XRP’s Bullish Pattern Sets the Stage for a Price Surge to $3 as ETFs Surpass $1 Billion!

Jakarta, Pintu News – The price of XRP (XRP) fell 1.2% on December 17, continuing a downward trend that began in July when it reached a high peak of $3.6575.

This decline may be coming to an end as the token has formed a sparse bullish pattern, which could push its price towards $3 as ETF fund flows surge.

XRP Price May Benefit from Ongoing ETF Flows

One factor that could push the price of XRP higher in the coming weeks is the fact that XRP is currently in an accumulation phase.

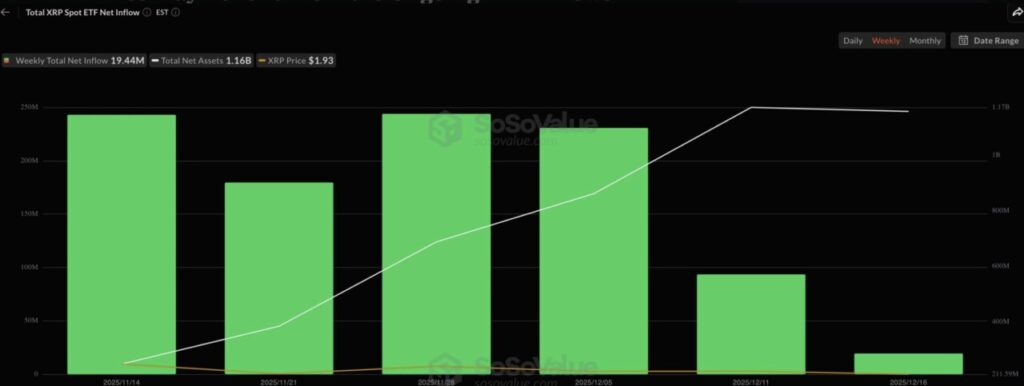

Data compiled by SoSoValue shows that the spot XRP ETF, which was launched last month, has become extremely popular among investors.

Also read: Solana Starts Quantum Proofing Update as Blockchain Industry Accelerates Security Measures

The Ripple ETF has surpassed the $1 billion fund flow mark, a significant achievement considering all Ethereum funds took over a month to reach that amount.

Most importantly, the XRP ETF has never had a single day without fund flows, with their worst day occurring on November 18 when they received $8.2 million in fund flows.

It is possible that these ETFs will continue to gain assets in the coming months as JPMorgan predicts that their fund flows will reach between $6 billion to $8 billion in the first year. Thus, if this trend continues, there is a chance that the fund will surpass these predictions.

The ongoing flow of XRP ETF funds is also noteworthy as it comes amid investors dumping their Bitcoin (BTC) and Ethereum (ETH) funds. Spot Bitcoin ETFs saw outflows of more than $277 million on Tuesday after losing $357 million the previous day. These funds have lost billions of dollars in assets in recent months.

Similarly, the Ethereum ETF has lost over $500 million in assets in the last four days, bringing its cumulative fund flows down to $12.6 billion, from a record high of almost $15 billion. Thus, there are signs of a potential switch from Bitcoin and Ethereum to XRP funds.

XRP Price Technical Analysis

The daily chart shows that the price of XRP has fallen sharply in recent months as demand has dried up and the crypto market continues to decline.

Read also: ASTER price threatens to drop another 10%, Whale Loyal starts to offload shares?

Most technical indicators suggest that the coin’s price will likely continue to fall. For example, the price of Ripple remains below all moving averages, while oscillators such as the Relative Strength Index (RSI) and Percentage Price Oscillator (PPO) point in a downward direction.

However, on closer inspection, the token has formed an inverted head-and-shoulders pattern with the neckline connecting the swing highs since October 2. Currently, XRP is at the right shoulder stage.

Additionally, the token also formed a double-bottom pattern at $1.8140. Therefore, the most likely price projection for XRP is a price recovery that moves towards the psychological level of $3, which is 57% higher than the current level.

Conversely, if the price drops below the important support level of $1.8140, then this bullish projection will be invalidated.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. XRP Price: Rare Pattern Points to a Surge to $3 as ETFs Cross $1B Milestone. Accessed on December 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.