

What makes this significant is the fact that these whale wallets previously added to their positions when prices were falling. Their decision to sell when the market is weakening indicates that confidence in a short-term rebound is fading.

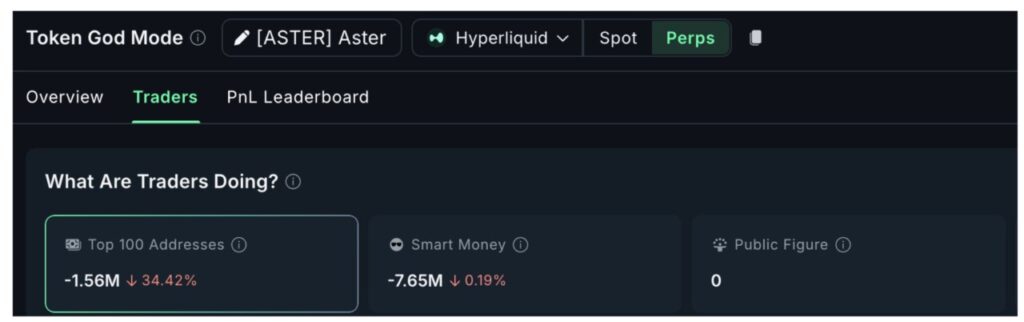

Data from the derivatives market also confirmed the same negative signals. The 100 largest addresses (mega whales)-which are more reflective of large leveraged traders than spot owners-showed a 34.42% decrease in positions. More worryingly, the remaining positions are now dominated by shorts, not longs.

This kind of condition-where both spot whales and large leveraged traders both reduce exposure simultaneously-is usually not a sign of momentary volatility, but rather an expectation of further price declines.

With sentiment and technical data aligned in a bearish direction, the ASTER market may not have reached its bottom yet.

Smart Money is also starting to move away from ASTER?

The Smart Money Index (SMI) indicator adds to the concerns over ASTER’s prospects. This indicator tracks the behavior of experienced and informed traders – those who typically enter early before big moves occur.

In the case of ASTER, the SMI dropped below its signal line since November 22, marking a shift from accumulation to distribution phase. Since then, ASTER’s price has continued to decline, and more strikingly, there is no sign of smart money coming back into the market.

This provides an important signal: although ASTER prices are approaching the lower area in a falling wedge pattern-a technical pattern that is theoretically bullish-smart traders are not taking positions for a price bounce.

As long as the SMI has not turned up and crossed its signal line again, any rally is likely to be a selling moment, not the start of a new uptrend.

When combined with the data on whale behavior, it is clear that the current selling pressure is not driven by emotional panic, but rather strategic decisions. Large investors and experienced traders are actively choosing to reduce risk, rather than simply reacting to volatility.

In summary, the ASTER market is currently ruled by organized and deliberate selling pressure, and there are no strong signals yet that suggest a trend reversal in the near future.

Read also: Is Altcoin Season Over? Top Traders Reveal New Timeline for Altcoin Rally

ASTER’s pricing structure hints at additional downside risk of 10%

Technically, ASTER is still in a falling wedge pattern, and the price is currently pressing the bottom of the trendline. While this pattern usually leads to a rebound, it only happens if there is strong buying interest – and right now, buyers have yet to show up.

If the lower trendline is broken, the next downside target is around $0.66, which means a potential additional drop of around 10% from the current level. Worse still, if $0.66 is unable to hold, then the $0.55 zone could be the next target, opening up the risk of a deeper drop.

To reverse this trend to bullish, ASTER needs to close above $0.96 in the daily time frame. This level is not only the upper limit of the wedge pattern, but also a previous important support area. As long as there is no daily close above $0.96, any upside is only considered a technical bounce (corrective rebound), not a true trend reversal.

With loyal whales now selling, smart money staying away, and the price structure losing support, selling pressure looks increasingly dominant. Unless a big buyer steps in soon, further declines seem increasingly inevitable for ASTER prices.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Aster Price Down 10% as Risk of Whales Selling Increases. Accessed on December 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.